A medical emergency on Nauru—one of the world’s least-visited countries—triggers an air ambulance bill of AUD 50,000 to 120,000. The island’s sole hospital has 30 beds, no ICU, no surgical capability beyond minor procedures, and no specialist care. Every serious case requires evacuation to Brisbane, 3,000 kilometers away.

Standard travel insurance policies create a dangerous gap here. Most cap medical evacuation at AUD 50,000—half what a Pacific air ambulance actually costs—or exclude “remote area” evacuations entirely. Air Traveler Club’s travel insurance requirement analysis for Nauru identifies explicit unlimited evacuation coverage to Australia as non-negotiable based on 2024-2025 incident data and Royal Flying Doctor Service pricing.

For travelers planning Nauru trips in 2025-2026, the decision is binary: upgrade to a policy with AUD 100,000+ evacuation limits (or unlimited coverage) before booking, or accept personal liability for a bill that bankrupts most households.

Why Nauru’s medical reality demands specialist coverage

Nauru Republic Hospital offers basic outpatient services only. There’s no inpatient psychiatric facility, no air ambulance stationed on the island, and no capacity for anything beyond stabilization. According to the Medical Association for the Prevention of War’s 2024 analysis, 65% of cases requiring advanced care needed evacuation to Australia—a statistic derived from refugee populations but applicable to any patient on the island.

The evacuation logistics are punishing. A chartered PC-12 or Beechcraft aircraft flies 4.5 hours direct from Nauru International Airport (INU) to Brisbane. Royal Flying Doctor Service 2025 data shows Pacific island evacuations averaging AUD 60,000-120,000 depending on aircraft type, medical escorts required, and patient condition. International Medical Group’s 2024 statistics confirm the global average air ambulance cost hit USD 50,820—and that’s before factoring in Nauru’s extreme remoteness.

The hidden 12% cost surge

RFDS 2025 data reveals evacuation costs rose 12% year-over-year due to fuel price volatility. A route that cost AUD 80,000 in 2023 now runs AUD 90,000+. Insurance limits set two years ago may no longer cover current pricing.

Commercial repositioning flights exist for stable patients at AUD 20,000-40,000, but these require medical clearance and aren’t available for emergencies. When you need evacuation from Nauru, you need an air ambulance—and you need coverage that pays for one.

Where standard policies fail

The gap between what travelers assume and what policies actually cover creates the financial exposure. Three common exclusions appear in standard travel insurance:

- Remote area caps. Many policies limit Pacific island evacuations to AUD 25,000-50,000—covering perhaps half the actual cost. The remaining AUD 50,000+ becomes personal liability.

- Destination exclusions. Some insurers list specific countries or regions as excluded from evacuation coverage without explicit rider purchase. Nauru rarely appears on inclusion lists.

- Pre-existing condition triggers. Any undisclosed condition can void evacuation coverage entirely, leaving travelers exposed regardless of policy limits.

IATA’s 2025 travel insurance guidelines recommend minimum USD 100,000 evacuation coverage for remote Pacific islands. Standard policies typically fall 50-70% short of this threshold.

