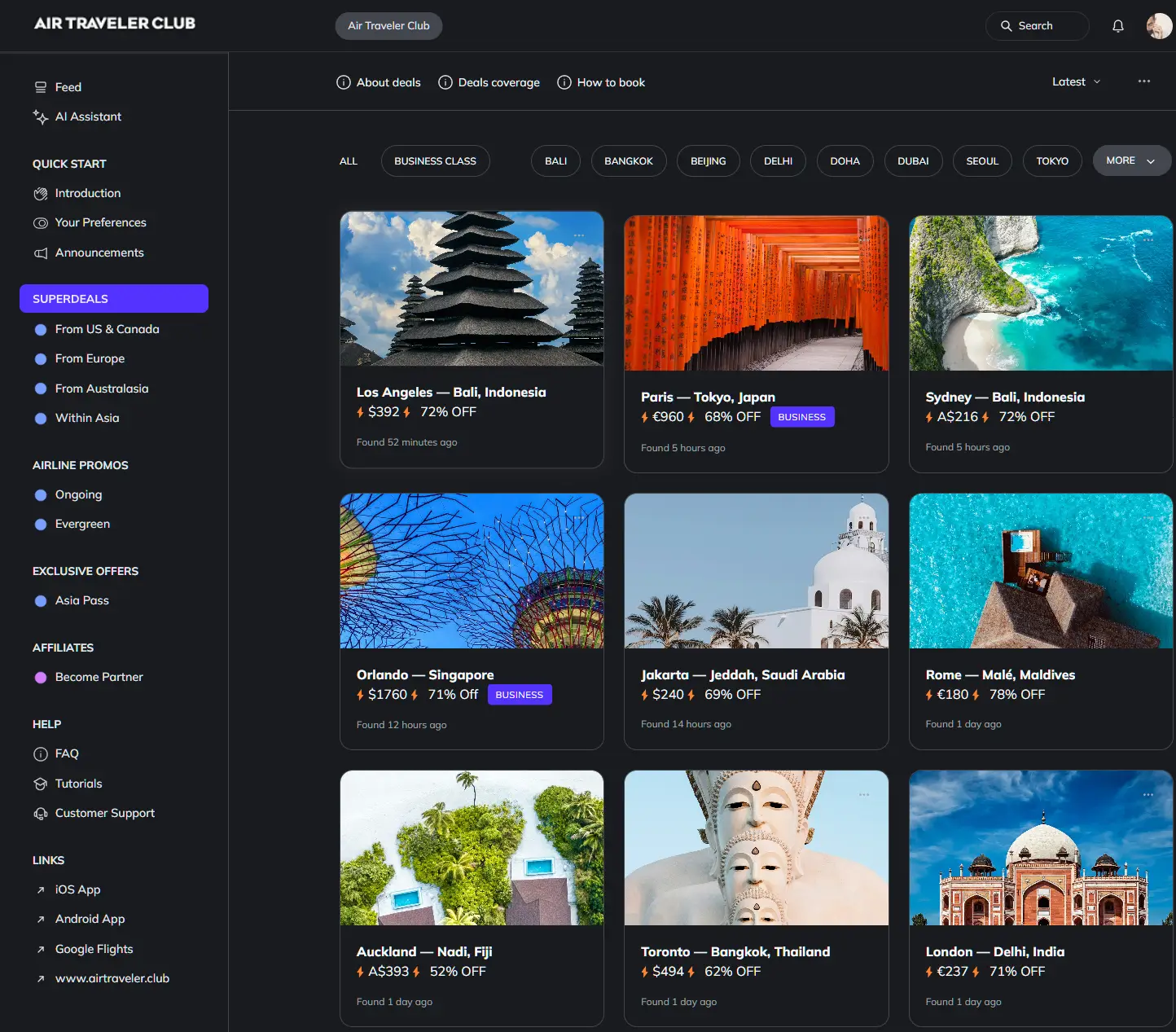

Quick summary

Chinese carriers have slashed 60.5% of China-Japan flight capacity for February 2026 and 63.4% for March, with 49 routes cancelled entirely. The budget fares of $600–850 that made Chinese carriers attractive for Japan travel are no longer reliably available. Air China cancelled Beijing–Sapporo service completely, reduced Shanghai–Tokyo Narita from 4 daily to 2 daily flights, and announced a 56% capacity cut for Northern Summer 2026.The crisis stems from geopolitical tensions triggered in mid-November 2025, not seasonal adjustments. Surviving routes face upward fare pressure, and the special refund policy window closed on 26 January 2026. Travelers targeting Japan in Q1–Q2 2026 need alternative routing strategies.Chinese carriers were the budget traveler’s best-kept secret for Japan flights—Air China, China Eastern, and China Southern routinely filed fares 35–50% below legacy airline prices, saving $400–700 per roundtrip via Shanghai or Beijing. That advantage has collapsed. As of late January 2026, these carriers have cancelled all flights on 49 China-Japan routes for February and reduced remaining capacity by over 60%.

The trigger is geopolitical, not seasonal. Following Japanese PM Sanae Takaichi’s remarks regarding China’s Taiwan in mid-November 2025, China’s foreign ministry issued a travel advisory discouraging trips to Japan. Airlines responded with the steepest capacity cuts on any single international corridor in recent memory. Air Traveler Club’s route monitoring across 200+ Asia-Pacific city pairs flagged the first schedule reductions in December 2025, with cuts accelerating through January 2026. For travelers departing North America, Europe, or Australasia toward Japan between February and October 2026, the China routing strategy requires a complete reassessment.

The capacity crisis in hard numbers

