Summary

- Many European and North American airlines can’t use Russian airspace; Europe to Asia routes typically take +1–4 hours and sometimes shift to one‑stop itineraries.

- Airlines that can still overfly Russia (several Chinese, Gulf, Turkish, and Indian carriers) often keep near‑pre-2022 timings and can price competitively.

- Detours drive higher fuel burn, crew duty time, and tighter aircraft utilization—rising flight costs significantly.

- Smart hub choices (Istanbul/Dubai/Doha/Abu Dhabi/Delhi) and well‑planned stopovers can beat some detoured “nonstops.”

- Premium Economy and Business Class matter more on stretched flights; value pockets appear via unaffected carriers.

Listen to the podcast version of this article:

What changed and why

In late February 2022, Russia’s invasion of Ukraine triggered Western airspace bans on Russian aircraft. Russia quickly responded in kind, closing its skies to most Western-aligned carriers. Overnight, the once-standard “Siberian corridor” that cuts across 11 time zones became off-limits, pushing airlines to detour either north over the pole or south via the Middle East and Central Asia.

Russia has banned most EU, UK, US, Canadian, and other allied countries’ airlines from its skies. Only a few European exceptions (Serbia’s Air Serbia, Turkey’s Turkish Airlines and Pegasus, and Belarus’ Belavia) are allowed due to diplomatic ties.

The immediate effects: longer block times, higher operating costs, and a broad reshuffle of long-haul networks. Carriers that can still use Russian airspace—especially several Asian and Middle Eastern airlines—now have a competitive edge on speed and, at times, price.

The good news: with a bit of strategy you can still book efficient, comfortable itineraries. Understanding the new routing patterns—and knowing when to consider hubs like Istanbul, Dubai, Doha, Abu Dhabi, or Singapore—helps you keep total journey time in check and often unlocks better value on Premium Economy or Business Class.

Why Russia’s airspace mattered

Russia spans eleven time zones, making it the world’s largest country by land area. Its territory covers the most direct path between Europe and much of Asia, particularly Northeast Asia destinations like Japan, South Korea, and northern China.

These routes follow “great circle” paths—the shortest distance between two points on a sphere.

Europe to Asia flights: the new reality

The closure of Russian airspace to European airlines has fundamentally transformed travel between Europe and Asia, creating ripple effects that extend far beyond simple route adjustments. What was once a straightforward journey over Siberia has become a complex logistical puzzle, forcing airlines to reimagine their operations and travelers to adjust their expectations.

The impact is most immediately visible in flight times. Routes that once followed efficient great-circle paths over Russia now snake thousands of kilometers south through Central Asia or north over the Arctic, adding substantial time to journeys.

The numbers tell the story:

Table 1. Europe → Asia: the new reality

| Route (example carrier) | Pre-2022 | 2025 typical | Added |

|---|---|---|---|

| London–Tokyo (EU carrier) | ~12h | ~14h | +2h |

| Helsinki–Tokyo (EU carrier) | ~9h | ~13h (polar) | +4h |

| London–Beijing (EU carrier) | ~10h | ~11.5h | +1.5h |

| London–Delhi (EU carrier) | ~8.5h | ~9.5h | +1h |

| Shanghai–Helsinki (Chinese carrier)* | ~9h | ~9h | ~0h |

Expect longer blocks on many EU‑flag flights to East Asia, slightly longer to North India/China, and more competitive one‑stops through Istanbul and Gulf hubs. Fares rose overall, but competition from unaffected carriers creates “deal pockets,” especially out of continental Europe.

This shift has created winners and losers among European carriers. See our comprehensive guide for comparisons of which European and Middle Eastern now offer the airlines best service, routing efficiency, and value on Europe-to-Asia flights.