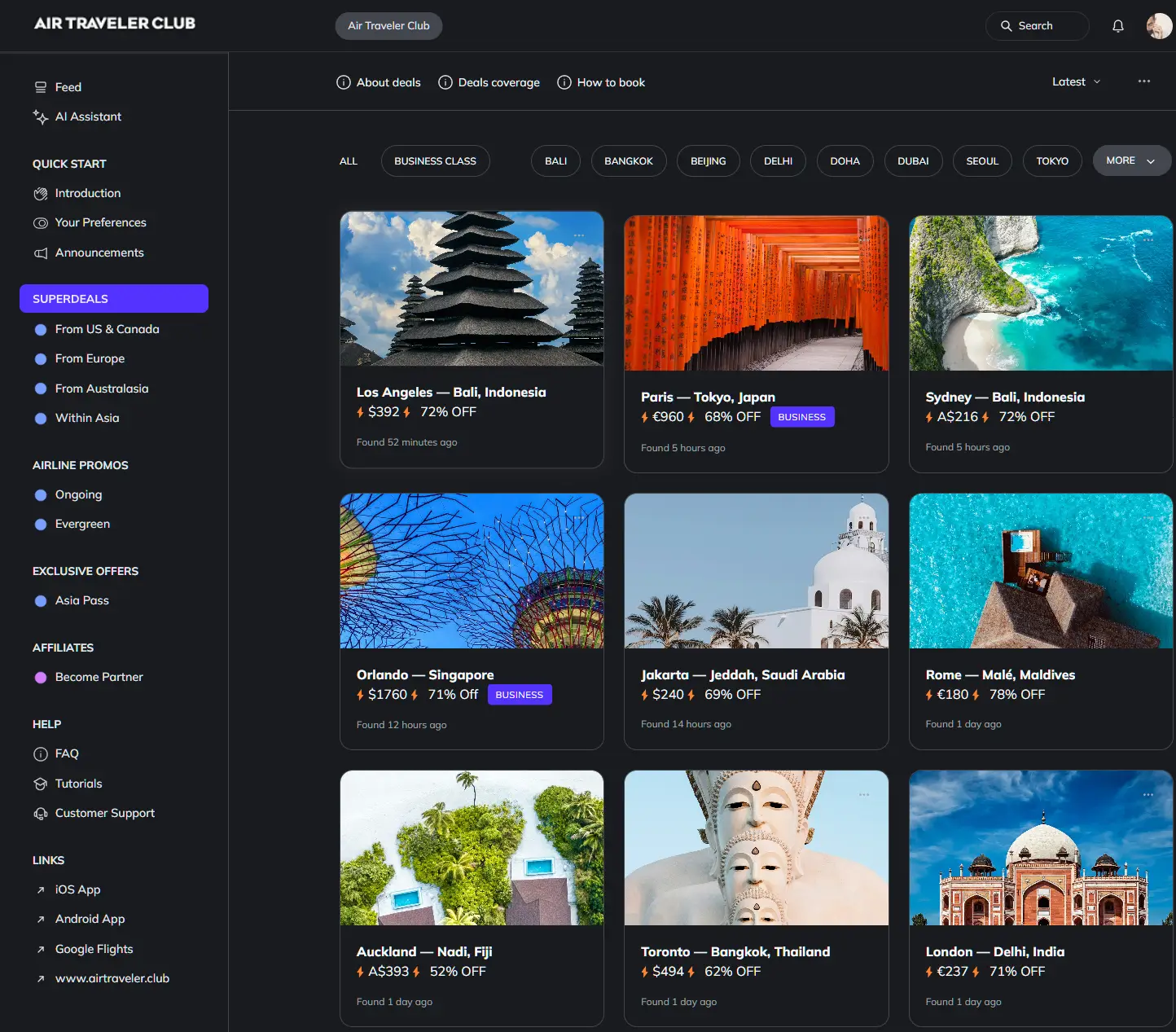

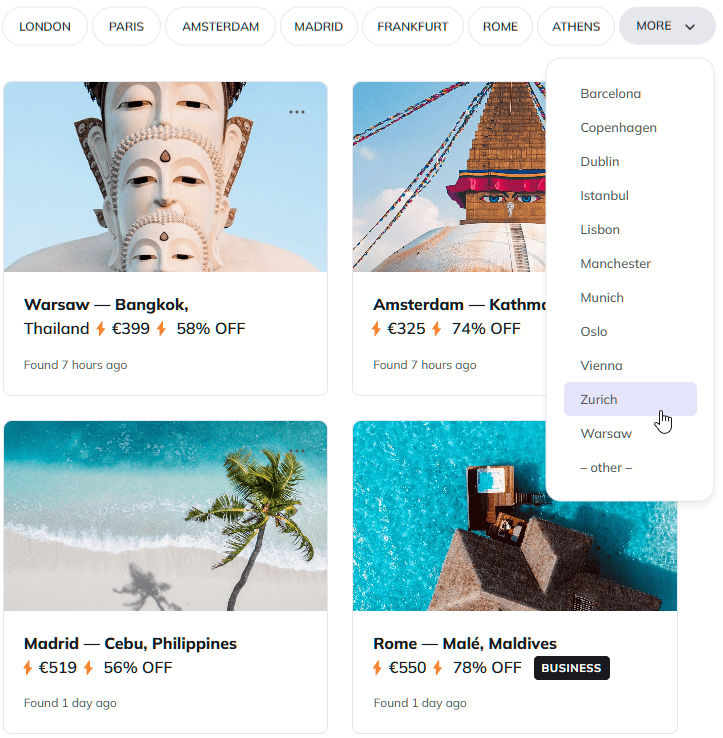

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Coverage that actually protects you

