Why Chinese carriers fly a faster route

The core advantage is airspace access. Since 2022, US and European airlines have been banned from Russian airspace due to sanctions following the invasion of Ukraine. That ban forces United, Delta, and American to route their Asia-bound flights on long southern arcs—swinging over the North Pacific, skirting Russian borders, or detouring through polar corridors that add significant distance.

Chinese carriers face no such restriction. Air China, China Southern, and China Eastern fly great-circle routes that cut across northern latitudes, shaving 1,500–2,500 miles off the journey depending on origin and destination. On a JFK–Beijing flight, that distance reduction translates to roughly 2–3 fewer hours in the air and substantially less jet fuel burned per passenger.

Less fuel means lower operating costs. Those savings flow into ticket prices. A nonstop JFK–PEK on Air China typically blocks at 13–14 hours, while United’s equivalent routing runs 15.5–16 hours. From the West Coast, the gap narrows to 1–1.5 hours because the great-circle paths converge over the Pacific regardless of airspace restrictions.

The airspace detour penalty, quantified

A Boeing 787 burns approximately 5,400 kg of fuel per hour at cruise altitude. Two extra hours of flight time means roughly 10,800 kg of additional fuel—about $9,000 in jet fuel costs at current prices. Spread across 250 passengers, that’s $36 per seat in fuel alone, before factoring in crew costs, maintenance cycles, and airport fees for the longer routing.

The fare gap across major gateways

The savings aren’t uniform. East Coast departures show the widest gap because US carriers face the longest detours from airports like JFK, EWR, and IAD. West Coast routes from LAX and SFO compress the advantage because both Chinese and American carriers follow similar Pacific tracks. This pattern mirrors the broader pricing dynamics of Chinese airlines undercutting Western rivals by 25–50% on long-haul routes, driven by operational efficiencies most travelers overlook.

| Route | Chinese carrier fare | US carrier fare | Time saved | Fare savings |

|---|---|---|---|---|

| JFK–PEK (Air China vs United) | $1,100–$1,200 | $1,500–$1,600 | 2–3 hrs | $350–$500 |

| JFK–PVG (China Southern via CAN vs Delta) | $1,000–$1,200 | $1,400–$1,500 | 2–2.5 hrs | $300–$400 |

| LAX–PEK (Air China vs United) | $900–$1,000 | $1,300–$1,400 | 1–1.5 hrs | $300–$400 |

| SFO–PVG (China Eastern vs United) | $950–$1,100 | $1,300–$1,400 | 1–1.5 hrs | $250–$350 |

The pattern is consistent: Chinese carriers deliver both the shorter flight and the lower fare. On a $1,500 baseline, that $300–$500 discount represents a 20–30% reduction—for a flight that actually arrives sooner.