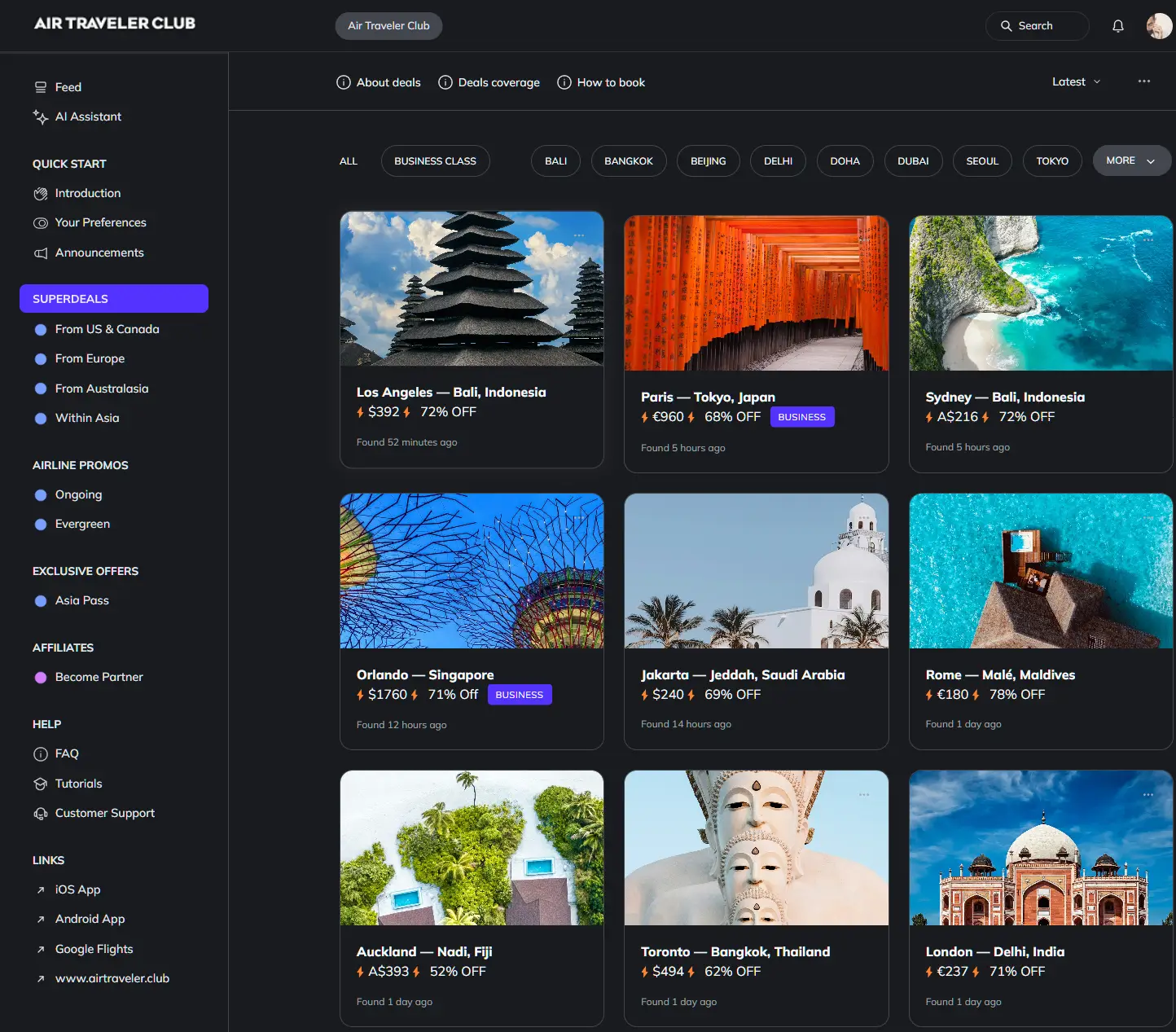

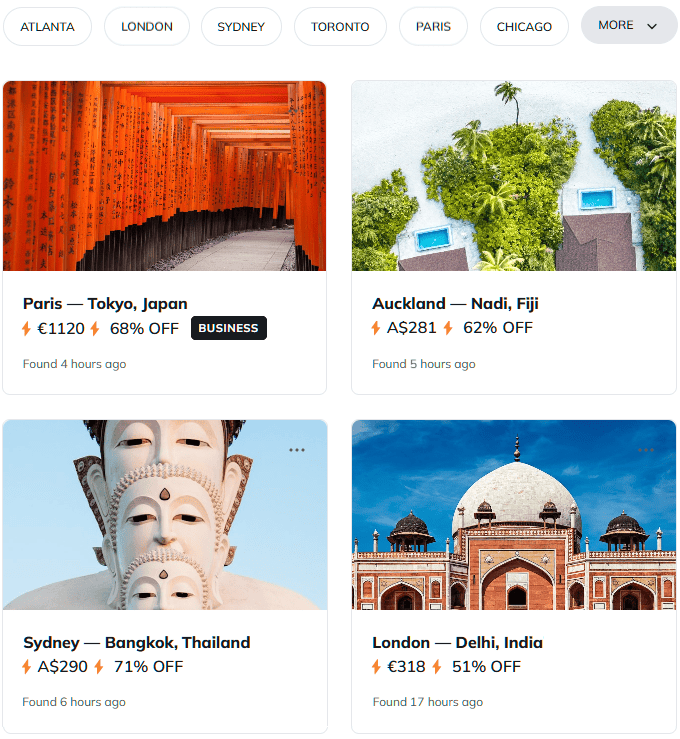

Flights to Asia for half-price. Thanks, AI.

