Indonesia’s domestic aviation market carries a safety asterisk that most island-hopping travelers never see. The FAA rates Indonesia Category 2—meaning the country’s civil aviation authority doesn’t meet international safety oversight standards—and the EU banned all Indonesian airlines until 2018. For travelers connecting to Komodo, Lombok, or Bali’s outer islands, carrier selection isn’t just about price. It’s about whether your operator passes international audits.

Three carriers consistently clear the bar: Garuda Indonesia, Citilink, and AirAsia Indonesia. All three hold IOSA certification (the airline industry’s global safety audit standard), and Garuda and Citilink leadership participated in Indonesia’s January 2025 DGCA safety review following global aviation incidents. Smaller regional operators—particularly charter services to Papua or remote eastern islands—frequently lack equivalent oversight, with some still appearing on historical EU restriction lists.

For international travelers booking domestic connections in Indonesia through 2026, this three-carrier rule applies regardless of departure region. The price difference between a vetted carrier and an unknown regional operator typically runs 20-50% higher—a premium that buys meaningful safety margin on routes over difficult terrain.

The safety hierarchy: which carriers pass international audits

Indonesia’s aviation safety improvements since 2018 have been uneven. While major carriers aligned with ICAO standards to escape the EU blacklist, the country’s 59 smaller operators faced varying levels of scrutiny. The distinction matters most on domestic routes where international travelers have limited visibility into operator quality.

Air Traveler Club’s carrier safety analysis tracking DGCA compliance and IOSA certification status identifies clear tiers for booking decisions:

| Carrier | IOSA Certified | DGCA Compliance | Recommended Routes | Recent Audit Notes |

|---|---|---|---|---|

| Garuda Indonesia | Yes | High | Komodo, Lombok, all major islands | 5-Star Skytrax safety rating; CEO in Jan 2025 DGCA meeting |

| Citilink | Yes (Garuda group) | High | Lombok, Bali-Jakarta, Surabaya | Strict standards mandated 2025; fatigue review completed |

| AirAsia Indonesia | Yes (group standard) | Medium | Major islands only | Post-2018 EU clearance; group IOSA standards apply |

| Lion Air | Improving | Low-Medium | Avoid for remote islands | Historical incidents; not in 2025 DGCA safety meetings |

| Regional charters (Papua) | No | Low | Avoid | Poor ATC infrastructure; Cat 2 oversight gaps |

The gap between tiers reflects real operational differences. Garuda and Citilink executives met directly with Indonesia’s Director General of Civil Aviation in January 2025 to review aircraft maintenance standards, crew fatigue protocols, and early warning systems—a response to global aviation incidents that signaled regulatory seriousness. Lion Air, despite fleet improvements since its 2018 crash, was notably absent from these safety discussions.

Why FAA Category 2 matters for your booking

The FAA’s Category 2 rating means Indonesia’s civil aviation authority lacks sufficient technical expertise or inspection capacity to meet international standards. This designation restricts US airline codeshares and signals broader oversight gaps that affect all domestic operations.

The 2018 turning point

The EU lifted its blanket ban on Indonesian airlines in June 2018 after a decade-long blacklist—the longest for any major aviation market. The reversal required Indonesia to demonstrate Significant Safety Concern resolution through ICAO’s Universal Safety Oversight Audit Programme. Garuda was the first carrier cleared; others followed incrementally.

For practical booking decisions, FAA Cat 2 means two things. First, US carriers cannot add new codeshare routes with Indonesian operators—existing agreements are grandfathered but expansion is frozen. Second, the rating reflects systemic issues (training standards, maintenance documentation, inspector qualifications) that persist beyond individual airline improvements. Even well-run carriers operate within this constrained regulatory environment.

The OpsGroup aviation safety analysis notes that 59% of Indonesia’s historical aviation accidents stemmed from training and maintenance deficiencies—problems that major carriers have addressed but smaller operators have not.

