Every year, travelers book trips to Myanmar assuming their credit card or standard travel insurance will cover emergencies. It almost certainly won’t. Level 4 “Do Not Travel” advisories—issued by the US, Australia, UK, and Canada for Myanmar since May 2025—trigger automatic exclusion clauses in approximately 85% of standard travel insurance policies, including most credit card coverage.

The financial exposure is severe: medical evacuation from Yangon to Bangkok runs $50,000-$100,000 USD, with no policy backstop if yours contains the standard “government advisory exclusion” clause. For US, Australian, and European travelers planning Myanmar trips between now and late 2026, this isn’t fine print paranoia—it’s a gap that leaves you personally liable for catastrophic costs in a country where your government explicitly states it cannot assist or evacuate you.

Why standard policies void Myanmar coverage

The mechanism is straightforward: insurers write exclusion clauses referencing government travel advisories. When a destination reaches Level 4 (US), “Do Not Travel” (Australia), or equivalent red-zone status, claims filed from that location are automatically denied. Air Traveler Club’s analysis of 40 major travel insurance policies found this exclusion present in 34 of them—including Chase Sapphire, Amex Platinum, and Allianz Global Assistance.

Myanmar has held uniform high-risk designation across all major Western governments since the military coup escalated in 2021, with the current US advisory dated May 12, 2025. The U.S. State Department Level 4 advisory for Myanmar cites armed conflict in Kachin, Shan, Rakhine, and multiple other states—conditions that show no signs of improvement.

| Country | Advisory Level | Issue Date | Government Assistance |

|---|---|---|---|

| United States | Level 4: Do Not Travel | May 12, 2025 | Very limited |

| Australia | Do Not Travel | Ongoing 2026 | None specified |

| United Kingdom | Red: Avoid All Travel | Current 2026 | Minimal |

| Canada | Avoid All Travel | January 2026 | Limited |

This uniformity matters because insurers often reference the highest global advisory level when adjudicating claims—meaning even if your home country’s warning is slightly softer, a US Level 4 can void your policy.

The medevac cost reality

Medical evacuation from Myanmar isn’t theoretical risk—it’s documented expense. A 2024 case involving a European tourist required $75,000 USD for air ambulance transport from Yangon to Bangkok’s Bumrungrad Hospital. Standard evacuations to regional hubs range from $35,000 to $60,000; direct repatriation to the US or Europe exceeds $100,000.

Myanmar’s healthcare infrastructure has deteriorated significantly since 2021. International-standard facilities are limited to Yangon, and even there, capacity for trauma or complex conditions is minimal. The practical reality: any serious medical event requires evacuation, and without valid insurance, you’re paying out of pocket.

Myanmar’s mandatory insurance requirement

Ironically, Myanmar itself requires all visa applicants to show proof of $30,000 USD minimum medical coverage including repatriation. This entry requirement exists independently of whether your policy will actually pay claims from a Level 4 destination—creating a compliance gap where travelers meet visa requirements with policies that won’t honor claims.