Our custom AI finds rare deals that save 40–80% compared to regular fares. Why overpay?

See how it works →

Case study: Finnair’s dramatic pivot

Finnair exemplifies this disruption.

Once positioned as the fastest bridge between Europe and Asia, the Finnish carrier was forced to cancel several Asian destinations in 2022. Rather than retreat, Finnair pioneered creative solutions: by 2023, they struck partnerships to operate flights via Doha, and by 2025, the airline plans to base many Asian services out of Dubai rather than Helsinki.

This represents a fundamental reimagining of the traditional Europe–Asia network, where southern routing hubs replace direct northern passages.

Alternative routing strategies

Airlines now navigate around blocked Russian territory using three primary strategies:

Southern corridor: Middle Eastern bridge

Most European airlines now route flights southeast through Turkey, Iran, Pakistan, or India before turning toward Asian destinations. This southern path is a frequent choice for Europe-to-Southeast Asia routes, adding only modest time penalties to destinations like Bangkok and Singapore since these cities align naturally with the southern arc. However, the route proves less ideal for Northeast Asian destinations like Japan and Korea, where flights must travel far south before turning north again, creating significant inefficiencies where political constraints override optimal routing.

Central Asian gateway

Airlines have discovered viable paths through neutral Kazakhstan, Uzbekistan, Kyrgyzstan, and Tajikistan. This Central Asian routing proves particularly useful on select Europe-to-North China pairs like Beijing and Shanghai, offering better geometry than the extreme southern detour. While dependent on evolving permits and ATC constraints, and still substantially longer than pre-2022 Siberian routes, this compromise solution provides measurable fuel savings and reduced flight times compared to southern alternatives.

Extended polar route

Some carriers push existing polar routes to their limits, flying north over Greenland and the Arctic before crossing the North Pacific. This approach is popular for Northern Europe-to-Japan routes and works better for North American airlines with existing Arctic capabilities than European carriers. While reliable, the extreme northern routing from Europe often requires +2-4 hours versus pre-2022 routes and may need specialized aircraft or fuel stops due to significant deviations from optimal paths.

Table 2. Routing corridors that replaced the Siberian shortcut

| Corridor | Big Advantage | Watch‑outs |

|---|---|---|

| Southern via ME/SA | Abundant hubs (IST/DXB/DOH/AUH/DEL); strong onward connectivity | Congestion windows; longer for NE Asia |

| Central Asia | Shortcuts on certain pairs | Permits/airspace dynamics vary |

| Polar/Northern | Stable ops for some carriers | Longer blocks; crew planning impacts |

Practical strategies for travelers

For those planning Europe-to-Asia travel in this new landscape, preparation is key:

- Time management: Build extra time into your itinerary. A flight that previously landed in the afternoon might now arrive in the evening, affecting connection times and hotel bookings.

- Embrace stopovers: Consider turning necessity into opportunity. On many Europe↔Asia pairs, a one‑stop via IST/DXB/DOH/AUH/DEL can be equal to—or faster than—a detoured nonstop. Some airlines also offer special stopover programs with free travel perks.

- Search by duration, not just price to surface faster one‑stops that beat detoured nonstops.

- Hunt value in Premium Economy/Business, especially on unaffected carriers and via competitive hubs.

- Stay informed via deal alerts delivered on daily basis by Air Traveler Club; airspace dynamics can change quickly and trigger short‑notice reroutes.

- Leverage airline programs: Many carriers now offer free stopover packages to entice travelers, recognizing that the new routing realities can become selling points rather than mere inconveniences.

Unaffected airlines

Some airlines continue operating with minimal disruption, maintaining their pre-2022 routing advantages and often providing faster connections than their restricted competitors.

Chinese carriers

Chinese airlines including Air China, China Eastern, China Southern, Hainan, Xiamen, Juneyao, etc. continue to overfly Russia on Europe routes, often matching pre-2022 times.

Middle Eastern carriers

Emirates, Qatar Airways, Etihad sit ideally for one‑stops between Europe and Asia and maintain strong premium cabins.

Turkish Airlines

The airline leverages Istanbul’s crossroads location, offering dense Europe feed and broad Asia coverage.

