Sydney and Melbourne travelers pay a $200-300 AUD premium for identical Taiwan flights that Brisbane passengers book for less. The gap isn’t timing, cabin class, or booking window—it’s airport economics that China Airlines exploits to fill seats from Australia’s third-largest gateway.

The arbitrage is straightforward: book Brisbane-Taipei instead of Sydney-Taipei on China Airlines, position domestically for $100, and pocket $100-200 net savings. Air Traveler Club’s fare analysis of China Airlines’ three Australian gateways confirms Brisbane one-way economy fares at A$850-950 versus Sydney at A$1,100-1,200 for March 2026 departures. Lower Brisbane airport taxes (A$60 versus Sydney’s A$75) plus China Airlines’ capacity focus on Brisbane as a secondary hub create a persistent pricing gap.

For Australian travelers departing between January and June 2026, this strategy delivers A$150-250 net savings per person after positioning costs. Families multiply the benefit—two adults and two children save A$600-1,000 roundtrip after a A$200 domestic positioning investment.

The positioning math: gateway by gateway

Not every Australian city benefits equally from the Brisbane play. The domestic positioning cost, flight time, and connection complexity vary significantly based on your starting point.

| Origin | CI TPE One-Way | Domestic to BNE | Net Savings | Min Buffer | Risk Level |

|---|---|---|---|---|---|

| Sydney (SYD) | A$1,150 | A$100 (Jetstar) | A$200 | 4 hours | Medium |

| Melbourne (MEL) | A$1,200 | A$150 (Virgin) | A$150 | 4.5 hours | High |

| Gold Coast (OOL) | A$1,100 | A$80 (Jetstar) | A$250 | 3.5 hours | Low |

| Adelaide (ADL) | A$1,250 | A$200 (Qantas) | A$100 | 5 hours | High |

Gold Coast residents enjoy the sweetest deal—shortest positioning flight, lowest cost, and proximity to Brisbane’s international terminal. Adelaide travelers face marginal returns that barely justify the complexity. Perth and Darwin positioning costs exceed the savings entirely.

Why Brisbane undercuts Sydney by $250

The pricing gap stems from two structural factors that aren’t going away. First, Brisbane Airport’s passenger service charge runs A$60 versus Sydney’s A$75—a A$15-20 per-ticket advantage baked into every fare. Second, China Airlines treats Brisbane as its Australian growth hub following 2024 slot expansion, pricing aggressively to fill capacity.

Sydney’s premium reflects its status as Australia’s primary international gateway. Airlines can charge more because demand supports it. Brisbane competes for the same Taiwan-bound passengers by undercutting on price—a classic secondary hub strategy that savvy travelers can exploit.

China Airlines’ quiet Brisbane bet

While Qantas and Virgin battle for Sydney-Melbourne dominance, China Airlines has steadily built Brisbane into its largest Australian operation by seat capacity. The carrier added 40% more Brisbane-Taipei frequencies in 2024, banking on Queensland’s growing Asian diaspora and tourism links. That capacity glut keeps fares suppressed—good news for positioning arbitrageurs.

Peak holiday periods compress the gap. December and January see Brisbane surcharges rise to match Sydney demand, shrinking savings to A$100 or less. March through November offers the most consistent arbitrage opportunity.

