A single mosquito bite in Colombo can trigger a $2,000-4,000 hospital bill that your travel insurance may not cover. Dengue fever hospitalizes thousands of visitors to Sri Lanka annually, yet most travelers assume their existing policies handle tropical diseases automatically. They often don’t.

The coverage gap is straightforward: home country health insurance excludes overseas treatment, credit card travel benefits typically cover accidents but not illness, and standard travel policies frequently require explicit “tropical disease” or “endemic illness” clauses to pay dengue claims. Air Traveler Club’s analysis of major provider terms confirms that while insurers like Allianz and AXA generally include dengue under hospitalization coverage, verification takes five minutes and could save thousands.

For travelers departing to Sri Lanka between January and December 2026, the decision matrix is simple: check your policy’s fine print for illness coverage abroad, confirm tropical disease inclusion with your provider directly, and purchase supplemental coverage if gaps exist. The math favors action—a 14-day travel medical policy costs $40-80 versus potential out-of-pocket expenses 40-80 times higher.

Why your current insurance probably falls short

The assumption that “I have insurance” equals “I’m covered” breaks down across three common scenarios. Home health insurance—whether NHS, Medicare, or private plans—explicitly excludes treatment abroad in nearly all cases. You’re covered at home, not in a Colombo hospital.

Credit card travel insurance sounds comprehensive but typically limits coverage to trip cancellation, lost baggage, and accidents. Illness from endemic diseases like dengue rarely qualifies. American Visitor Insurance’s provider comparison notes that credit card benefits often exclude sickness entirely, covering only injury-related emergencies.

Even dedicated travel insurance policies vary dramatically. Some include “illness/hospitalization” broadly, capturing dengue as an acute onset condition. Others carve out tropical or vector-borne diseases unless you purchase enhanced coverage. The UK Foreign Office warns of dengue risk even in urban Colombo, advising travelers to secure appropriate insurance for local treatment or medical evacuation—but leaves the policy verification to you.

Dengue isn’t just a rural risk

Unlike malaria, which concentrates in specific zones, dengue mosquitoes thrive in urban environments. Colombo, Kandy, and Galle—the stops on most tourist itineraries—all report cases year-round, with monsoon season (May-October) elevating transmission rates significantly.

The five-minute policy check that protects you

Before booking flights, contact your insurance provider with three specific questions. First: Does my policy cover hospitalization for illness contracted abroad? A “yes” here is necessary but not sufficient. Second: Are tropical or endemic diseases explicitly included or excluded? Some policies list specific conditions; others use broad “illness” language that typically covers dengue. Third: What’s my maximum benefit for medical evacuation? Air ambulance from Colombo to your home country can exceed $100,000—policies capping evacuation at $50,000 leave dangerous gaps.

Document the answers in writing. Email confirmation from your insurer creates a paper trail if claims arise later. For travelers whose policies fall short, supplemental travel medical insurance from providers like IMG, Seven Corners, or Allianz Global fills gaps at modest cost. Our comprehensive guide to reducing Asia travel costs emphasizes that the cheapest flight means nothing if medical expenses wipe out savings.