Indian carriers

Air India along with other regional airlines preserve advantages on North America↔India and Europe↔India flows.

A word of caution: Even though these airlines can overfly Russia, the situation can be fluid. There have been instances of short-notice airspace changes and risks inside Russia due to the war. While airlines that cross Russia avoid active combat zones, the broader conflict means things can change quickly.

If you do fly with an airline crossing Russia, stay aware of news, and understand there’s a very small but non-zero chance of route changes or diversions.

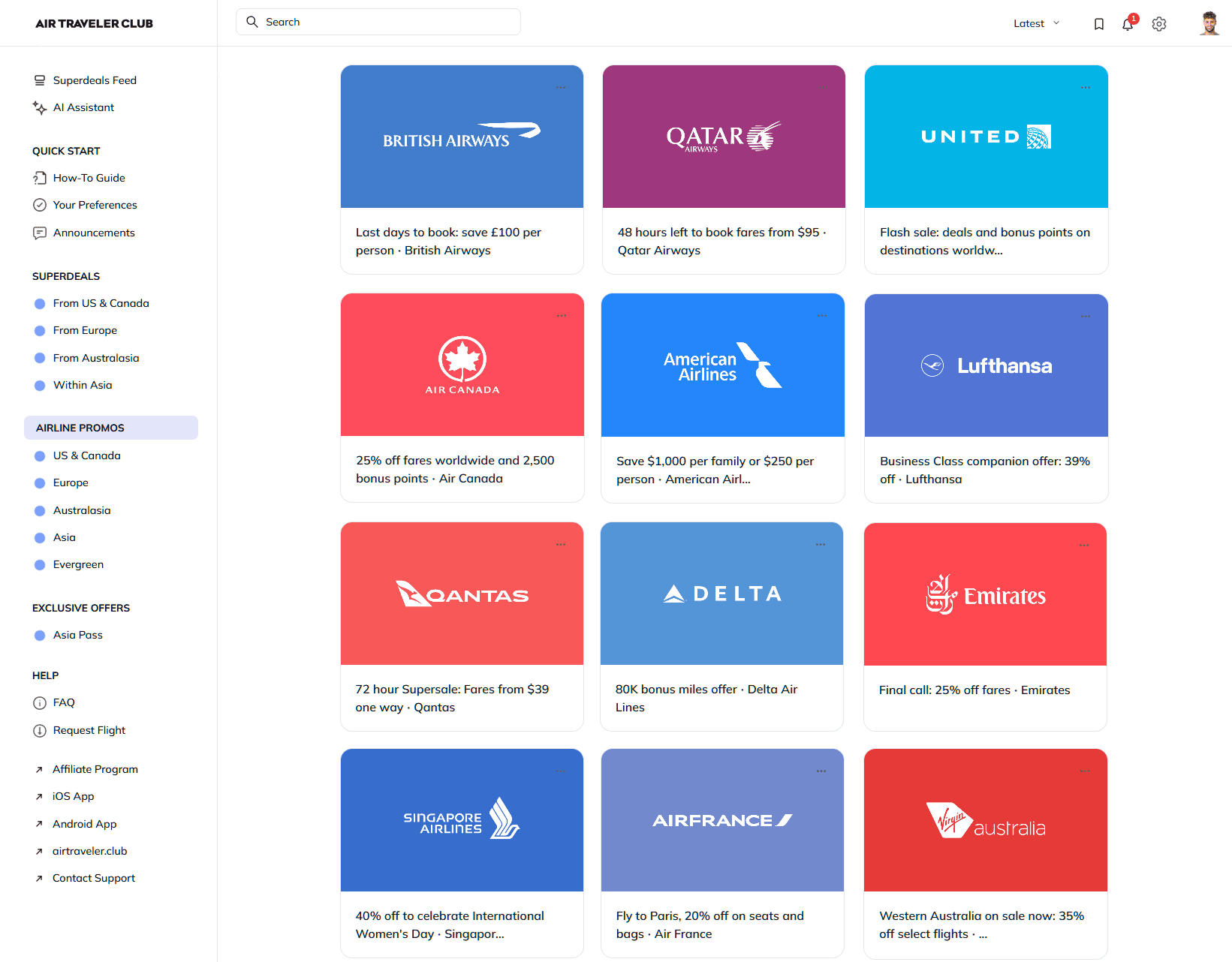

Our AI detects sales and promotions from 150+ airlines

Get promos →

Learn more →

Destination snapshots

Thailand (Bangkok)

Southern‑corridor routings add roughly +1–2h for many EU carriers. Turkish and Gulf one‑stops often balance price, time, and schedule flexibility. Chinese carriers can be sharp on fares via North Asia connects.