The scale of reductions is unprecedented for a peacetime aviation corridor. February 2026 flights dropped from 4,508 to 1,783—a 60.5% reduction. Seat availability fell from 860,947 to 370,146. March projections are worse: 63.4% fewer flights and 60.2% fewer seats than originally scheduled.

Osaka Kansai airport absorbed the heaviest blow, with February flights declining 72% year-on-year. Xiamen Airlines cut Xiamen–Osaka from 4 weekly flights to just 1. Spring Airlines reduced Shanghai–Osaka from 25 to 21 weekly, dropping further to 18 from 1 March. Smaller carriers like Juneyao and Shandong Airlines followed with 50–75% reductions, citing weak forward bookings and operational risk.

Air China’s Northern Summer 2026 schedule, effective 29 March, confirms this isn’t a temporary blip: 182 weekly Japan flights reduced to 80—a 56% cut extending well beyond winter. According to AeroRoutes’ analysis of OAG schedule filings, the reductions span every major Japanese destination, with complete cancellations on secondary routes like Beijing–Sapporo and Shanghai–Sendai.

| Route | Carrier | Pre-Crisis | Current | Capacity Loss |

|---|---|---|---|---|

| Shanghai–Tokyo Narita | Air China | 4 daily | 2 daily | 50% |

| Beijing–Tokyo Haneda | Air China | 35 weekly | 32 weekly | 9% |

| Shanghai–Osaka Kansai | Spring Airlines | 25 weekly | 18 weekly (from 1 Mar) | 28% |

| Beijing–Sapporo | Air China | 14 weekly | 0 | 100% |

| Shanghai–Sapporo | China Eastern | 14 weekly | 3 weekly (from 17 Mar) | 79% |

| Xiamen–Osaka | Xiamen Airlines | 4 weekly | 1 weekly | 75% |

What this means for fares and stopovers

The social media advice circulating about $600–850 China-routed Japan fares assumed stable capacity. That assumption no longer holds. Capacity loss of 60%+ on a corridor typically compresses discount inventory first—the cheapest fare classes disappear, and surviving seats command premium pricing. The $400–700 savings that made Chinese carriers attractive are likely eroded or eliminated on most routes through at least October 2026.

