A medical emergency in Mongolia’s Gobi Desert triggers a $30,000-50,000 evacuation bill to Seoul or Beijing—payable in full before the aircraft departs. Most travelers discover their credit card’s “worldwide coverage” caps medical evacuation at $25,000-50,000, leaving them personally liable for five-figure costs when facilities demand upfront payment.

The gap is structural, not exceptional. Mongolia’s medical infrastructure handles routine care adequately, but serious trauma, cardiac events, or complex surgeries require evacuation to South Korea or China. Air ambulance operators and receiving hospitals require confirmed payment before transport begins. Credit card travel benefits operate on reimbursement models—you pay first, claim later. In a Mongolian emergency, “later” means after you’ve somehow produced $40,000 in cash or wire transfer.

Air Traveler Club’s analysis of 12 major credit card travel benefit programs confirms the pattern: Chase Sapphire Reserve caps evacuation at $100,000 (the highest among premium cards), while most cards including Amex Platinum limit coverage to $50,000 or less. For US passport holders planning Mongolia travel in 2025-2026, this creates a quantifiable protection gap requiring supplemental coverage with minimum $100,000 medical evacuation limits.

The coverage gap most travelers miss

Credit card travel insurance operates fundamentally differently from standalone travel medical policies. The distinction matters in Mongolia’s cash-first medical system.

Reimbursement versus direct payment: Credit card benefits reimburse expenses after you’ve paid them. Standalone policies from providers like GeoBlue or Allianz offer direct billing—the insurer pays the provider directly, eliminating the need for travelers to front five-figure sums during emergencies.

Pre-existing condition exclusions: Most credit card policies exclude pre-existing conditions entirely. A traveler with controlled hypertension who suffers a stroke in Ulaanbaatar may find their evacuation claim denied. Standalone policies offer pre-existing condition waivers if purchased within 14-21 days of initial trip deposit.

Activity restrictions: Horse trekking across the steppes, Gobi Desert expeditions, and mountain hiking—Mongolia’s primary attractions—often fall outside standard credit card coverage as “extreme activities.” Tour operators increasingly require proof of adventure-specific coverage before departure.

Why Mongolia demands upfront payment

Unlike Western medical systems accustomed to insurance billing, Mongolian facilities and evacuation operators have learned from experience. International patients who promise insurance reimbursement sometimes disappear after treatment. The solution: no payment, no transport. This policy applies equally to air ambulances, receiving hospitals in Seoul, and medical escort services.

What your policy actually covers

Before booking Mongolia travel, request the full policy document (not the summary) from your credit card issuer. Look for these specific terms:

| Coverage Type | Typical Medevac Limit | Pre-Existing Covered? | Direct Payment? | Mongolia Suitable? |

|---|---|---|---|---|

| Standard Credit Card | $25,000-50,000 | No | Reimbursement only | No |

| Premium Credit Card (CSR) | $100,000 | No | Reimbursement only | Marginal |

| GeoBlue Voyager | $1,000,000+ | Waiver available | Yes | Yes |

| Allianz Global | $100,000-500,000 | No (waiver extra) | Yes | Yes |

| Standalone Medevac (Medjet) | $500,000+ | Optional rider | Yes | Yes |

The U.S. Department of State’s Mongolia travel advisory explicitly recommends supplemental insurance covering medical evacuation, noting that facilities are limited and evacuation may be necessary for serious conditions.