Japan (Tokyo/Osaka)

Among the most affected from Europe. Polar loops and southern detours push flights to ~14–16h. Time‑sensitive travelers may prefer one‑stops via Istanbul or Gulf hubs; otherwise, budget extra time and consider Premium Economy or an overnight stopover.

Singapore

Geography helps. Typical detours are modest (~+1–2h). Singapore Airlines remains strong; one‑stops via Gulf/Turkey compete well, especially in premium cabins.

China (Beijing/Shanghai)

Story depends on airline. Chinese carriers keep shorter great‑circle paths over Russia and often undercut timings and fares. European carriers have reduced or reshaped services where economics no longer work.

How longer flights translate into higher fares

These Russia-related route changes are just one factor in why flights to Asia have become significantly more expensive. When aviation experts say flights are now “longer,” they’re referring to several interconnected changes that create a cascade of effects throughout your entire travel experience.

The most dramatic examples illustrate just how significant these changes have become:

- Flight duration increases range from 12% to 45% — London to Tokyo now takes 14-15 hours instead of 12, while Finnair’s Helsinki to Tokyo route jumped from 9 to 13 hours, representing a grueling 4-hour increase

- Fuel consumption rises exponentially, not proportionally — When routes expand from 6,000 to 7,500 miles, aircraft must carry extra fuel for the distance, which adds weight, requiring even more fuel to transport that additional weight

- Crew duty regulations create scheduling constraints — Longer flights push against maximum work period limits, sometimes requiring additional pilots or cabin crew that increase operational costs

- Aircraft utilization drops significantly — When planes spend 14 hours completing routes that previously took 11 hours, airlines lose three hours of daily revenue-generating capacity per aircraft

- Operating costs compound across multiple factors – Higher fuel burn, extended crew time, increased maintenance schedules, and additional catering requirements all contribute to substantially higher per-passenger expenses

North America to Asia: fewer options

U.S. and Canadian airlines can no longer fly over Russia, forcing dramatic route changes that affect millions of travelers each year. The restrictions have fundamentally altered how airlines plan their Asia routes, often making previously viable flights economically impossible to operate.

- South Asia routes hit hardest — Flights to India and Pakistan that once crossed the North Pole now take 2+ extra hours

- East Asia: Minimal impact — Pacific routes to Japan, Korea and China from California avoid Russian territory entirely.

- Some nonstop flights eliminated — Routes like Seattle-Bangalore were scrapped as commercially unviable

- More connections required — Delta and American now rely heavily on partner airlines for Asia access

Foreign airlines still using Russian airspace have gained a massive competitive advantage, fundamentally shifting market dynamics. This has led to a notable increase in American travelers choosing non-U.S. carriers for their Asia trips, as the time and cost differences have become too significant to ignore.

- Air India‘s nonstop New York-Delhi beats any U.S. carrier’s connection time

- Emirates and Gulf carriers are capturing American passengers with faster, often cheaper routes

- Some journeys on U.S. airlines now take 16+ hours versus 12-13 hours on foreign competitors

The playing field won’t level anytime soon. U.S. airlines remain cautious, keeping these restrictions in place indefinitely. Understanding which US airport hubs offer the best Asia connectivity and competitive pricing has become critical in this new landscape.

Booking strategies

The new reality requires travelers to approach Asia bookings differently than they might have in the past. What once seemed like obvious routing choices may no longer make sense, and the carrier you’ve always used might not offer the best option anymore.

- Compare all options: Don’t assume your usual U.S. carrier is fastest or cheapest for Asia trips.

- Consider foreign airlines: Air India, Emirates, Qatar Airways, and ANA often offer more direct routing.

- Check total travel time: A connection on a foreign carrier might save hours versus a “direct” U.S. flight.

- Break up ultra-long journeys: Sometimes splitting trips (like New York-Dubai-Singapore) is more comfortable than marathon rerouted flights.

Intra-Asia flights: mixed impact

If your travels originate within Asia itself, the impact of Russian airspace restrictions varies dramatically depending on your country’s political stance and geographic location. Here’s how different Asian carriers are handling the new reality.

Japan & South Korea: allied with the West

Both Japan and South Korea quickly aligned with their Western allies by avoiding Russian airspace, even though they weren’t explicitly banned from using it. This voluntary restriction affects their long-haul routes significantly.

