Quick summary

Qatar Airways business class from Oslo to Kuala Lumpur prices at €1,780 roundtrip versus €3,180 from London Heathrow—a verified €1,400 gap per person as of February 2026. Turkish Airlines shows identical patterns: Milan to KUL at €1,920 versus €3,220 from Frankfurt, a 40% discount for the same seat and service.Net savings exceed €1,100 per person after positioning flights and an overnight hotel. The strategy breaks down during July–August and December peak periods, and separate tickets carry connection risk. The full fare matrix, positioning costs, and KUL gateway connections follow below.European business class passengers flying to Kuala Lumpur from London or Frankfurt are overpaying by €1,200–1,400 per person. The identical Qatar Airways and Turkish Airlines seats—same aircraft, same lie-flat bed, same lounge access—cost 35–42% less when booked from secondary European cities like Oslo, Budapest, or Milan.

Air Traveler Club’s fare analysis of eight European departure cities to KUL, verified against airline booking engines on 14 February 2026, confirms the gap is structural, not promotional. Qatar Airways files OSL–DOH–KUL business class at €1,780 roundtrip. The same routing from LHR: €3,180. Turkish Airlines prices MIL–IST–KUL at €1,920 versus €3,220 from FRA. A €55–80 positioning flight on Ryanair or Wizz Air erases the geographic disadvantage while preserving over €1,100 in net savings.

These fares apply to non-peak travel between February and June 2026, with a minimum 21-day advance purchase. For European residents willing to add one short intra-European flight, the math is unambiguous.

Why secondary cities price 40% lower

Gulf and Turkish carriers file market-specific fares through IATA’s fare filing system, setting prices independently for each departure city. London Heathrow and Frankfurt attract intense competition from British Airways, Lufthansa, and Singapore Airlines—carriers that anchor premium pricing. Qatar and Turkish match those elevated fare levels at major hubs because the market sustains them.

Secondary cities operate differently. Oslo, Budapest, and Milan have fewer premium competitors on Asia-Pacific routes. To fill widebody aircraft on legs like OSL–DOH or BUD–IST, carriers file aggressively low fares targeting 85% load factors on underutilized segments. This isn’t a glitch—it’s deliberate yield management, and the practice widened by roughly 25% since 2023 as post-COVID capacity strategies pushed carriers to diversify beyond saturated hubs.

The UK’s Air Passenger Duty compounds the problem for London departures, adding £180 per premium cabin passenger on long-haul flights. But even without APD, the filed fare differential between LHR and OSL exceeds €1,000. Tax policy accelerates the gap; competitive dynamics create it.

This pricing pattern mirrors the Continental Hop Trick strategy our detailed European routing guide documents across dozens of Asia-Pacific destinations—secondary departures consistently unlock 30–50% savings that major hub passengers never see.