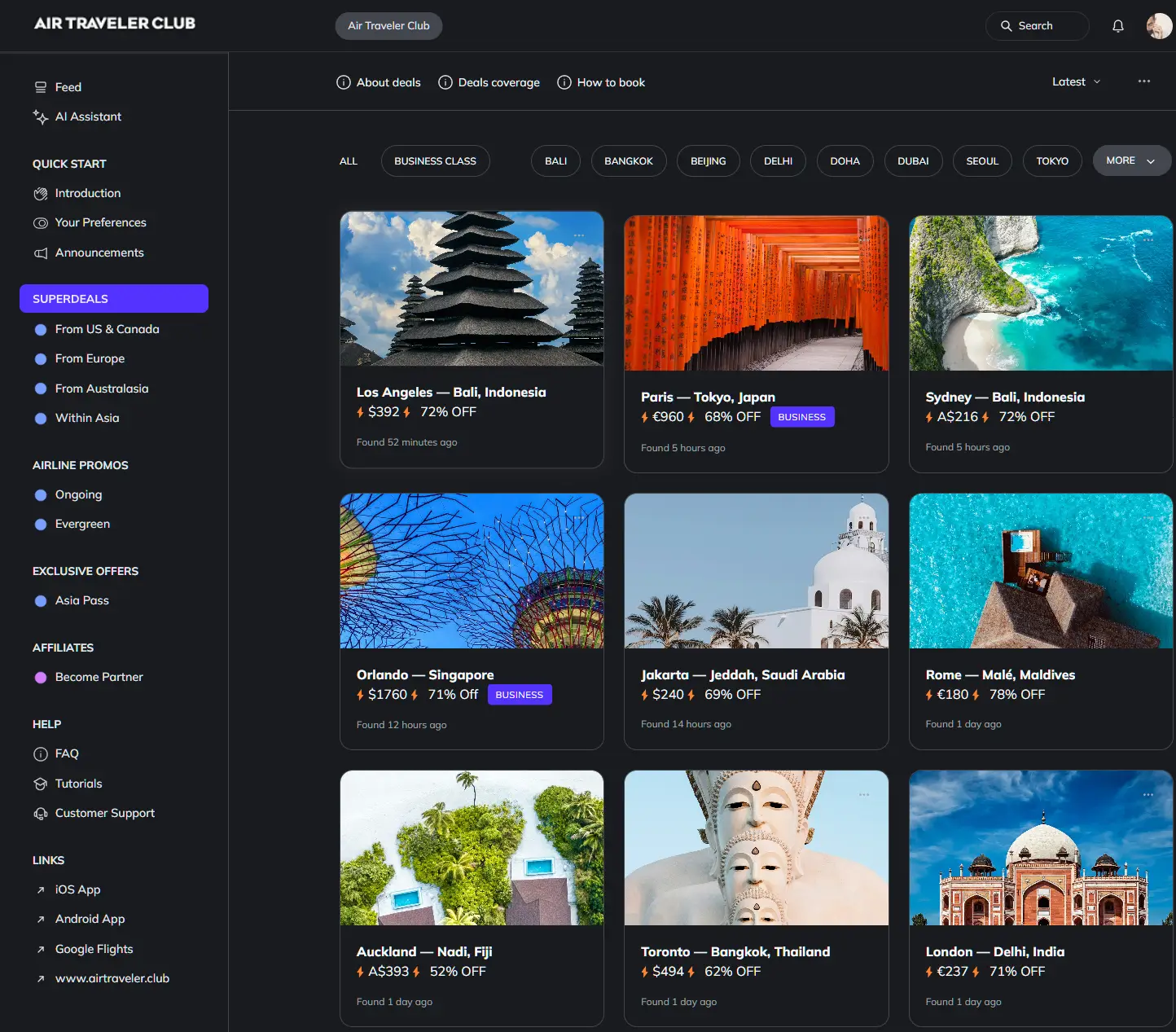

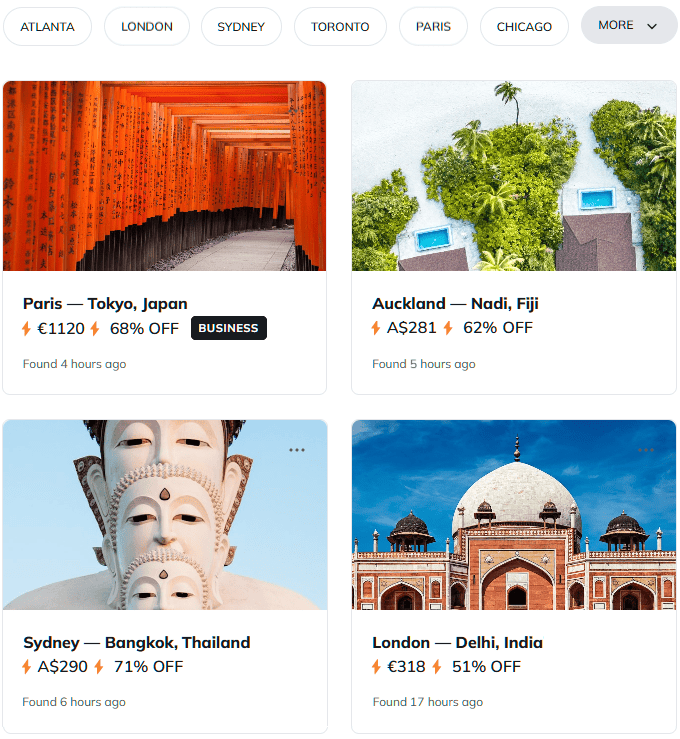

How to cut fares to Asia by 40–80%

Our custom AI ✨ tracks pricing anomalies that traditional search engines miss.