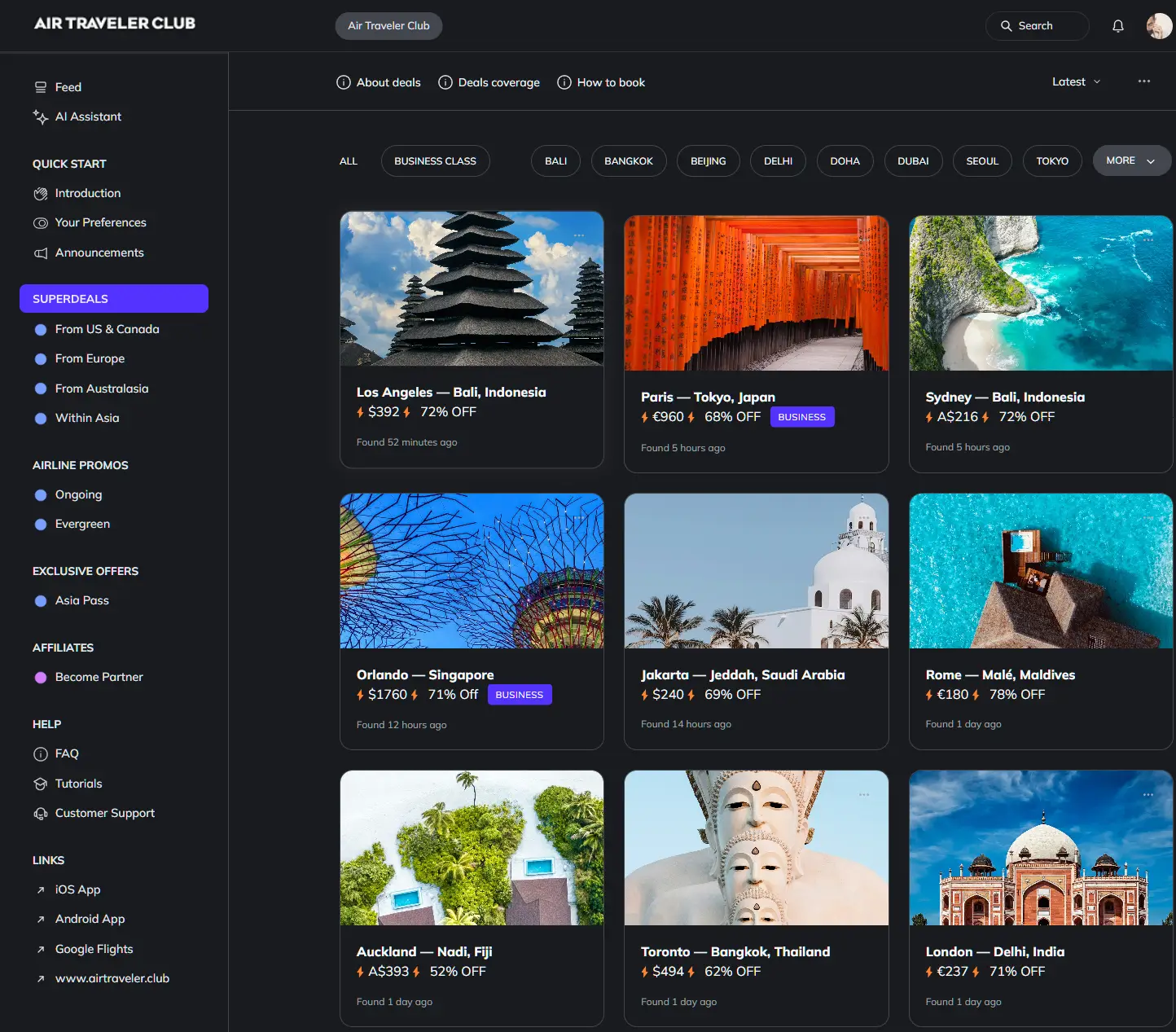

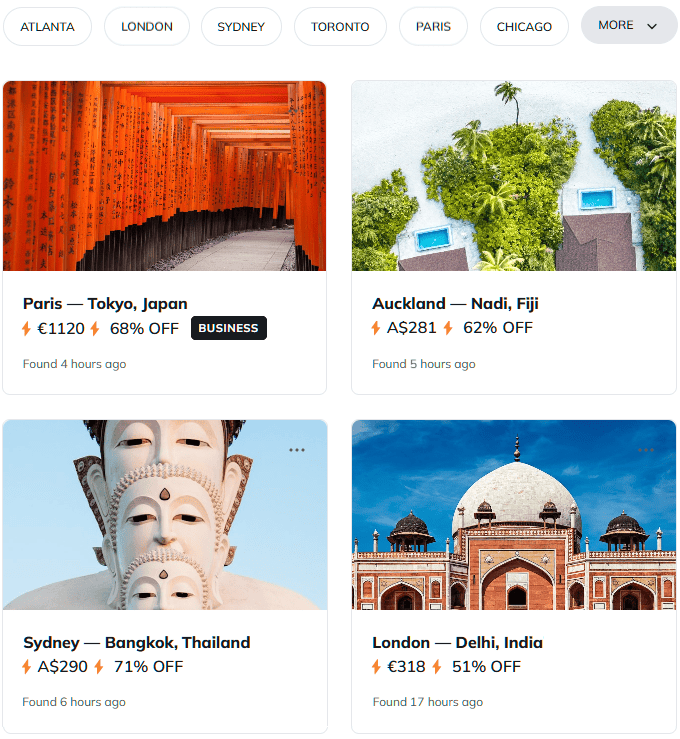

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Coverage comparison: what $50 buys versus $4,000 risk