Japanese carriers like JAL and ANA now route their European flights the long way around, often over Alaska or Central Asia. A Tokyo to London flight that once took about 12 hours now stretches to around 14 hours. The same extended travel times apply to Korean Air’s European routes.

The good news for regional travelers is that domestic and short-haul Asian routes remain completely unaffected. It’s only the intercontinental flights to Europe and North America that require the longer detours.

China: business as usual

China has not sanctioned Russia, giving Chinese airlines a significant competitive advantage on Europe-Asia routes. Chinese carriers continue operating almost exactly as they did before 2022, crossing Siberian skies without restriction.

- No detours required — Beijing to Paris, Shanghai to Frankfurt routes cross Russia normally

- Shorter flight times — Chinese airlines save hours compared to sanctioned competitors

- Strong market position — Western airlines complain they can’t compete on this “unlevel playing field”

- Post-COVID recovery boost — As China reopened, their efficient routing attracted more passengers

If you’re booking through Air China, China Eastern, China Southern, or Hainan Airlines, your flight durations to Europe might seem surprisingly short compared to other carriers.

India: neutral stance, complex routing

India’s neutral position means Air India and other Indian carriers can still use certain Russian flight corridors. This allows efficient operations on routes like Delhi to New York or Chicago, where flights can still cross the far North.

However, a separate challenge emerged in 2023 when Pakistan restricted Indian overflights. This forced Air India to take more southerly routings on some Europe-bound flights, adding time and even leading to route cancellations like Kochi-London.

For travelers, Indian carriers generally still offer shorter routes than European or American competitors, though you might notice detours around Pakistan or Iran on some flights.

Middle East and Central Asia: the big winners

Gulf carriers and Turkish Airlines have actively capitalized on their continued access to Russian airspace. These airlines often provide the most efficient routings for many intercontinental journeys.

Emirates, Etihad, Qatar Airways, and Turkish Airlines all continue overflying Russia when it’s the optimal path. Dubai to Moscow operates normally, and flights from Gulf hubs to East Asia can dip into Russian airspace as needed.

Turkish Airlines has particularly benefited from this situation. Istanbul has become a major transfer hub for Europe-Asia travel, scooping up business from travelers who need alternative routing options.

When could Russian airspace open again?

The short answer remains: not anytime soon. The possibility of Russian airspace reopening remains highly uncertain and hinges on complex geopolitical and military developments.

Despite Russia’s February 2025 proposal to the U.S. to reopen airspace and resume direct flights, Western governments continue tying any reopening to meaningful progress in Ukraine.

Recent developments underscore this reality. The EU Council renewed its restrictive measures against Russia, while NATO recently condemned Russia for airspace violations, reaffirming commitments to support Ukraine. Even as Russia calls on the UN aviation body to lift sanctions, Western regulators show no signs of reciprocating Moscow’s overtures.

Three key indicators to watch: credible ceasefire negotiations, regulatory changes from EU/US transport authorities, or airlines filing Siberian route schedules for future seasons. Until then, travelers should assume detours persist into 2026, with Europe-Northeast Asia trips remaining 2-4 hours longer than pre-2022 standards.

Questions? Answers.

Why is Russia’s airspace closed to many airlines?

Russia closed its airspace to most Western-aligned airlines in retaliation for Western airspace bans on Russian aircraft following its invasion of Ukraine in . This tit-for-tat measure reshaped global flight routes to Asia.

Are the alternate flight paths (over Central Asia or the Middle East) safe given regional conflicts?

Yes – airlines actively avoid any known conflict zones, and they continuously adjust routes for safety. It’s true that some of the detours pass over regions that sound unstable (e.g. flights may go over parts of Afghanistan, or near Iran, etc.), but they fly at high cruising altitudes and stay clear of areas with active fighting.

Are there any airlines unaffected by the closure?

Yes, airlines from countries that have not sanctioned Russia, such as most Chinese, Middle Eastern (Emirates, Qatar Airways, Etihad, Turkish Airlines), and Indian carriers, can still overfly Russian airspace, maintaining more direct routes.

Is it safe to fly with airlines that still use Russian airspace?

Flying over Russia is generally considered safe right now. The airspace where these flights cruise is far from any active conflict zones (mostly high over Siberia), and many international flights pass through without incident. Carriers that are still allowed continue to use those routes routinely, which indicates they deem it safe.

Are Russian airlines involved in Europe-Asia international flights?

Russian airlines have largely been sidelined in international Europe-Asia routes due to sanctions and closed airspace.