China’s 144-hour visa-free transit policy technically remains active, allowing travelers to leave the airport during long layovers in Shanghai, Beijing, and other designated cities. But the policy’s practical value depends on flight frequency. Beijing–Sapporo is cancelled entirely—no flight means no stopover. Shanghai–Sapporo at 3 weekly flights offers minimal connection flexibility. Only Beijing–Tokyo Haneda (32 weekly) and Shanghai–Tokyo Narita (2 daily) retain enough frequency to support reliable 8+ hour layover planning.

For travelers who previously relied on Chinese carriers for affordable Japan access, our analysis of Chinese airline pricing dynamics and trade-offs provides context on when these carriers deliver genuine value versus when alternatives perform better—a distinction that matters more than ever during this capacity crisis.

The refund window that already closed

Air China, China Eastern, and China Southern offered fee-free refunds and one free rebooking for tickets purchased before 26 January 2026 midday, covering Japan flights through 24 October 2026. That window has closed. Travelers booking after this date face standard cancellation terms—no special protections despite the airline-initiated schedule changes.

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Alternative routing strategies for Japan in 2026

With Chinese carriers effectively sidelined, three alternative approaches deliver competitive Japan fares without the geopolitical uncertainty.

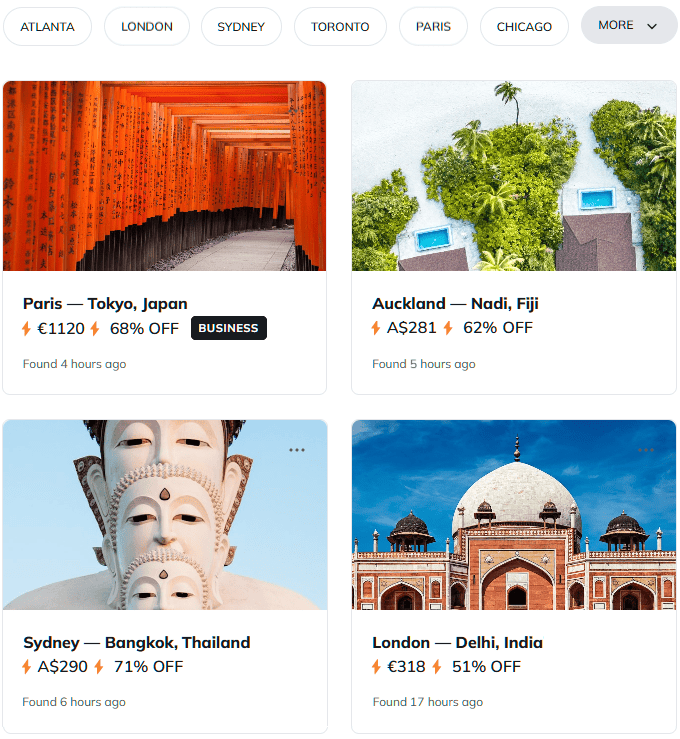

Korean Air and Asiana via Seoul Incheon. South Korea’s carriers maintain full Japan capacity with 40+ daily flights to Tokyo, Osaka, and secondary Japanese cities. Seoul connections add 2–4 hours versus nonstop flights but offer stable pricing and Incheon Airport’s consistently top-ranked transit facilities. Fares from North American gateways via Seoul typically run $800–1,100 roundtrip to Tokyo—higher than pre-crisis Chinese carrier pricing but significantly more reliable.

Japanese carriers on competitive routes. ANA and JAL have maintained or increased capacity on transpacific routes. West Coast departures from LAX, SFO, and SEA offer the strongest pricing, particularly on Boeing 787 Dreamliner and Airbus A350 equipment. Our analysis of US airport pricing for Asia flights shows West Coast gateways consistently undercut East Coast departures by $150–300 on Japan routes.