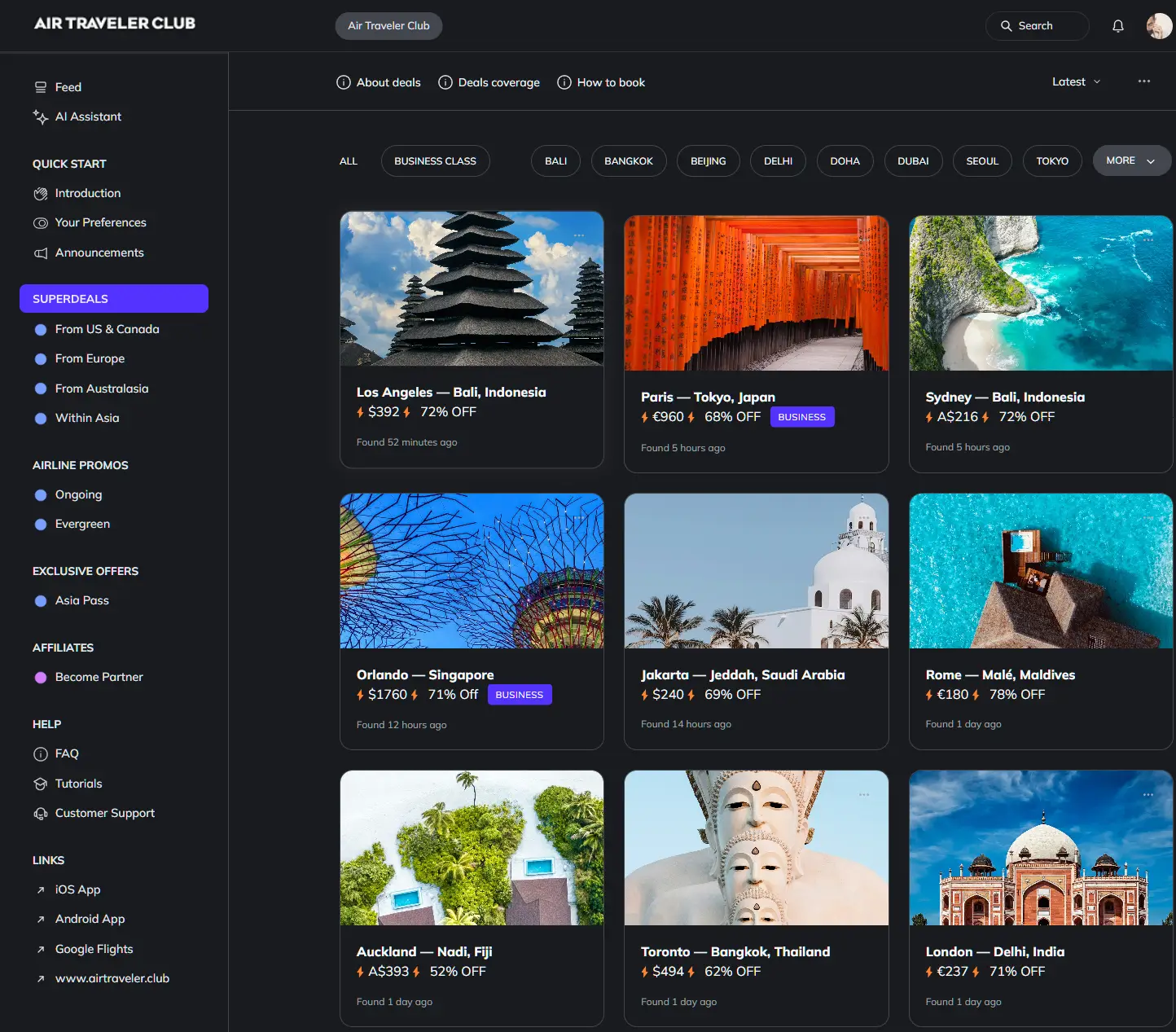

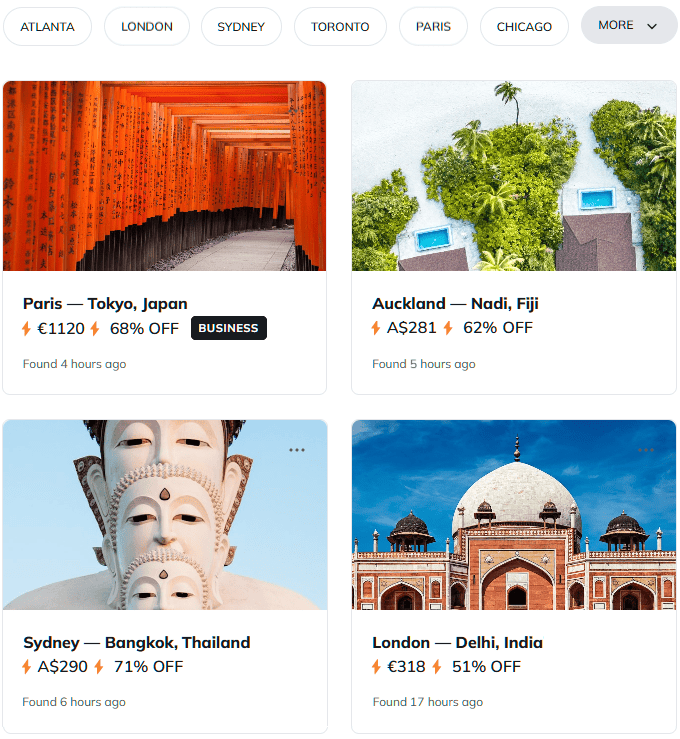

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

The 10-minute verification checklist

Call your credit card’s benefits administrator (not general customer service) and confirm these specific points:

- Medical evacuation limit in USD. Ask for the exact figure, not “up to” language. If below $100,000, you need supplemental coverage.