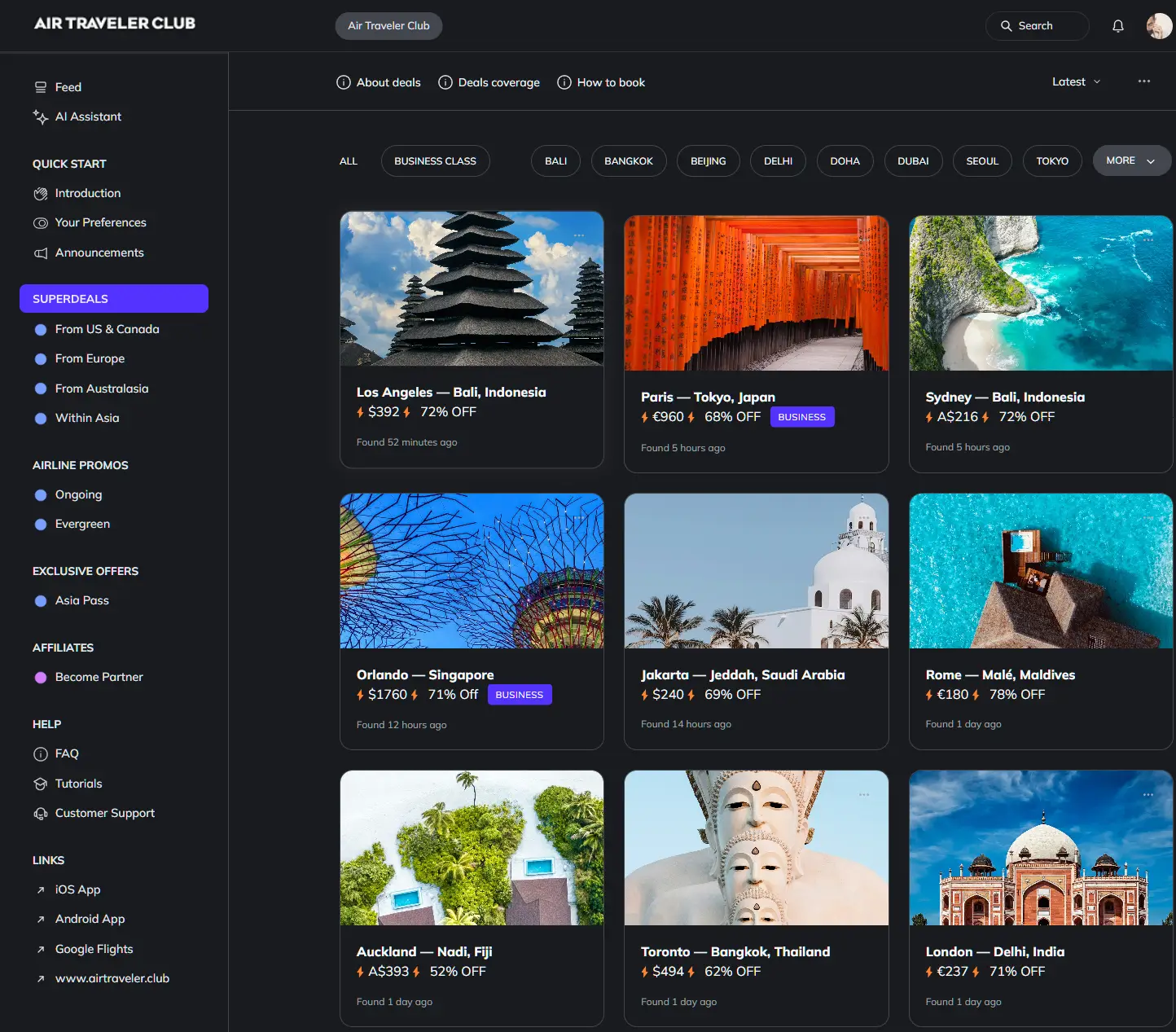

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

Bilateral quotas and the capacity imbalance

The fare gap is reinforced by a lopsided capacity structure. As of early 2024, the US Department of Transportation authorized Chinese carriers to operate 50 weekly flights to the United States, while American airlines fly significantly fewer frequencies to China. Air China runs 4x weekly LAX–PEK, China Southern operates 4x weekly JFK–CAN (Guangzhou), and China Eastern flies 8x weekly to Shanghai from multiple US gateways.

US carriers, by contrast, have been slower to rebuild. United added 3x weekly LAX–PEK in May 2025, and Delta resumed 3x weekly LAX–PVG in June 2025. The US–China bilateral flight agreements that govern these allocations have gradually expanded since pandemic-era restrictions, but Chinese carriers still dominate available seat capacity on transpacific routes to mainland China.

That capacity advantage matters for pricing. More flights mean more inventory to fill, which keeps Chinese carrier fares competitive. US airlines, operating fewer frequencies with longer routings and higher fuel costs, have less room to discount.

The trade-offs worth weighing

The math favors Chinese carriers, but the experience differs. Service style leans toward efficiency over warmth—meals are adequate but rarely memorable, and English-language announcements can be limited on some routes. In-flight entertainment systems on Air China and China Southern have improved with A350 and 787 fleet additions, but don’t expect the polish of Singapore Airlines or ANA.

Language barriers at connecting hubs like Beijing Capital (PEK) or Guangzhou Baiyun (CAN) can challenge first-time visitors, particularly during tight connections. Signage is bilingual, but staff English proficiency varies. For travelers connecting onward to secondary Chinese cities, our analysis of how Russian airspace closures reshaped Asia routing explains why Chinese hubs have become increasingly important transit points for the entire region.

Visa requirements apply regardless of carrier. US citizens need a Chinese visa for transit beyond 144 hours (or for leaving the airport zone), though China’s Transit Without Visa (TWOV) policy allows 72–144 hour stays in certain cities without a visa for qualifying nationalities.

When the advantage shrinks or disappears

Three scenarios reduce the Chinese carrier edge:

- West Coast departures compress the time gap. From LAX or SFO, US carriers only add 1–1.5 hours versus 2–3 from the East Coast. The fare gap also narrows to $250–$400, making the trade-off less compelling for travelers who prioritize familiar service.

- Peak summer travel (July–September) tightens availability. Bilateral quota caps limit how many seats Chinese carriers can add during high demand, pushing fares closer to US carrier levels. Book 3–5 months ahead for shoulder season travel to maximize the gap.

- Connecting to Southeast Asia erodes the time advantage. If your final destination is Bangkok or Bali, a connection through Beijing adds ground time that can eliminate the 2–3 hour flight savings. Compare total journey time, not just the transpacific segment.