Middle East hub routing. Qatar Airways, Emirates, and Turkish Airlines serve Japan via Doha, Dubai, and Istanbul respectively, with full schedules unaffected by the China-Japan tensions. These routings add 4–8 hours but frequently appear in pricing anomalies that our AI-powered Superdeal detection system identifies across 200+ routes—temporary drops of 40–80% that typically last 3–7 days.

When the China routing still works—barely

Two specific corridors retain enough frequency to consider. Beijing–Tokyo Haneda at 32 weekly flights maintains reasonable schedule density, and the 9% capacity cut is modest compared to other routes. Travelers with flexible dates who can tolerate potential further reductions may still find competitive pricing on this pairing.

Shanghai–Tokyo Narita at 2 daily flights offers a viable stopover opportunity in Shanghai, though the 50% frequency cut means fewer connection options and tighter booking windows. Cherry blossom season (late March–April) and autumn foliage (October–November) will face intense competition for limited seats.

Critical caveat: All frequencies cited are filed schedules as of 29 January 2026. Further reductions are possible through March and beyond. Verify current schedules directly with airlines before committing to any China-routed Japan booking. The January cancellation rate of 47.2%—up 7.8 percentage points from December—suggests the trend is accelerating, not stabilizing.

Questions? Answers.

Why are Chinese airlines cutting Japan flights so dramatically?

China’s foreign ministry issued a travel advisory in mid-November 2025 discouraging trips to Japan, following Japanese PM Sanae Takaichi’s remarks regarding China’s Taiwan. This triggered demand destruction among Chinese travelers, leading to weak forward bookings. Airlines responded with capacity cuts rather than operating near-empty flights at a loss. The January 2026 cancellation rate reached 47.2%, up 7.8 percentage points from December.

Can I still use China’s 144-hour visa-free transit for a stopover?

The policy remains legally valid at designated airports including Shanghai Pudong, Beijing Capital, Guangzhou, and Chengdu. However, practical viability depends on flight frequency. Beijing–Sapporo is cancelled entirely, and Shanghai–Sapporo drops to 3 weekly flights from 17 March. Only Beijing–Tokyo Haneda (32 weekly) and Shanghai–Tokyo Narita (2 daily) support reliable 8+ hour layover planning.

Are the $600–850 China-routed Japan fares still available?

Unlikely at scale. Capacity loss of 60%+ compresses discount inventory first. The cheapest fare classes disappear when seats become scarce, pushing average fares upward. Spot-check current pricing directly on carrier websites, but expect fares closer to $900–1,200 on surviving routes—narrowing or eliminating the savings advantage over Korean or Japanese carriers.

What happened to the special refund policies?

Air China, China Eastern, and China Southern offered fee-free refunds and one free rebooking for tickets purchased or reissued before 26 January 2026 midday. This window has closed. New bookings are subject to standard airline cancellation terms, with no special protections for geopolitically-driven schedule changes.

Which Japanese destinations are most affected by the cuts?

Osaka Kansai faces the steepest decline at 72% year-on-year in February. Sapporo has lost all Air China service and most China Eastern service. Secondary cities like Fukuoka, Nagoya, and Sendai have lost all Air China flights. Tokyo remains the least affected, with Haneda retaining 32 weekly Air China flights.

Should I wait for capacity to recover before booking China-routed flights?

Air China’s Northern Summer 2026 schedule (effective 29 March) confirms a 56% reduction through at least October 2026. This is not a temporary winter adjustment—it reflects sustained geopolitical tension. Recovery depends on diplomatic developments that are unpredictable. Plan alternative routing now rather than waiting for normalization.

What are the best alternative hubs for reaching Japan affordably?

Seoul Incheon offers the most direct replacement with 40+ daily flights to Japanese cities on Korean Air and Asiana. Taipei on EVA Air and China Airlines provides strong secondary options. For European travelers, Istanbul via Turkish Airlines and Helsinki via Finnair maintain full Japan capacity. All of these hubs avoid the China-Japan geopolitical risk entirely.