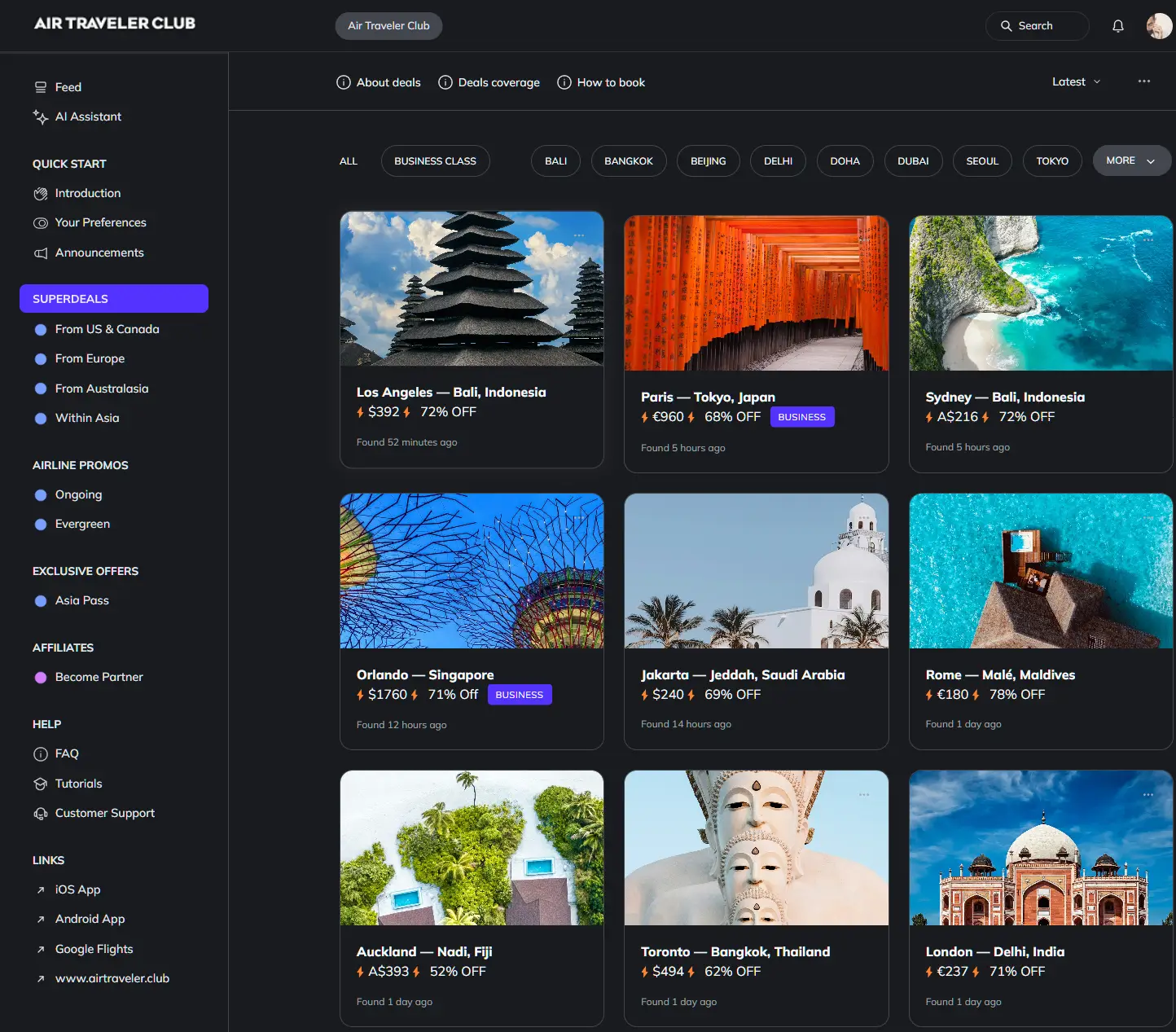

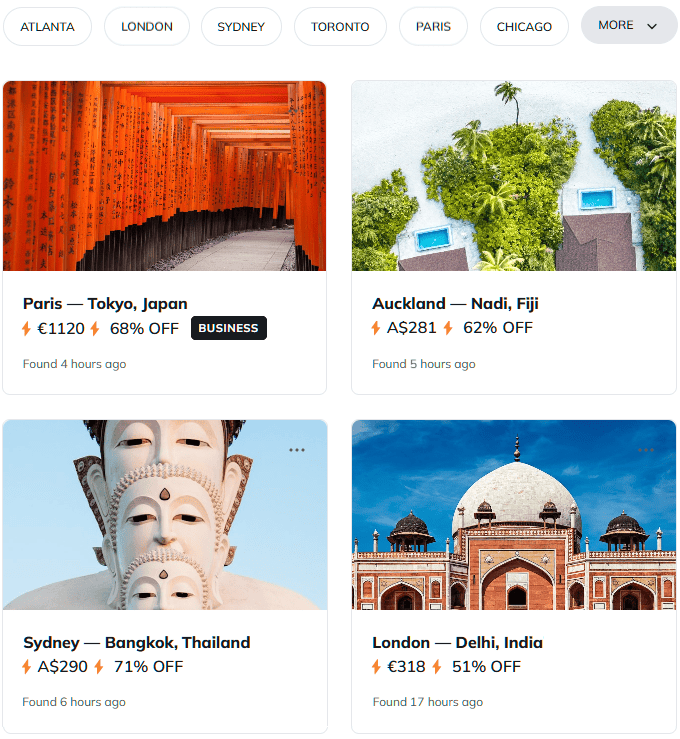

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

High-risk coverage options that actually work

Specialized providers explicitly cover Level 4 destinations where standard policies exclude. Two leading options for Myanmar travel:

- Battleface High-Risk Travel Insurance: Covers Level 4 destinations with medevac limits up to $1 million USD. Pricing starts at $365 for basic 30-day coverage; conflict zone add-ons increase premiums 20%. Requires pre-approval for active conflict areas and health declaration.

