Your Chase Sapphire Reserve, Amex Platinum, or standalone travel insurance policy will not cover you in Lebanon. The country holds a U.S. State Department Level 4 “Do Not Travel” advisory—and virtually every standard travel insurance policy, including credit card bundles, excludes destinations under active government advisories. The moment you arrive in Beirut, your medical coverage, emergency evacuation benefits, and trip interruption protections are void.

Air Traveler Club’s travel advisory monitoring system flagged Lebanon’s persistent Level 4 status, now active since October 2023 and continuing into 2026, as a critical insurance gap affecting travelers from the United States, Canada, Europe, Australia, and New Zealand. If you need emergency medical evacuation from a Level 4 zone, you face bills of $100,000 to $200,000 with zero reimbursement from your standard insurer. Specialized high-risk providers like Battleface and Global Rescue offer the only viable alternative, at $100–$200 per week.

Why your premium credit card won’t save you

Chase Sapphire Reserve and Amex Platinum cardholders often assume their bundled travel insurance is comprehensive. It isn’t—not for Level 4 destinations. The insurance certificates for both cards contain exclusion clauses for countries under active government travel advisories. These aren’t obscure technicalities buried in appendices. They’re standard underwriting practice across the industry.

Generali, one of the largest travel insurers globally, explicitly lists Lebanon among destinations it will not cover. This pattern repeats across Allianz, Zurich, and the underwriters behind most credit card programs. The exclusion applies to all coverage components: medical expenses, medical evacuation (medevac), trip interruption, and baggage claims. Your $550 annual fee buys you nothing in Beirut.

The financial exposure is staggering. A conflict-zone air ambulance evacuation to Europe runs $100,000–$200,000. A hospital stay in a destabilized medical system with limited supplies can exceed $50,000 before transport. Standard policies deny every claim filed from a Level 4 country, regardless of the medical circumstances.

What Level 4 actually means for insurance

The U.S. State Department’s four-tier advisory system directly triggers insurance exclusions. Level 1 (Exercise Normal Precautions) and Level 2 (Exercise Increased Caution) rarely affect coverage. Level 3 (Reconsider Travel) creates partial restrictions—some insurers limit coverage, others exclude specific regions within a country. Level 4 voids coverage entirely.

Lebanon has maintained Level 4 status since the U.S. State Department elevated its advisory on October 17, 2023, citing terrorism, armed conflict, kidnapping, and civil unrest. Despite minor administrative updates—including lifting ordered departure for embassy personnel—the advisory level remains unchanged heading into mid-2026.

The advisory-insurance chain reaction

When the State Department upgrades a country to Level 4, insurers don’t individually reassess risk. Their policies contain blanket exclusion clauses referencing government advisories directly. The upgrade triggers automatic coverage voids across the entire insurance industry within days—no insurer-by-insurer decision required.

Australian and New Zealand travelers face identical restrictions. The Australian government’s Smartraveller advisory for Lebanon sits at the highest risk level, explicitly warning that the government cannot assist with evacuation and requiring travelers to obtain high-risk insurance independently. EU member states issue comparable warnings through their respective foreign affairs ministries.