Specialist insurers designed for remote destinations close the gap that standard policies leave open. The decision matrix below compares options for Nauru-specific coverage:

| Provider Type | Evacuation Limit (Nauru-AUS) | Remote Exclusion? | Annual Premium Est. | Best For |

|---|---|---|---|---|

| Standard (e.g., Allianz Basic) | AUD 50,000 | Yes—Pacific caps apply | AUD 150 | Budget trips, not remote |

| Comprehensive (e.g., Cover-More) | AUD 100,000+ | No, if specified | AUD 300 | General Asia-Pacific |

| DAN Asia-Pacific | Unlimited | No—remote focus | AUD 450 | Nauru/Pacific travelers |

| IMG Patriot Platinum | USD 1,000,000 | No | AUD 500 | High-risk remote |

Divers Alert Network (DAN) Asia-Pacific deserves special mention. Despite the name, DAN offers non-diver plans with unlimited evacuation from remote Pacific sites including Nauru. Their logistics coordination for island evacuations is unmatched—they’ve handled this exact scenario repeatedly. The AUD 450 annual premium buys complete peace of mind against a potential AUD 100,000 bill.

For travelers exploring multiple remote destinations, our Asia Pass portfolio of travel perks includes guidance on insurance requirements across 60+ Asia-Pacific countries, helping identify coverage gaps before departure.

Verification before you book

Policy documents use vague language. Explicit written confirmation is the only protection that holds.

Email your insurer with this exact request: “Please confirm in writing that my policy covers medical evacuation from Nauru (NRU) to Brisbane (BNE) for emergency medical conditions, with a limit of AUD 100,000 or greater.” Save the response. Print it. Carry it.

Check specifically for:

- Named destination coverage. “Pacific islands” isn’t specific enough—Nauru must be explicitly included or not excluded.

- Evacuation destination. Policy should specify Australia, not “nearest adequate facility” (which could mean Fiji with limited improvement).

- Aircraft type coverage. Air ambulance costs differ from commercial medical escort—confirm which applies.

Edge cases that change the calculation

Several scenarios complicate the standard advice:

Adventure activities. Diving, hiking, or water sports on Nauru trigger “high-risk activity” exclusions in most standard policies. DAN covers these by design; others require explicit riders at additional cost.

Overweight patients. Passengers exceeding 100kg face aircraft surcharges of 30% or more. Declare weight accurately during policy purchase—undisclosed excess weight can void coverage.

COVID or infectious disease. 2025 protocols add AUD 10,000+ in isolation costs if evacuation involves infectious patients. Verify pandemic coverage hasn’t been excluded post-2024.

Trip duration. Most annual policies expire if a single trip exceeds 30-90 days. Extended Nauru stays require specific long-stay coverage.

Questions? Answers.

Does DAN insurance work if I’m not diving on Nauru?

Yes. DAN Asia-Pacific offers non-diver membership plans with unlimited medical evacuation from remote Pacific sites including Nauru. The logistics coordination—arranging aircraft, medical escorts, and hospital admission in Brisbane—is included regardless of activity.

Can Australian Medicare cover evacuation from Nauru?

No. Medicare doesn’t cover overseas medical evacuation under any circumstances. Australia’s reciprocal health agreements exclude Pacific islands beyond basic care. Private insurance is the only protection.

What’s the actual flight time for Nauru evacuation?

Approximately 4.5 hours direct to Brisbane via chartered PC-12 or Beechcraft aircraft from Nauru International Airport (INU). No scheduled air ambulance service exists—every evacuation requires dedicated charter.

Does this apply to other Pacific micro-nations?

Similar evacuation requirements apply to Kiribati, Tuvalu, and the Marshall Islands. Brisbane remains the primary destination, though costs run 20-30% lower due to shorter distances. The same insurance verification process applies.

Are there cheaper alternatives to full air ambulance evacuation?

Commercial medical escort flights cost AUD 20,000-40,000 for stable patients who can fly seated with medical supervision. However, these require advance medical clearance and aren’t available for emergencies. Air ambulance remains the standard for acute cases.

How do I verify my policy covers Nauru specifically?

Email your insurer requesting written confirmation of “medical evacuation from Nauru (NRU) to Brisbane (BNE) for emergency medical conditions with minimum AUD 100,000 limit.” Generic responses about “worldwide coverage” aren’t sufficient—you need Nauru named or explicitly not excluded.