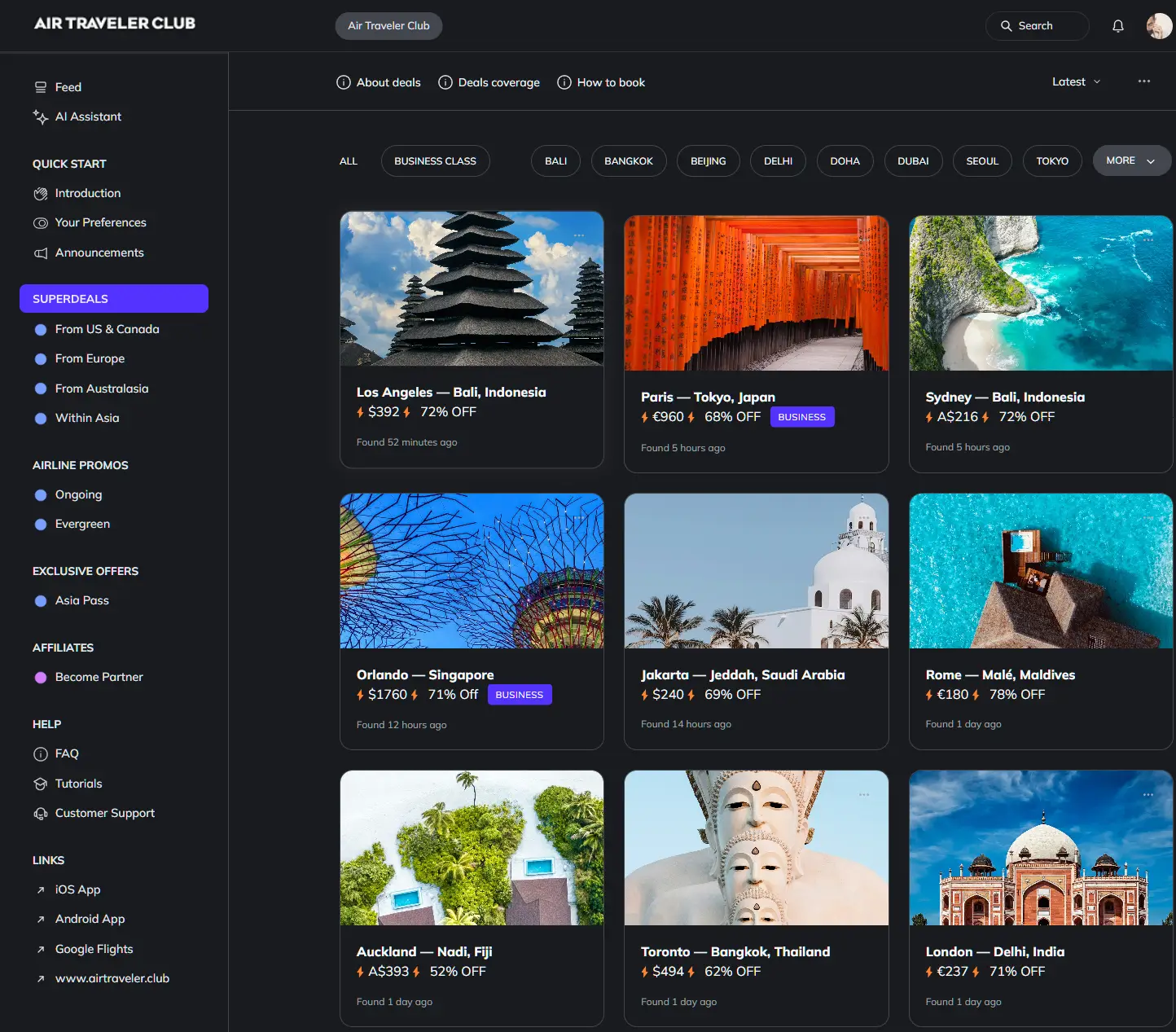

The pricing matrix: six cities compared

The savings hold across multiple secondary gateways. Positioning costs vary by origin, but net savings remain above €1,100 in every tested scenario.

| Departure City | Airline | Business RT (€) | Positioning (€) | Net Savings vs LHR (€) | Savings % |

|---|---|---|---|---|---|

| Oslo (OSL) | Qatar Airways | 1,780 | 75 | 1,325 | 42% |

| Budapest (BUD) | Qatar Airways | 1,850 | 55 | 1,275 | 40% |

| Milan (MXP) | Turkish Airlines | 1,920 | 60 | 1,200 | 37% |

| London (LHR) | Qatar Airways | 3,180 | 0 | 0 | Baseline |

| Frankfurt (FRA) | Turkish Airlines | 3,220 | 0 | –40 | Baseline |

Oslo delivers the highest net savings at €1,325 per person. Budapest follows closely at €1,275 with the lowest positioning cost. Milan offers the strongest Turkish Airlines option. For a couple traveling business class, the total savings range from €2,400 to €2,650—enough to fund the entire ground portion of a two-week Southeast Asia trip.

According to IATA’s fare filing guidelines, carriers set market-specific prices independently, enabling €1,200–1,500 gaps between primary and secondary European departure points on identical KUL routings. The practice is standard yield management, not a pricing error.

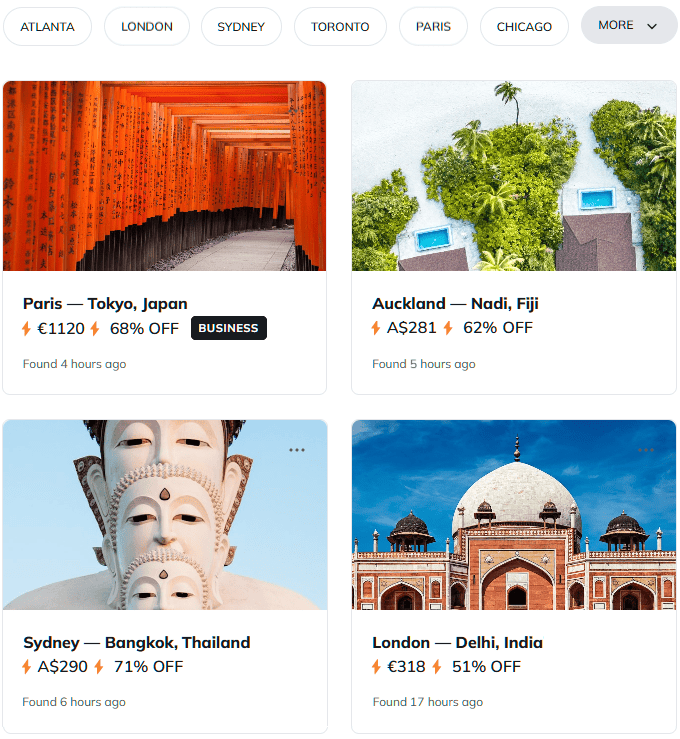

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Booking the positioning strategy

Execution requires two separate bookings. First, the long-haul: search Qatar Airways or Turkish Airlines directly for your chosen secondary city to KUL, selecting business class with flexible dates ±3 days for optimal pricing. Book 21–60 days before departure for the best fare availability.

Second, the positioning flight: Ryanair, Wizz Air, or EasyJet connect major hubs to secondary cities for €40–80 one-way. Schedule the positioning flight to arrive the evening before your long-haul departure. Budget €80–120 for an airport hotel overnight.