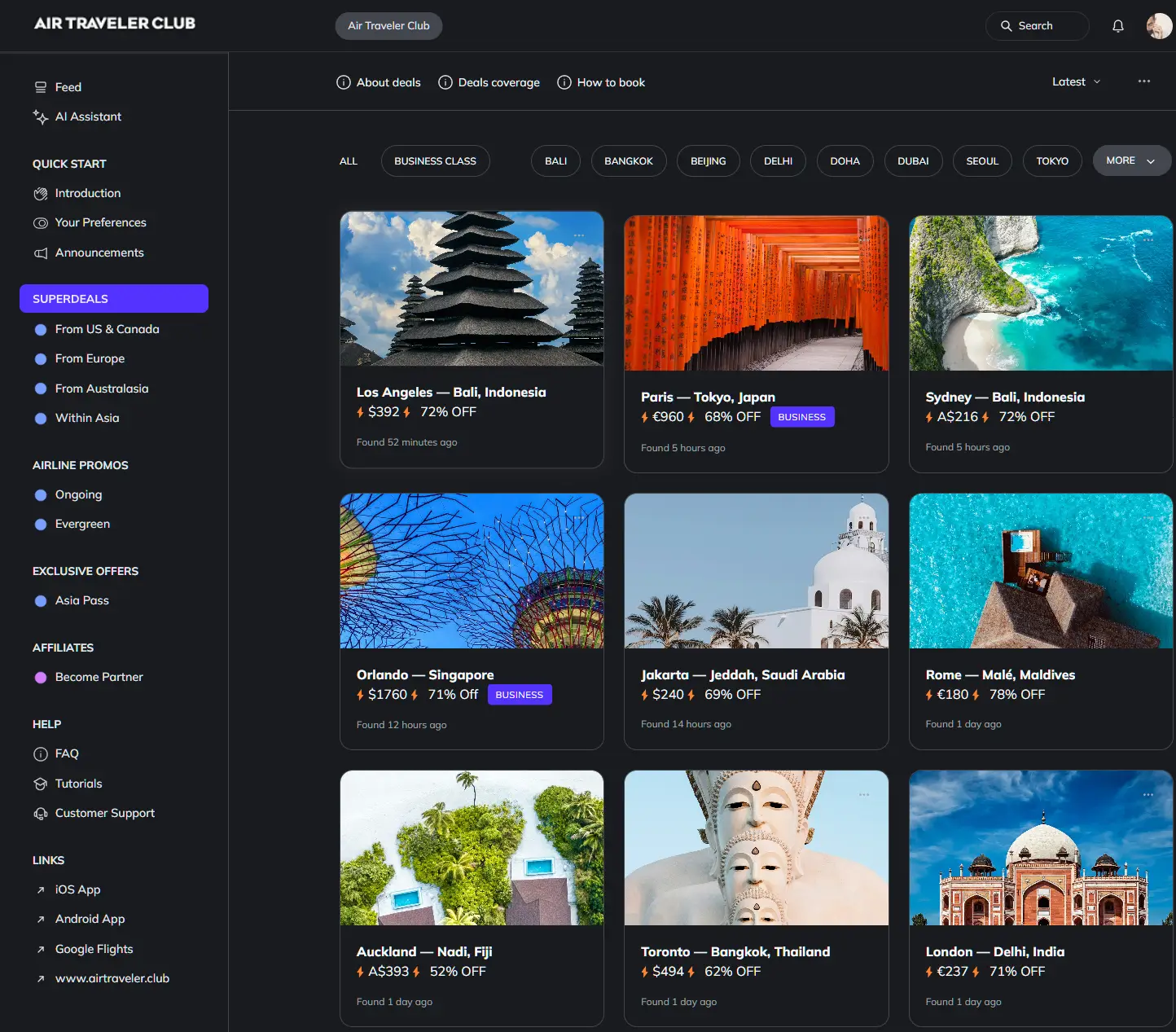

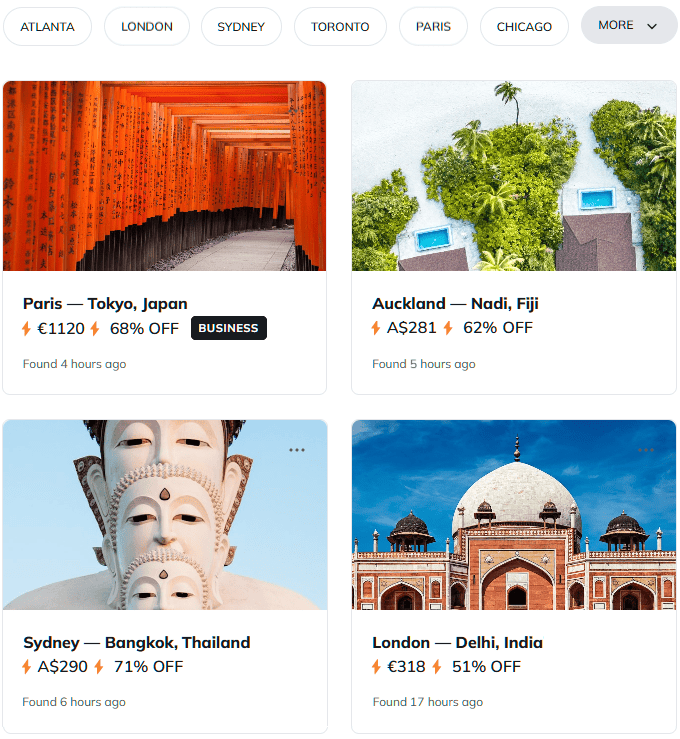

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

The two providers that actually cover Level 4 zones

Specialized high-risk insurance exists, but the market is small. Two providers dominate: Battleface and Global Rescue. Both explicitly underwrite coverage for Level 4 destinations, including active conflict zones.

| Provider | Covers Level 4 | Medevac Limit | Weekly Cost | Key Exclusion |

|---|---|---|---|---|

| Chase Sapphire Reserve | No | $0 (void) | Bundled | All Level 4 zones |

| Amex Platinum | No | $0 (void) | Bundled | Advisory exclusions |

| Generali Standard | No | $0 (void) | ~$40/wk | Lebanon listed explicitly |

| Battleface High-Risk | Yes | $1M | ~$125/wk | None for advisories |

| Global Rescue | Yes | Unlimited evac | ~$195/wk | None |

The cost difference is significant—$125–$195 per week versus $0–$50 for standard coverage. But the math is simple: $195 per week versus $200,000 out-of-pocket for a single evacuation event. Global Rescue’s unlimited evacuation benefit includes extraction from active conflict zones to the hospital of your choice, not merely the nearest facility.

