Your travel insurance policy almost certainly won’t cover you in Iran—and you probably won’t find out until you need it. US State Department Level 4 advisories automatically void coverage from major providers like Allianz and AXA, leaving travelers completely unprotected for medical emergencies, evacuations, and trip interruptions. The same applies to Canadian “Avoid All Travel” warnings and equivalent UK FCDO advisories.

The insurance gap affects US, Canadian, UK, EU, Australian, and New Zealand passport holders planning Iran visits in 2025-2026. Here’s what most travelers miss: Iran requires its own mandatory insurance for visa approval, costing just $8-20 USD depending on age and trip length. This Iranian policy provides €10,000 medical coverage—sufficient for most tourist emergencies but inadequate for complex evacuations or detention scenarios that government advisories specifically warn about.

Why your current policy won’t work

Standard travel insurance policies contain exclusion clauses that void coverage when visiting destinations under the highest government travel advisories. The US State Department’s Level 4 advisory for Iran cites arbitrary detention risks for American citizens, particularly dual nationals with Iranian heritage. This advisory level triggers automatic policy exclusions across virtually all mainstream insurers.

Air Traveler Club’s analysis of major Western insurance providers confirms the pattern: policies from Allianz, AXA, World Nomads, and similar providers explicitly exclude claims arising from travel to Level 4 destinations. Credit card travel benefits—including premium cards like Chase Sapphire Reserve and Amex Platinum—follow identical exclusion logic for sanctioned or high-advisory destinations.

The exclusion isn’t buried in fine print. It’s fundamental to how insurers assess risk. When your government says “do not travel,” insurers interpret this as unacceptable liability exposure.

Iran’s mandatory insurance: cheap but limited

Iran requires all visa applicants to hold travel insurance as a condition of entry. The good news: this insurance is automatically issued through Iran Insurance Company when your visa is approved, delivered via email within 3 hours of visa processing. You don’t need to purchase it separately before applying.

The €25 catch most travelers miss

Iranian mandatory insurance applies a €25 deductible to all non-emergency medical claims. If your hospital stay is under 24 hours, you may receive no coverage at all. Pre-existing conditions are excluded entirely, and chronic illness complications won’t be reimbursed regardless of severity.

Coverage levels depend on age and trip duration. For travelers under 70, a 15-day policy costs approximately $8 USD; 30 days runs $14 USD. Travelers over 70 pay slightly more—$12 USD for 15 days, $20 USD for 30 days. The policy provides €10,000 maximum medical coverage, repatriation of remains (actual expenses), and €250 legal assistance.

This coverage handles routine tourist emergencies: a broken ankle requiring local hospital treatment, a severe stomach illness needing IV fluids, or minor surgery following an accident. It does not provide adequate protection for complex medical evacuations to Western hospitals, which can exceed €50,000.