Post-COVID capacity strategy widened the gap

Before 2020, the business class pricing gap between primary and secondary European hubs averaged 15–20%. Post-pandemic, Gulf carriers expanded secondary city frequencies to capture demand while major hubs remained congested. The result: a 25% wider pricing disparity that shows no sign of narrowing as carriers continue chasing load factors on newer routes.

Separate tickets carry zero delay protection. If your positioning flight cancels, the long-haul carrier has no obligation to accommodate you. Mitigate this by arriving the night before, which the hotel cost already assumes. Morning positioning flights on the same day are risky—afternoon weather delays or strikes can cascade.

For travelers who regularly spot these pricing patterns, our European Superdeal alerts surface verified business class anomalies from secondary cities within hours of filing, catching temporary drops that standard booking sites miss.

KUL as your Southeast Asia gateway

Kuala Lumpur International Airport operates 200+ daily Asia-Pacific flights, making it one of the region’s most connected hubs. AirAsia runs high-frequency budget connections from KUL to Singapore (€28), Bali (€35), Bangkok (€32), and dozens of other destinations—all bookable separately for minimal cost.

This transforms a business class trip to Malaysia into a multi-country Southeast Asia journey. Fly lie-flat to KUL, spend a few days in Kuala Lumpur, then hop to Bali for €35. The total cost—business class long-haul plus budget regional connections—still undercuts a London economy fare to Bali on many dates.

Our analysis of optimal European hub airports for Asia flights ranks Istanbul and secondary cities consistently higher than London or Frankfurt for both pricing and connection efficiency on Southeast Asian itineraries.

When this strategy breaks down

Three scenarios erode or eliminate the savings advantage:

- Peak travel periods compress the gap. July–August and December 2026 fares from secondary cities rise 25–50%, shrinking savings to €400–600. The positioning logistics become harder to justify for a smaller differential.

- Elite status members face inventory constraints. Oneworld and Star Alliance elites may find award-blocking fares from secondary cities, where carriers allocate fewer discounted business class seats to protect loyalty redemption inventory.

- Separate ticket delays have no safety net. Under EU Regulation 261/2004, your long-haul carrier bears no responsibility if a positioning flight delay causes you to miss the connection. The overnight-before strategy is essential, not optional.

Making it work: the booking checklist

Search the long-haul first using incognito browsing. Compare OSL, BUD, and MXP departures on the same dates. Lock the cheapest business class fare, then book positioning separately. Allow a full overnight buffer. Pack carry-on only for the positioning leg—business class long-haul includes 2×32kg checked bags, but low-cost positioning flights typically allow only 10kg cabin baggage.

For a couple, this strategy converts €6,360 in London business class fares into roughly €3,800 all-in from Oslo—including positioning, hotel, and the same Qatar Airways lie-flat seat. The €2,560 saved buys three weeks of hotels across Southeast Asia.

Questions? Answers.

Does this strategy work for destinations beyond Kuala Lumpur?

Yes, but KUL shows the widest gap. Singapore business class from Oslo runs approximately €2,400 versus €3,600 from London—still significant but narrower due to higher Singapore Airlines competition on secondary routes. Bangkok and Jakarta show similar patterns to KUL with €1,000+ savings from secondary European cities.

Can I earn frequent flyer miles on the discounted fare?

Full miles accrue on Qatar Airways and Turkish Airlines business class regardless of departure city. The fare class may vary (J, C, D, or I), affecting earning rates by 50–150%. Check your loyalty program’s earning chart for the specific booking class before purchasing. Low-cost positioning flights on Ryanair earn no miles; Wizz Air offers limited Turkish Miles&Smiles accrual on select fares.

What happens to checked bags between the positioning and long-haul flights?

On separate tickets, bags do not transfer. You must collect luggage in the secondary city, clear it through any applicable customs, and re-check for the long-haul flight. This is why arriving the evening before is essential—it eliminates time pressure. Business class long-haul allows 2×32kg, but budget positioning flights charge €25–40 per checked bag.

Do non-EU passport holders need a Schengen visa for the positioning stop?

If your positioning flight routes through a Schengen country (Norway, Hungary, Italy), you must be eligible for Schengen entry—either visa-free or with a valid Schengen visa. US, UK, Canadian, and Australian passport holders enter visa-free for up to 90 days. Note that ETIAS pre-authorization will be required for visa-exempt travelers once implemented.

Could EU green taxes narrow this pricing gap in the future?

The European Commission’s aviation sustainability proposals could introduce carbon-linked surcharges by 2027–2028, potentially adding €30–80 per flight regardless of departure city. However, since these taxes would apply uniformly, the relative gap between primary and secondary hubs should persist—the pricing difference stems from competition dynamics, not tax structures.

Is booking through a travel agent or OTA better for this strategy?

Book directly with the airline for the long-haul segment. Direct bookings provide easier rebooking if schedules change and ensure full loyalty program accrual. For the positioning flight, book directly with the low-cost carrier. Avoid OTAs that bundle separate tickets into a single itinerary—this creates false expectations of connection protection that does not exist.