For Australian and New Zealand travelers, Battleface offers 7-day policies starting around AUD 150, with quotes adjusted by age and specific risk profile. These are not optional add-ons—Smartraveller explicitly states that government evacuation assistance is unavailable, making private coverage the only safety net.

Edge cases that catch travelers off guard

Pre-trip cancellation differs from in-trip coverage. If Lebanon’s Level 4 advisory was issued after you purchased your policy, some standard plans allow trip cancellation or interruption claims—typically within 30 days of departure. But this applies only to pre-trip cancellation. Once you’re in-country, medevac and medical coverage remain void regardless of when you bought the policy.

Cancel For Any Reason (CFAR) add-ons cover pre-trip cancellation at 50–75% reimbursement but do not extend in-destination coverage for Level 4 zones. CFAR is a pre-departure tool, not a safety net for travelers already on the ground.

University and institutional travel to Level 4 countries is typically prohibited outright. Academic institutions carry separate liability frameworks that ban faculty and student travel to advisory zones, with no insurance workaround available. Employers enforcing similar bans may void workers’ compensation claims for injuries sustained in prohibited destinations.

Border proximity matters too. Travelers visiting northern Israel within 4 kilometers of the Lebanese border may trigger geo-fenced exclusions in their policies, even if Lebanon isn’t the primary destination. Policy language varies, but proximity to active conflict zones can void coverage for adjacent travel.

Before you book: the three-step verification

First, pull your actual insurance certificate—not the marketing summary, the full policy document. Search for “government advisory,” “Level 4,” and “Do Not Travel.” If any of those terms appear in exclusion clauses, your coverage is void for Lebanon. For travelers heading to other destinations in the region, our analysis of geopolitical disruptions affecting Asia-Pacific routing covers how conflict zones reshape flight paths and insurance requirements.

Second, verify Lebanon’s current advisory status directly through the State Department or your country’s equivalent. Advisory levels can change—though downgrade from Level 4 remains unlikely given ongoing armed conflict.

Third, if you proceed, purchase specialized high-risk coverage before departure. Battleface and Global Rescue both require policies to be active before entering the advisory zone. Neither will issue retroactive coverage once you’re in-country. Budget $125–$195 per week as a non-negotiable travel cost, the same way you’d budget for flights and accommodation.

Questions? Answers.

Does Chase Sapphire Reserve explicitly name Lebanon in its exclusions?

The policy certificate doesn’t list individual countries. Instead, it excludes all destinations under a U.S. government Level 4 “Do Not Travel” advisory. Since Lebanon holds Level 4 status, coverage is automatically void. The same applies to Amex Platinum and most major credit card insurance bundles.

What happens if the advisory level changes while I’m in Lebanon?

If Lebanon is downgraded to Level 3 during your trip, standard insurers may reinstate partial coverage—but this depends on your specific policy language and when coverage was purchased. If the advisory was Level 4 when you departed, most insurers maintain the exclusion for the entire trip duration. High-risk policies from Battleface or Global Rescue are unaffected by advisory changes.

Can airlines refund my ticket because of the Level 4 advisory?

Airlines are not required to issue refunds based on government travel advisories. Some carriers offer credits or rebooking waivers voluntarily, particularly for newly issued advisories. For flights departing from the U.S., DOT regulations require refunds only for airline-initiated cancellations or significant schedule changes—not for advisory upgrades.

Do EU travelers face the same insurance exclusions?

Yes. European foreign affairs ministries issue equivalent high-risk advisories for Lebanon, and EU-based insurers apply similar exclusion clauses. Standard policies from Allianz, AXA, and other major European underwriters void coverage for destinations under their respective government’s highest advisory level. High-risk providers like Global Rescue operate internationally and cover EU passport holders.

How quickly can I get a Battleface or Global Rescue policy?

Both providers issue policies online within 24 hours. Battleface offers instant quotes and same-day activation for most destinations. Global Rescue membership can be activated within 48 hours for standard requests. Neither provider requires waiting periods for Level 4 zone coverage, but policies must be purchased before entering the advisory zone.

Does high-risk insurance cover pre-existing medical conditions in Lebanon?

Coverage varies by provider. Battleface offers optional pre-existing condition riders at additional cost. Global Rescue’s evacuation membership covers transport regardless of medical cause but does not function as traditional health insurance. Both require full medical disclosure during application. Undisclosed conditions may void claims.