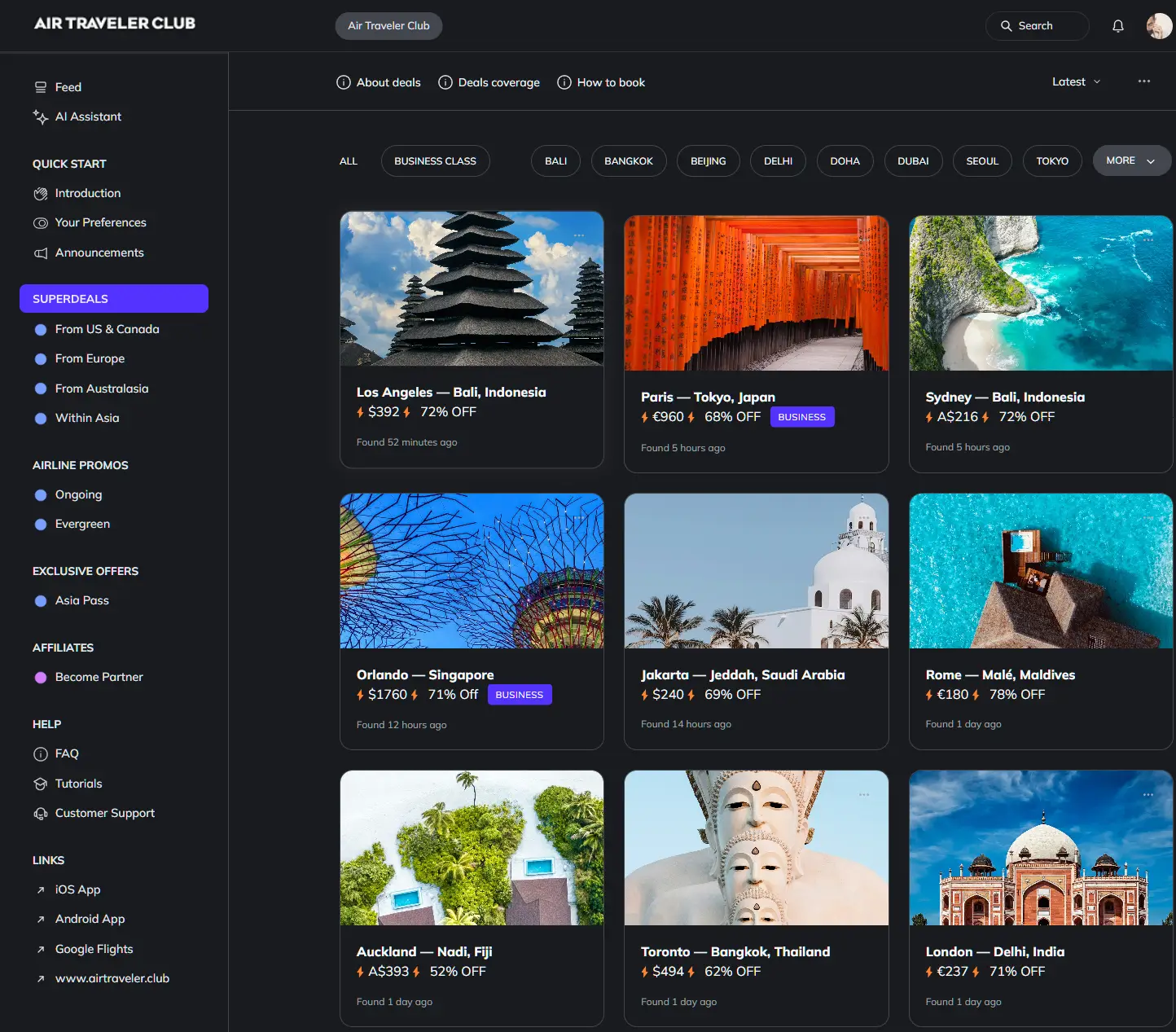

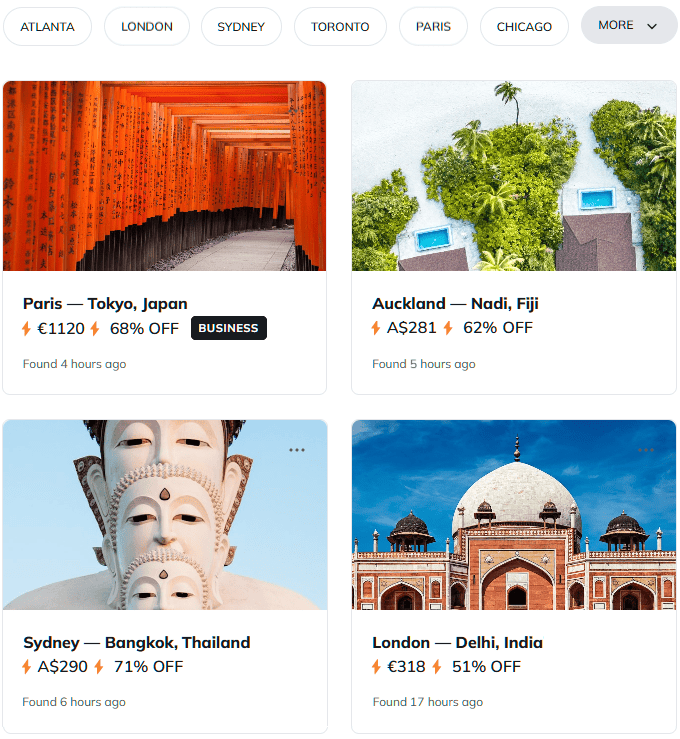

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

The insurance decision matrix

Your choice depends on risk tolerance and trip purpose. Three options exist, each with distinct trade-offs:

| Option | Cost (15-day, under 70) | Medical Coverage | Key Exclusions | Visa Valid? |

|---|---|---|---|---|

| Standard Western Policy | $0 (bundled) | Varies | Iran excluded entirely | No |

| Iranian Mandatory | $8 USD | €10,000 | Pre-existing, €25 deductible | Yes |

| Specialist High-Risk | $150+ USD | €100,000+ | War zones, detention | Yes (if Iran listed) |