Get the these deals in your inbox, for free:

The Brisbane terminal shuffle: what you must know

This strategy carries one non-negotiable requirement: you must allow a minimum 4-hour buffer between your domestic arrival and international departure. Brisbane’s domestic terminals (T2 and T3) sit physically separate from the international terminal (T1), and you’re on separate tickets with zero airline protection.

The logistics break down as follows. Your Jetstar or Virgin flight lands at T2 or T3. You collect checked baggage from the domestic carousel—allow 20-30 minutes. You transfer to T1 via the free Airtrain connection or A$15 taxi—allow 20 minutes. You re-check bags at China Airlines’ international counter, clear security, and reach your gate—allow 90 minutes minimum.

Brisbane Airport Corporation officially recommends 90 minutes for protected connections. For separate tickets with bag reclaim and terminal change, 4 hours provides genuine safety margin. Peak afternoon periods can add an hour to each step.

Three scenarios where positioning fails

The math breaks down under specific conditions that eliminate or reverse the savings advantage.

- Domestic delays torpedo the strategy. Australian domestic flights run a 24% delay rate according to Brisbane Airport statistics. A 2-hour Jetstar delay with a 4-hour buffer leaves you sprinting through terminals. No China Airlines rebooking, no compensation, no recourse on separate tickets.

- Peak season compresses the gap. December and January pricing sees Brisbane fares surge 20% while Sydney holds steady due to higher base competition. The A$250 gap shrinks to A$100—barely worth the logistics hassle and risk.

- Premium Economy widens then erodes. The fare gap expands to A$400 in Premium Economy, but positioning on premium domestic tickets costs A$250-300, eating most of the upside. Economy positioning to Premium Economy international works; premium-to-premium doesn’t.

Travel insurance becomes essential for this strategy. A policy covering missed connections due to domestic delays costs A$50-80 and provides rebooking coverage that separate airline tickets cannot.

Booking the two-ticket strategy

Execute this in two separate transactions—never attempt to book as a single itinerary, which will route you through Sydney anyway.

Step one: Search China Airlines directly at china-airlines.com for Brisbane (BNE) to Taipei (TPE). Confirm the fare shows A$850-950 one-way economy for your dates. Book and pay.

Step two: Search Jetstar or Virgin Australia for your home city to Brisbane, targeting arrival at least 4 hours before your China Airlines departure. Morning China Airlines flights work best—position the night before and hotel in Brisbane if needed.

Step three: Print both itineraries. You’ll need to show the international booking at domestic check-in if questioned about onward travel, though Australian domestic flights rarely require this.

Fares quoted here are valid as of January 2026 for March departures. Pricing fluctuates within 30-day windows—book when the gap exceeds A$200 to ensure worthwhile net savings.

Questions? Answers.

What’s the exact terminal transfer process at Brisbane Airport?

Domestic flights arrive at Terminal 2 (Virgin, Rex) or Terminal 3 (Jetstar, Qantas). The free Airtrain connects to International Terminal 1 in 20 minutes, or taxis cost A$15. You must collect checked bags from domestic baggage claim before transferring—there’s no airside connection between terminals.

Does China Airlines offer any protected connections for Sydney-Brisbane-Taipei?

No. China Airlines does not sell single-ticket itineraries routing through Brisbane from other Australian cities. You must book separate tickets, which means no minimum connection time guarantee and no rebooking if your domestic flight delays.

How does EVA Air pricing compare for Taiwan flights?

EVA Air focuses on Sydney with fares around A$1,050 one-way to Taipei—only A$100 more than China Airlines Brisbane pricing. The gap is too small to justify positioning. China Airlines’ Brisbane capacity focus creates the arbitrage; EVA doesn’t replicate it.

Can I use this strategy for other China Airlines destinations like Japan?

Yes. China Airlines Brisbane-Osaka (KIX) shows a similar A$150 gap versus Sydney departures. The same positioning math and terminal logistics apply. Verify current fares before booking—Japan routes see more seasonal variation than Taiwan.

Do I need a visa or ETA for Taiwan as an Australian citizen?

Australian passport holders can enter Taiwan visa-free for stays up to 90 days. No advance ETA required. However, your passport must have at least 6 months validity from your entry date.

What happens if my domestic flight is cancelled entirely?

You’ll need to rebook on the next available domestic flight at your own expense. If no same-day options exist, you’ll miss your China Airlines flight with no compensation. Travel insurance covering trip interruption is strongly recommended for this strategy.