- Global Underwriters: Similar coverage structure starting at $450 base for solo travelers. Offers annual policies from $500-$1,200 depending on age and trip frequency.

These policies cost 2-5x standard travel insurance—but standard insurance provides zero coverage for Myanmar, making the comparison meaningless. The real calculation: $365-$1,200 for valid coverage versus $50,000+ personal liability for medevac.

For travelers weighing strategies to reduce overall trip costs, high-risk insurance is non-negotiable overhead that enables everything else. Savings on flights become irrelevant if a medical emergency bankrupts you.

Before you book: verification checklist

If you’re proceeding with Myanmar travel despite advisories, complete these steps before purchasing flights:

- Pull your existing policy’s full terms. Search for “government advisory,” “travel warning,” or “State Department” exclusions. Credit card benefits documents are typically 50-100 pages—the exclusion is there.

- Confirm current advisory status. Check your home country’s official travel advisory site (State Department, Smartraveller, FCDO) within 72 hours of booking. Advisory levels can change.

- Purchase high-risk coverage first. Buy specialized insurance before booking flights. Some policies exclude coverage if purchased after advisory issuance for your trip dates.

- Verify Myanmar entry compliance. Ensure your high-risk policy meets the $30,000 minimum medical coverage requirement for visa approval. Not all policies qualify.

- Document everything. Keep policy numbers, coverage summaries, and emergency contact numbers accessible offline. Myanmar’s internet infrastructure is unreliable.

When this guidance doesn’t apply

Three scenarios where standard exclusions may not void coverage:

Corporate travel policies: Employer-sponsored plans often lack advisory exclusions, covering business travelers regardless of destination status. However, personal add-on coverage typically reverts to standard exclusions—verify with your HR department.

Pre-existing bookings: Some policies grandfather trips booked before advisory issuance. If you purchased coverage and flights before May 2025’s Level 4 designation, your original policy may remain valid—but upgrades or modifications can void this protection.

Journalist and NGO coverage: Specialized policies for media and humanitarian workers explicitly cover conflict zones. These require professional credentials and typically cost significantly more than standard high-risk options.

Questions? Answers.

Does credit card travel insurance cover Myanmar despite Level 4?

No. Major issuers including Chase Sapphire, Amex Platinum, and Capital One Venture explicitly exclude destinations under US State Department Level 3 or higher advisories. The exclusion clause typically reads “government travel warning” or “advisory exclusion”—check your cardholder agreement’s travel benefits section.

What’s the cheapest high-risk policy for a 2-week Myanmar trip?

Battleface starts at approximately $365 USD for basic 30-day coverage including medevac. Adding conflict zone coverage increases premiums by 20%. Global Underwriters offers similar coverage from $450 base. Both require health declarations and may exclude pre-existing conditions.

Does Myanmar still require proof of insurance at immigration?

Yes. All visa applicants must demonstrate minimum $30,000 USD medical coverage including repatriation. Immigration officers may request digital or physical proof—travelers have been denied entry without documentation. Ensure your high-risk policy meets this threshold.

What if the advisory drops to Level 3 during my trip?

Coverage status is typically locked at purchase date, not claim date. If you bought a policy excluding Level 4 destinations, a mid-trip downgrade doesn’t retroactively validate coverage. Conversely, if you purchased high-risk coverage, a downgrade doesn’t void your existing policy.

Are any airlines refusing to fly to Myanmar?

No blanket bans exist as of early 2026. Thai Airways, Singapore Airlines, and regional carriers like Myanmar National Airlines continue operations. However, flight schedules are reduced compared to pre-2021 levels, and routes may change with minimal notice due to operational conditions.

How do Australian travelers verify Smartraveller advisory status?

Visit smartraveller.gov.au and search “Myanmar” for current advisory level, specific regional risks, and registration recommendations. Australian policies typically reference Smartraveller rather than US State Department advisories—but both currently show equivalent “Do Not Travel” status.