- Definition of “medical evacuation.” Some policies cover transport to the nearest adequate facility only (potentially a Mongolian hospital), not repatriation home.

- Pre-existing condition exclusions. Request the specific policy language. “Stable for 60 days” clauses may still exclude chronic conditions.

- Adventure activity coverage. Confirm horse riding, desert trekking, and mountain hiking are included. Many policies exclude these as “hazardous activities.”

- Payment mechanism. Ask whether the insurer pays providers directly or reimburses you after payment. For Mongolia, direct payment is essential.

For travelers whose existing coverage falls short, our Asia Pass benefits portfolio includes emergency assistance coordination and medical facility recommendations across Asia-Pacific destinations, complementing but not replacing dedicated evacuation insurance.

When standard advice doesn’t apply

Extended stays beyond 30 days: Most travel insurance policies expire with your trip. Digital nomads or long-term travelers need annual policies or country-specific expat coverage.

US domestic health insurance holders: Your Anthem or Blue Cross plan provides zero coverage outside the United States, including evacuation. The “worldwide” network some plans advertise refers to provider directories, not actual benefits.

Travelers over 65: Many policies impose age limits or dramatically increase premiums. Verify coverage availability before assuming your standard provider applies.

Extreme altitude or remote regions: Western Mongolia and high-altitude areas may fall outside standard coverage zones. Confirm your policy covers the specific regions you’re visiting, not just “Mongolia” generally.

The cost-benefit calculation

A comprehensive travel medical policy with $100,000+ evacuation coverage costs approximately $50-150 for a two-week Mongolia trip—roughly 4-5% of typical adventure tour costs. The alternative: personal liability for $30,000-50,000 in evacuation expenses, plus potential hospital bills in Seoul or Beijing averaging $500-2,000 per day.

The math favors insurance overwhelmingly. A $100 policy premium versus potential $40,000 exposure represents 400:1 risk mitigation—before accounting for the practical impossibility of producing five-figure sums from a hospital bed in Ulaanbaatar.

Questions? Answers.

Does Mongolia require proof of travel insurance at entry?

No legal mandate exists for travel insurance to enter Mongolia. However, many tour operators require proof of medevac coverage before confirming bookings, and some visa applications through third-party embassies request insurance documentation. The absence of a legal requirement doesn’t reduce the practical necessity—your domestic health insurance provides zero coverage for international evacuations.

What if my credit card claims “worldwide medical coverage”?

“Worldwide” typically refers to geographic scope, not coverage adequacy. Most credit card policies cap medical evacuation at $25,000-50,000 and operate on reimbursement models requiring you to pay upfront. Request the full policy document and verify the specific evacuation limit, payment mechanism, and activity exclusions before relying on credit card coverage for remote destinations.

Can I purchase evacuation insurance after arriving in Mongolia?

No. Travel insurance policies must be purchased before departure. Attempting to buy coverage after a medical event has occurred—or even after arriving at your destination—voids the policy for that trip. Some providers allow mid-trip extensions for travelers who decide to stay longer, but the original policy must have been in force before departure.

Are GeoBlue and Allianz the only options for Mongolia coverage?

No, but they’re among the most commonly recommended for remote Asia-Pacific travel. Other providers include IMG Global, World Nomads (popular with adventure travelers), and dedicated medevac membership programs like Medjet. Compare policies specifically for evacuation limits, direct payment capabilities, and adventure activity coverage rather than choosing based on brand recognition alone.

What vaccinations should I get beyond insurance coverage?

CDC and WHO recommend routine vaccinations plus hepatitis A and B for Mongolia. Rabies vaccination is advised for travelers planning rural stays, horse trekking, or extended outdoor activities where animal contact is possible. These health preparations complement but don’t replace evacuation insurance—vaccines prevent certain diseases but don’t help if you break a leg on a horse trek.

How do I verify my policy includes direct payment to providers?

Look for terms like “direct billing,” “cashless claims,” or “coordination of benefits with providers” in your policy document. Call the insurer’s 24-hour assistance line and ask specifically: “If I need evacuation from Mongolia, will you pay the air ambulance company directly, or must I pay and seek reimbursement?” The answer determines whether your coverage actually functions in Mongolia’s cash-first system.