The economics favor purchasing dedicated coverage even when existing policies seem adequate. A 14-day travel medical policy for a 40-year-old US traveler costs $40-80 depending on coverage limits and provider. Dengue hospitalization in Sri Lanka’s private hospitals averages $2,000-4,000 for uncomplicated cases requiring IV fluids and monitoring—severe dengue with plasma leakage can exceed $10,000.

| Coverage Type | Dengue Included | Max Hospital Benefit | Evacuation Coverage | Approximate Cost |

|---|---|---|---|---|

| Home health insurance (US) | No | $0 abroad | $0 | $0 (but $2-4K exposure) |

| Credit card travel benefit | Rarely | Accident-only limits | Limited or none | $0 (included) |

| Patriot International Lite | Yes | Up to $1M | Included | $40-60 |

| Allianz Travel Insurance | Yes | Up to policy limit | Up to $100K | $50-80 |

The return on investment is stark: $50-80 premium versus $2,000-4,000 potential expense represents 40-80x leverage. Even travelers with robust existing coverage benefit from the certainty that dedicated travel medical insurance provides.

Edge cases that void coverage entirely

Several scenarios can invalidate otherwise adequate policies. Pre-existing conditions complicate claims if you have immune disorders or take medications affecting dengue severity—some policies exclude acute onset coverage for travelers over 70 or those with documented health histories.

Adventure activities like jungle trekking, wildlife safaris, or surfing often require separate riders. Base travel medical policies may exclude illness contracted during “high-risk activities” even if dengue itself is covered. Verify your itinerary activities against policy exclusions.

Australian travelers face an unusual gap: Smartraveller notes that insurance may not cover incidents if prerequisites like an International Driving Permit are unmet for vehicle-related claims. While this applies directly to driving accidents, it illustrates how policy fine print can void coverage through technicalities unrelated to the illness itself.

Monsoon season travel (May-October) heightens dengue exposure but doesn’t typically affect illness coverage. However, trip interruption claims from weather delays may face exclusions—verify whether your policy covers storm-related disruptions separately from medical emergencies.

What to do if dengue symptoms appear

Dengue presents with sudden high fever, severe headache behind the eyes, joint and muscle pain, and rash appearing 3-7 days after infection. If symptoms emerge, contact your insurer immediately—most require notification within 24-48 hours for cashless hospital admission.

Sri Lanka’s emergency medical number is 1990 for ambulance services. Colombo General Hospital (011 269 1111) handles severe cases, though private hospitals like Nawaloka or Lanka Hospitals offer faster admission for insured patients. Keep your policy number, insurer’s emergency hotline, and passport accessible at all times.

Questions? Answers.

Does dengue count as a pre-existing condition if I’ve had it before?

Previous dengue infection doesn’t automatically trigger pre-existing condition exclusions for new infections. However, second infections carry higher severity risk, and some policies may require disclosure. Acute onset dengue during your trip is typically covered as new illness if your policy includes hospitalization for sickness abroad.

Are credit card travel insurance benefits enough for Sri Lanka?

Rarely. Most credit card travel benefits cover trip cancellation, lost baggage, and accidents—not illness contracted abroad. Even premium cards like Chase Sapphire or Amex Platinum typically exclude sickness from their travel protection. Verify your specific card’s terms, but expect to need supplemental coverage.

How does monsoon season affect dengue insurance claims?

Monsoon season (May-October) increases dengue transmission but doesn’t affect illness coverage under standard policies. Your claim for dengue hospitalization processes the same regardless of season. However, trip interruption claims from monsoon-related flight delays may face separate weather exclusions.

Do I need separate medical evacuation insurance for Sri Lanka?

Depends on your base policy limits. Air evacuation from Colombo to North America or Europe can exceed $100,000. If your travel medical policy caps evacuation at $50,000 or less, consider supplemental evacuation coverage. Allianz and similar providers typically include evacuation up to $100,000 in comprehensive plans.

Is travel insurance mandatory for Sri Lanka entry?

No. Sri Lanka doesn’t require proof of travel insurance for visa or ETA approval. However, the lack of mandate doesn’t reduce the financial risk—without coverage, you’re personally liable for all medical costs incurred during your trip.

What if my insurer denies a dengue claim?

Request written denial with specific policy language cited. Many denials result from notification delays (failing to contact insurer within required timeframe) or documentation gaps. Appeal with medical records from treating physicians and proof of policy terms. Travel insurance ombudsman services exist in most jurisdictions for unresolved disputes.