Every airline certified to fly in Nepal—Buddha Air, Yeti Airlines, Nepal Airlines, all nine of them—has been banned from European airspace since December 2013. The EU Air Safety List isn’t just a European regulation. It’s a reference point that many travel insurance providers use to determine what they will and won’t cover.

That scenic 25-minute flight from Kathmandu to Lukla for your Everest Base Camp trek? Your insurance policy may specifically exclude carriers on the EU banned list. If it does, you’re flying uninsured for delays, cancellations, medical evacuations, or worse.

Why Nepal remains on the EU Air Safety List

The ban stems from deficiencies in Nepal’s Civil Aviation Authority (CAAN), not individual airline safety records. The European Union Aviation Safety Agency (EASA) conducts biannual audits assessing whether national aviation authorities meet international oversight standards. Nepal has failed every review since 2013—26 consecutive audits without removal.

The June 2025 EU update confirmed the ban continues. Nepal’s ICAO safety rating improved years ago, but EASA applies stricter standards. A September 2024 audit flagged ongoing issues with Nepal Airlines and Shree Airlines regarding flight scheduling and operational planning.

For context, Pakistan’s national carrier PIA was removed from the list in November 2024 after demonstrating oversight improvements. Nepal has tabled reform bills to split CAAN’s dual regulator-operator role, but Parliament hasn’t enacted them. The 2026 budget includes pledges, though previous commitments went unfulfilled.

The structural problem EASA keeps citing

CAAN both regulates Nepal’s airlines and operates Nepal Airlines—a conflict of interest that undermines independent safety oversight. Until Nepal separates these functions, the EU ban is unlikely to lift. The earliest realistic removal would be late 2027, assuming reforms pass this year.

How the ban affects your travel insurance

The EU Air Safety List serves as a global safety benchmark. Many insurers—particularly those based in the US, EU, UK, and Australia—reference it when defining coverage exclusions. If your policy excludes EU-banned carriers or EASA non-compliant operators, Nepal domestic flights fall outside your coverage.

This isn’t hypothetical. Standard travel insurance from providers like Allianz, AXA, and Cover-More often contains exclusion clauses for airlines failing international safety standards. The wording varies:

- “Excludes carriers on ICAO/EU ban lists” — Common in US policies; directly excludes all Nepal airlines

- “Non-EASA compliant operators excluded” — EU/UK policy language that captures the same carriers

- “Airlines failing international safety standards” — Broader Canadian wording that may or may not apply

The practical impact: if your Lukla flight cancels due to weather (common in monsoon and winter), you may have no claim for rebooking costs. If you’re injured and need evacuation, the insurer could deny the claim entirely.