Iranian mandatory insurance costs roughly 0.5-1% of typical trip expenses—negligible compared to specialist policies running 5-10% of trip cost. For budget-conscious travelers visiting family or pursuing cultural tourism, the Iranian option provides adequate baseline protection.

Specialist high-risk policies from providers like Battleface or Global Rescue offer comprehensive coverage including emergency evacuation to your home country. These policies explicitly list Iran as covered territory and provide 24/7 assistance coordination. The premium reflects the elevated risk profile insurers assign to Level 4 destinations.

When even specialist policies won’t help

Dual nationals with Iranian heritage face particular vulnerability that no insurance policy addresses. Iran does not recognize dual citizenship—if you hold Iranian nationality by birth or parentage, Iranian authorities consider you solely Iranian regardless of your other passport.

The US State Department explicitly warns that dual nationals face elevated detention risk. Several high-profile cases involve Iranian-Americans detained for years on espionage charges. Insurance policies universally exclude claims arising from government detention, arrest, or legal proceedings—meaning your €100,000 specialist policy provides zero protection in the scenario advisories specifically warn about.

US, Canadian, and UK citizens (even without Iranian heritage) require guided tours and face additional scrutiny. Visa applications undergo extended review periods, and independent travel is prohibited for these nationalities.

Before you book: the verification checklist

If you’re proceeding despite advisories, complete these steps before visa application:

- Contact your existing insurer directly. Ask specifically: “Does my policy cover medical claims arising from travel to Iran?” Get written confirmation—verbal assurances mean nothing during claims processing.

- Verify credit card exclusions. Call your card’s travel benefits line and request the full exclusion list. Most exclude sanctioned countries and Level 4 destinations by default.

- Assess your risk tolerance honestly. Iranian insurance covers €10,000. A medical evacuation flight to Dubai costs €15,000-30,000. Air evacuation to Europe or North America exceeds €50,000. Are you comfortable with this gap?

- Document everything. Photograph your Iranian insurance certificate, save policy PDFs offline, and carry emergency contact numbers for your embassy (even if they can provide limited assistance).

Questions? Answers.

Does my annual multi-trip policy cover Iran if it’s not explicitly excluded?

Almost certainly not. Most major providers auto-void coverage for Level 4 advisory destinations regardless of whether Iran appears in the exclusion list by name. Contact your provider directly and request written confirmation of Iran coverage before traveling.

Can I purchase Iranian insurance before my visa application?

Not necessary. The Iranian Ministry of Foreign Affairs automatically issues insurance through Iran Insurance Company after visa approval. You’ll receive the certificate via email within 3 hours of visa processing. If you prefer purchasing independently, providers like Saman Insurance offer pre-trip options.

What if I’m over 70—does Iranian insurance pricing change significantly?

Modestly. A 15-day policy increases from $8 USD (under 70) to $12 USD. A 30-day policy rises from $14 USD to $20 USD. Coverage limits remain identical at €10,000 medical maximum.

Is Iranian insurance sufficient for medical evacuation to the US or Europe?

No. Iranian insurance covers repatriation of remains and local medical treatment up to €10,000. Complex evacuations requiring air ambulance to Western hospitals cost €15,000-50,000+. Specialist high-risk policies are necessary for comprehensive evacuation coverage.

Do visa-free nationalities need Iranian insurance?

Not legally required, but strongly recommended. Citizens of countries like Malaysia, Armenia, and China can enter Iran without visas and without mandatory insurance. However, traveling without any coverage leaves you fully exposed to medical costs in a country where Western consular assistance is limited.

Will my specialist policy actually pay claims from Iran given sanctions?

Legitimate high-risk insurers like Battleface structure policies to comply with sanctions while still providing coverage. Verify that your specific policy explicitly lists Iran as a covered destination and confirm the claims process before departure. Some policies require pre-authorization for treatment at specific facilities.