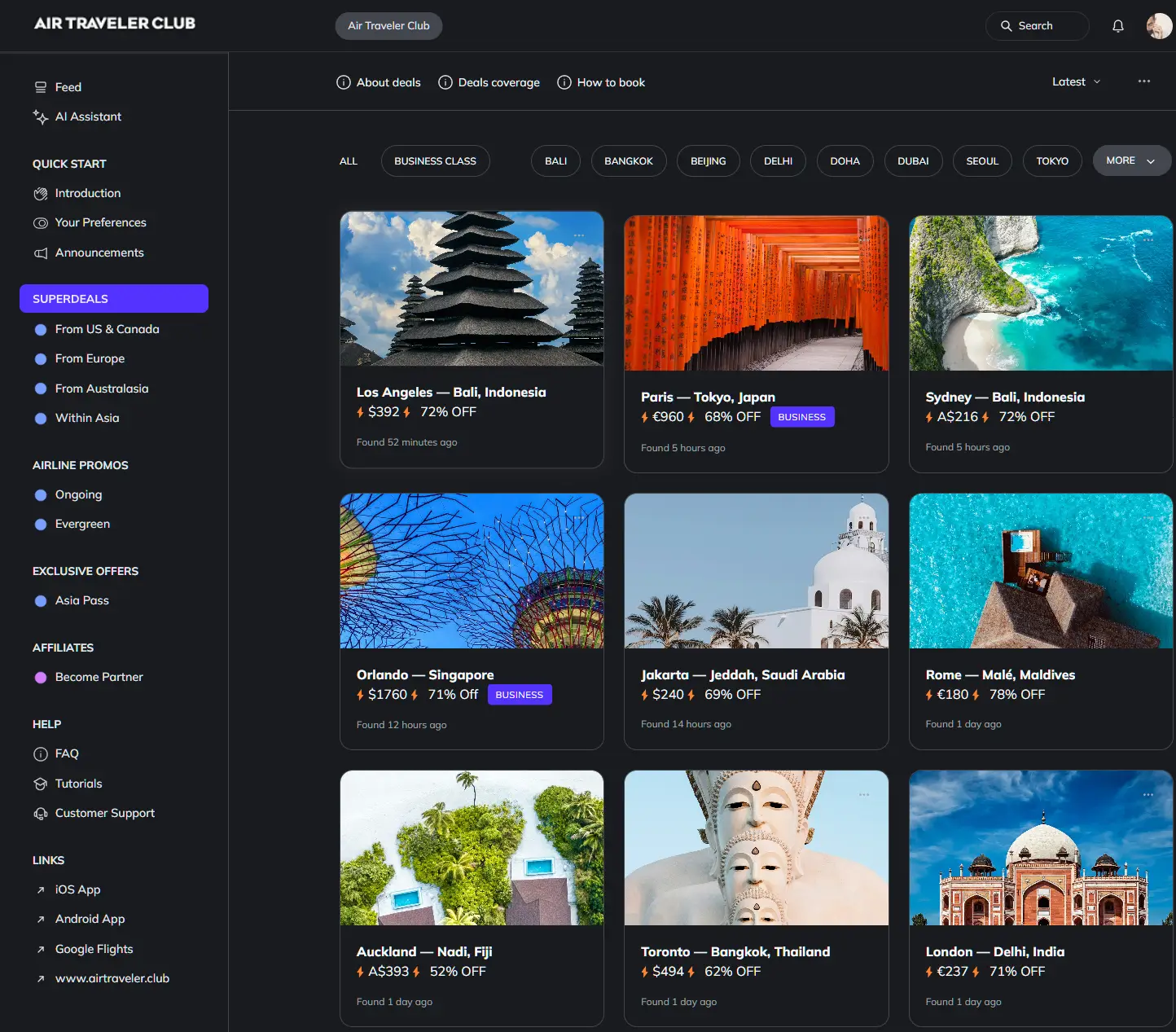

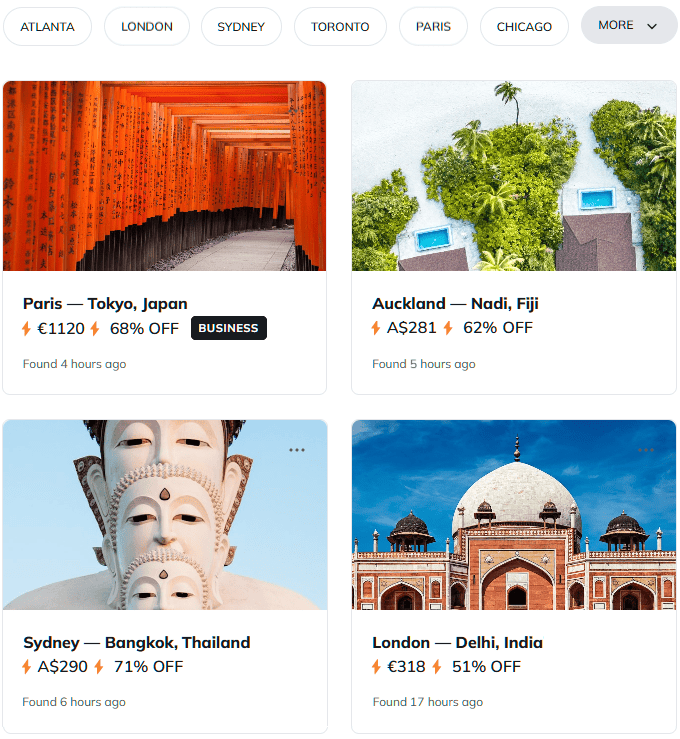

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Papua and remote island routes: the exception that proves the rule

The three-carrier rule breaks down in Papua and Indonesia’s eastern provinces, where Garuda, Citilink, and AirAsia don’t operate most routes. These regions rely on small charter operators flying over mountainous terrain with below-standard air traffic control and limited maintenance infrastructure.