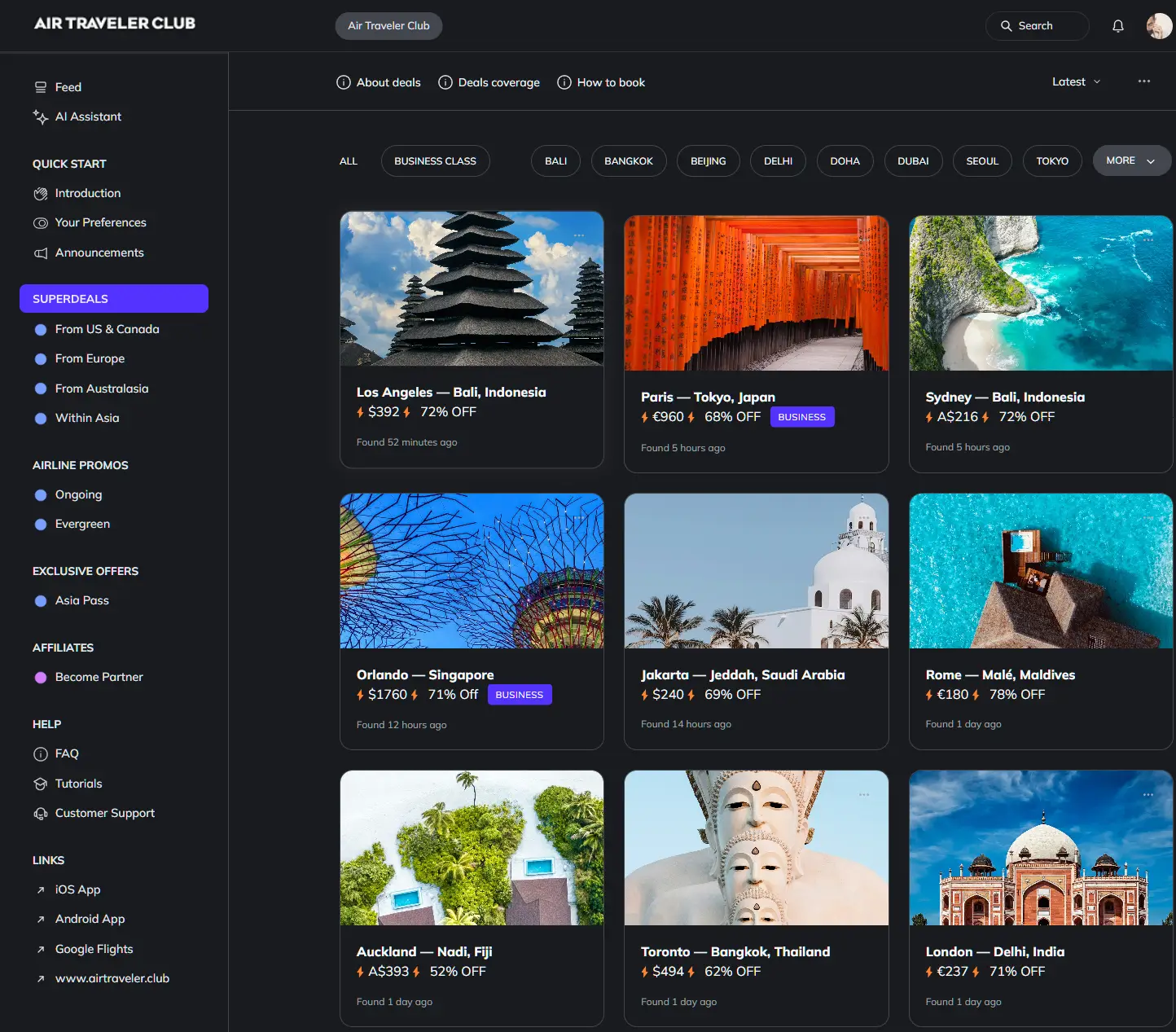

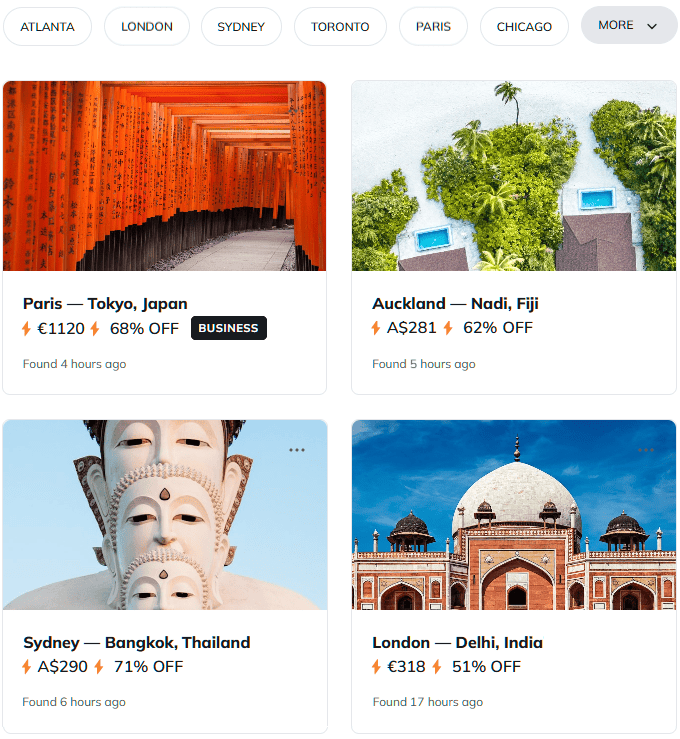

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Checking your policy: what to search for

Before booking Nepal domestic flights, review your policy document for specific exclusion language. Search for these terms:

- EU Air Safety List — Direct reference to the banned carrier database

- EASA — European Union Aviation Safety Agency standards

- Banned carriers or blacklisted airlines — Generic safety exclusions

- ICAO non-compliant — International Civil Aviation Organization standards

If you find any of these exclusions, contact your provider directly. Ask specifically: “Does my policy cover domestic flights within Nepal on carriers like Buddha Air or Yeti Airlines?” Get the answer in writing.