Making the booking work

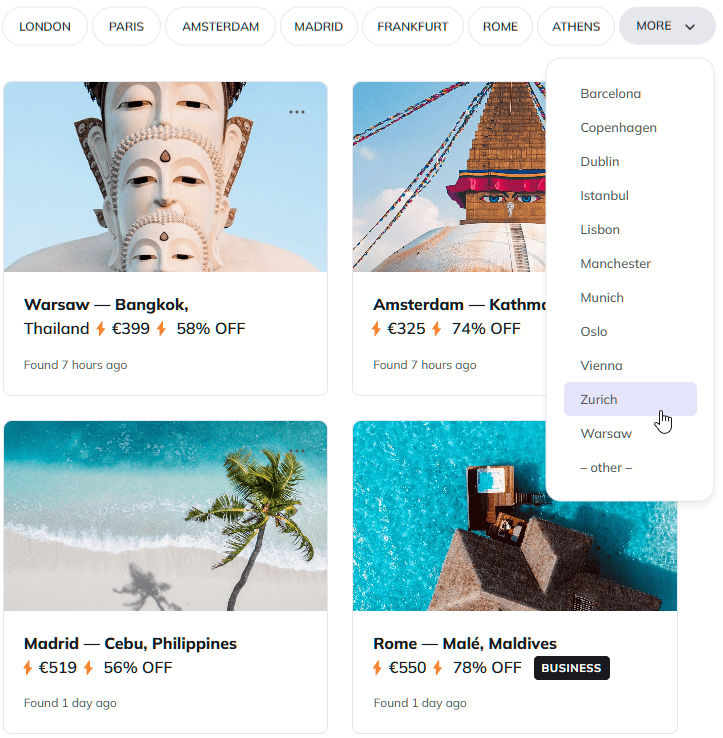

Search Google Flights for JFK–PEK or JFK–PVG with flexible dates 2–6 months out. Filter by airline to isolate Air China, China Southern, or China Eastern results. Midweek departures (Tuesday–Thursday) typically show the lowest fares. These pricing patterns are exactly what our AI-powered North America Superdeal detection monitors daily, catching temporary drops below even the standard Chinese carrier discount.

Book directly with the airline when possible—Chinese carriers honor fare protections and rebooking policies more reliably through their own channels. For connections through Chinese hubs, allow minimum 3 hours at PEK or CAN to clear immigration and re-check bags, even on through-ticketed itineraries.

The structural advantage isn’t going away. As long as US airlines can’t fly through Russian airspace—and there’s no indication that changes before 2027 at the earliest—Chinese carriers will continue offering shorter, cheaper flights to China from North America. The question isn’t whether the savings exist. It’s whether you’re willing to trade service familiarity for $300–$500 and two fewer hours in the air.

Questions? Answers.

Do Chinese airlines still fly through Russian airspace in 2025–2026?

The situation is nuanced. Post-2023 USDOT approvals explicitly noted that Chinese carriers like Air China and China Southern avoid Russian airspace on US-bound routes, likely as a condition of bilateral agreements. However, Chinese airlines may still use Russian airspace on other international routes not governed by US bilateral terms. For US–China flights specifically, both sides currently route around Russia.

How many weekly Chinese carrier flights operate from the US?

As of USDOT Order 2024-2-21, Chinese carriers are authorized for 50 weekly US flights. Key frequencies include Air China 4x weekly LAX–PEK, China Southern 4x weekly JFK–CAN, and China Eastern 8x weekly to Shanghai from multiple gateways. US carriers operate roughly 12–18 weekly China-bound flights in comparison.

What aircraft do Chinese carriers use on US routes?

Air China and China Southern have modernized their long-haul fleets with Airbus A350-900s and Boeing 777-300ERs on premium US routes. China Eastern deploys 787 Dreamliners on several Shanghai services. These are the same aircraft types used by top-rated Western carriers, with comparable safety certifications and cabin technology.

Can I use Chinese carrier flights to connect onward to Southeast Asia or Japan?

Yes, and hubs like Beijing (PEK), Shanghai (PVG), and Guangzhou (CAN) offer extensive domestic and regional connections. However, factor in total journey time including layovers. A 2-hour flight time savings to Beijing can evaporate with a 4–6 hour connection to Bangkok. For Japan or Korea specifically, compare direct US carrier options from the West Coast, which may be faster door-to-door.

Do I need a Chinese visa just to connect through a Chinese airport?

Not necessarily. China’s Transit Without Visa (TWOV) policy allows citizens of 54 countries, including the US, to stay 72–144 hours in designated cities without a visa, provided you hold a confirmed onward ticket to a third country. If your connection is under 24 hours and you stay in the international transit zone, no visa is required at all. Check current eligibility before booking, as policies update periodically.

Are Chinese carrier fares refundable if plans change?

Refund and change policies vary by fare class. Economy Saver fares on Air China and China Southern are typically non-refundable with change fees of $150–$300. Flexible economy fares allow changes with reduced penalties. Book directly through the airline’s website or call center for clearest terms—third-party booking sites sometimes impose additional restrictions that the airline itself doesn’t require.