Papua presents compounded risks: security tensions requiring Canadian and other government travel advisories, airports with inadequate instrument landing systems, and operators outside IOSA certification. For travelers who must reach destinations like Wamena or Jayapura, options narrow to accepting elevated risk or reconsidering the itinerary entirely.

Major hub airports—Jakarta’s Soekarno-Hatta (CGK), Bali’s Ngurah Rai (DPS), Surabaya’s Juanda (SUB)—operate at international standards. The safety gap widens dramatically at regional strips serving tourism destinations like Raja Ampat or the Banda Islands, where charter operators dominate.

Monsoon season compounds the calculus

November through March introduces additional variables. Jakarta’s Soekarno-Hatta operates at CAT I instrument landing minimums during heavy monsoon conditions, limiting visibility approaches that larger airports handle routinely. When weather deteriorates, even vetted carriers face delays and diversions—but their crews have training and equipment to manage these situations safely.

Smaller operators at regional airports often lack equivalent weather radar, crew training for low-visibility operations, or alternate airport fuel reserves. The combination of difficult terrain, monsoon weather, and limited operator capability creates risk multiplication that travelers can avoid by sticking with the major three carriers on well-served routes.

The price-safety trade-off: what the numbers show

Booking Garuda, Citilink, or AirAsia Indonesia typically costs 20-50% more than regional alternatives on the same routes. A Jakarta-Labuan Bajo (Komodo) flight might run $80-120 on a vetted carrier versus $50-70 on a smaller operator. For travelers who’ve already invested thousands in international flights and accommodations, the $30-50 premium buys meaningful safety margin.

The calculus shifts for budget-conscious backpackers, but even then, the question becomes whether saving $50 justifies flying an operator that failed to make EU clearance or lacks IOSA certification. For families, business travelers, or anyone whose risk tolerance doesn’t extend to unaudited aviation, the answer is straightforward: pay the premium, fly the big three.

Travelers seeking verified discounts on international flights to Indonesia—where the real savings exist—can monitor AI-detected pricing anomalies that surface 40-80% savings on routes from North America, Europe, and Australasia to Bali and Jakarta on carriers like Singapore Airlines, Cathay Pacific, and Garuda’s international operations.

Questions? Answers.

Is Lion Air safe now after the 2018 crash?

Lion Air has improved via DGCA and ICAO oversight programs, and its sister carrier Batik Air maintains stronger standards. However, Lion Air leadership was not included in Indonesia’s January 2025 safety review meetings with Garuda and Citilink CEOs—a notable absence. For remote island routes, prefer the audited carriers.

Does AirAsia Indonesia have the same safety standards as Malaysian AirAsia?

AirAsia Indonesia benefits from group-wide IOSA certification and standardized training protocols. However, it operates under Indonesia’s FAA Category 2 regulatory environment rather than Malaysia’s Category 1 rating. Prefer AirAsia Indonesia for major routes (Bali-Jakarta, Surabaya) but not for remote island connections.

How can I verify an Indonesian carrier’s current IOSA certification?

Check IATA’s public IOSA registry at iata.org/iosa-registry, which lists all certified operators with audit expiration dates. Garuda Indonesia and Citilink appear on this registry; most small regional operators do not. Verify before booking any unfamiliar carrier name.

Are there safety differences between Bali and Papua flights?

Significant differences exist. Bali’s Ngurah Rai airport operates at international standards with full instrument landing capability and vetted carrier service. Papua’s regional airports have below-standard ATC, limited maintenance facilities, and rely on small charter operators outside IOSA certification. The same carrier (Garuda) is safe to Bali but doesn’t serve most Papua destinations.

What if my international flight codeshares with an Indonesian domestic carrier?

Codeshares with major international partners (Singapore Airlines, Cathay Pacific, etc.) typically use Garuda Indonesia as the operating carrier on domestic segments. Confirm the operating carrier before booking—the codeshare partner’s safety reputation doesn’t transfer if the actual flight is operated by a different airline.

When will Indonesia’s FAA rating improve to Category 1?

No official timeline exists. DGCA and ICAO collaboration continues, with industry observers suggesting potential Category 1 upgrade by 2027-2028 if infrastructure investments and inspector training programs meet benchmarks. Until then, the Category 2 designation remains in effect.