Insurance alternatives that cover Nepal flights

If your standard policy excludes EU-banned carriers, you’ll need specialized adventure travel coverage. These policies explicitly include high-altitude trekking destinations and their associated transport.

| Your Region | Standard Policy Gap | Alternative Provider | Cost Premium |

|---|---|---|---|

| United States | Allianz excludes EU-banned | World Nomads Adventure Plan | +20-30% |

| European Union | AXA excludes non-EASA | True Traveller Trekker Policy | +15-25% |

| Australia | Cover-More excludes banned list | 1Cover Extreme Adventure | +25% |

| Canada | TuGo case-by-case | Specialty trek insurers | +10-20% |

The premium increase typically runs $50-150 for a two-week trek. Compare that to a $3,000+ helicopter evacuation from Lukla that your standard policy won’t cover.

Alternatives to scheduled domestic flights

If upgrading insurance isn’t feasible, consider transport options that may fall outside the ban’s scope:

Helicopter transfers: Private charter operators like Air Dynasty aren’t always classified as scheduled CAAN carriers. Costs run $200-400 per person to Lukla versus $180 for fixed-wing. Confirm with your insurer that chartered helicopters are covered—they often are when scheduled airlines aren’t.

Trek from Jiri: The classic Everest approach takes 10-14 days from Jiri (reachable by bus from Kathmandu) to Lukla, bypassing flights entirely. This adds significant time but eliminates the insurance gap and offers a more gradual altitude acclimatization.

International legs only: If you’re trekking the Annapurna Circuit, you can bus to Besisahar and trek out to Pokhara—no domestic flights required. The EU ban is irrelevant for your international arrival into Kathmandu.

The safety question beyond insurance

Does the EU ban mean Nepal flights are dangerous? The ban reflects oversight deficiencies, not per-flight risk assessments. Nepal was removed from the ICAO safety blacklist years ago. However, the EU applies stricter standards than ICAO minimums.

Recent incidents—including the Yeti Airlines crash in January 2023 that killed 72 people—were linked to weather and terrain challenges at Nepal’s mountain airports, not directly to regulatory oversight. Lukla’s Tenzing-Hillary Airport, with its 527-meter runway ending at a cliff face, is inherently high-risk regardless of carrier.

The EU ban signals something real: Nepal’s aviation authority hasn’t demonstrated the oversight capacity that European regulators require. Whether that translates to elevated personal risk on any given flight is debatable. What’s not debatable is that your insurer may use it as grounds to deny claims.

Questions? Answers.

Which specific Nepal airlines are on the EU banned list?

All nine carriers certified by Nepal’s Civil Aviation Authority appear on Annex A of the EU Air Safety List: Buddha Air, Yeti Airlines, Nepal Airlines, Shree Airlines, Saurya Airlines, Summit Air, Tara Air, Simrik Airlines, and Guna Airlines. The ban covers every CAAN-certified operator without exception.

Do Asian-based insurance providers also exclude EU-banned carriers?

Not always. Some Asian insurers don’t reference the EU Air Safety List in their exclusion clauses, potentially covering Nepal domestic flights that US/EU policies reject. If you hold insurance from a Singapore, Hong Kong, or Japanese provider, check the specific policy wording—coverage may exist where Western policies exclude.

What if my policy doesn’t mention the EU list at all?

Budget travel insurance sometimes lacks specific EU list exclusions. This could mean coverage applies, but it’s risky—insurers may invoke general “unsafe carrier” clauses during claims. Get explicit written confirmation before relying on ambiguous policy language for Nepal flights.

How often does the EU update the Air Safety List?

The European Commission updates the list biannually, typically in June and December. The next update after January 2026 will be June 2026. Check ec.europa.eu/transport before booking to confirm Nepal’s status hasn’t changed.

Could Nepal be removed from the list soon?

Unlikely before late 2027 at earliest. Removal requires EASA audits confirming oversight improvements, which depend on Nepal enacting CAAN reform legislation currently stalled in Parliament. Even if reforms pass in 2026, audit cycles mean a 12-18 month minimum timeline.

Does the ban apply to helicopter evacuation flights?

Helicopter operators providing emergency medical evacuation often fall under different certification categories than scheduled airlines. Many adventure insurance policies cover helicopter evacuation even when excluding scheduled CAAN carriers. Verify your specific policy’s evacuation provisions separately from transport coverage.