Summary

- Airlines need 70-78% load factors to break even, creating intense pressure to discount aggressively during launch months.

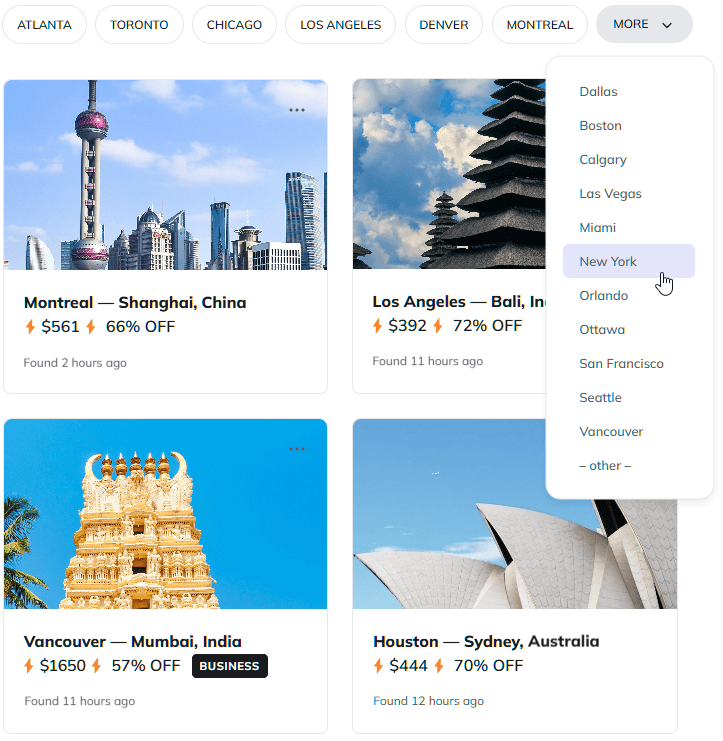

- Budget carriers release only 10-30% of seats at promotional prices—they sell out within hours once publicized.

- Premium carriers release far more business class award seats on new routes than established ones during initial months.

- New routes take days or weeks to appear in flight search engines, creating temporary invisibility and less competition.

Listen to the podcast version of this article:

New routes, half price

When Cathay Pacific launched their new Hong Kong to Brussels route in , they hit a wall every airline faces: nobody’s looking for a flight they don’t know exists yet. Think about it. You don’t wake up wondering if there’s suddenly a new nonstop to Belgium. This creates a golden opportunity for travelers.

Airlines pay roughly the same whether a plane is full or empty. Fuel, crew salaries, landing fees, and the aircraft itself—these costs happen regardless of how many passengers are onboard. An empty seat costs the airline almost nothing extra, but it generates exactly zero dollars in revenue. When airlines introduce fresh service, they face what industry insiders call the “empty plane problem,” and it’s why you’ll see dramatically lower fares when routes first launch.

This guide will show you exactly how to spot new route launches, which airlines offer the best deals, and how to book before everyone else catches on.

New routes vs. established routes

New airline routes are goldmines for savvy travelers. Compare them to a mature route like Los Angeles to Tokyo. The airline knows precisely when business travelers book, how demand changes with the seasons, and what competitors charge. Years of data feed into pricing systems that squeeze maximum profit from every seat.

New routes have none of this. Airlines are flying blind. The pressure to fill seats is intense. Load factor reports—basically how full the planes are—go straight to executives and investors. Most airlines need load factors around 70-78% just to break even, and poor performance in those first months can kill a route before it has time to succeed.

Market awareness presents another advantage. New routes simply don’t appear in most travelers’ search results initially. Google Flights needs time to index new schedules. Metasearch engines lag by days or weeks. This temporary invisibility means less competition for those promotional seats, especially if you’re monitoring airline channels directly rather than waiting for deals to appear on aggregator sites.

What this means for you

During those critical launch months, airlines will do whatever it takes to put bodies in seats. This is when you’ll find generous award seat availability and aggressive promotional fares. The airline would rather fill the plane at lower prices than risk the embarrassment of launching with empty rows. That desperation is your discount. New route launches offer the most predictable opportunity to snag deeply discounted fares.

We’re talking about real savings: business class tickets to Tokyo for the price of economy, Singapore for under $500 roundtrip, or premium cabin awards when saver space is normally impossible to find. The catch? These opportunities disappear fast, often within hours of announcement.

Flights to Asia for half-price. Thanks, AI.

Our custom AI finds rare deals that save 40–80% compared to regular fares. Why overpay?

See how it works →

Three types of new route fares

New flight routes don’t all follow the same pricing playbook. After watching dozens of Asia Pacific launches, We’ve noticed three clear patterns. Knowing which one an airline uses helps you book at the best time.

Type 1. Immediate deep discount (book announcement day)

When Cebu Pacific announced Manila to Sapporo flights on , they launched a Piso Fare

the same day—basically free flights before taxes. This is classic Type 1 pricing, and budget airlines love it.

How it works:

- Route announcement and sale happen together (or within 24 hours).

- Airlines treat it like a marketing event.

- Sale lasts just 24-72 hours.

- Creates massive social media buzz.

The discounts are wild. Scoot’s new Padang route sold for S$119 all-in versus S$300+ with connections. AirAsia’s Free Seats

promotions regularly feature flights for MYR 39-189, which is 85-95% off normal prices.

The catch? Only 10-30% of seats get these rates, and they disappear fast once deal hunters find them.

Budget carriers can afford this because they charge separately for bags, meals, and seat selection. The cheap base fare gets attention, but they make money on add-ons.

Type 2. Delayed drop (wait 2-4 weeks)

United Airlines announced new Hong Kong routes to Bangkok and Ho Chi Minh City in . Initial fares? Nothing special. Six weeks later, promotional business class appeared at 30% off. That’s the delayed drop, and most legacy carriers use it.

Why the delay?

Airlines spend those first weeks securing corporate contracts and negotiating with tourism boards. Announcing sale fares immediately would kill those higher-paying deals.

This creates a choice: book now at regular prices, or wait for the sale and risk your dates selling out? For business routes like Hong Kong to Tokyo, waiting usually pays off. Airlines need leisure travelers for weekends and off-peak flights. For beach destinations launching in summer, book immediately.

The optimal strategy for delayed drop routes is patience combined with price monitoring.

Type 3. Slow burn (watch for 2-3 months)

Singapore Airlines launched London Gatwick service in . No promotional fares. No headline discounts. Just regular pricing that adjusted based on demand. Premium carriers like Singapore Airlines, ANA, and Cathay Pacific often skip the sales completely.

This approach signals confidence. These carriers don’t feel pressure to discount aggressively. They’re betting their product quality, schedule convenience, and network connectivity justify premium pricing.

Where’s the opportunity? Award seats. Premium carriers release way more award inventory on new routes than established ones. That first week when booking opens (usually 330-355 days out) is golden for snagging business class awards that would be impossible on mature routes.

The slow burn also creates opportunities for last-minute travelers. When airlines gradually reduce prices based on booking pace, you might find deals 2-3 weeks before departure if the flight isn’t filling as expected. This is particularly true for shoulder season travel on new routes. Monitor prices consistently, and be ready to pull the trigger when you see unexpected drops.

Table 1. New route booking strategies by airline type

| Airline Type | Example Carriers | Booking Strategy |

|---|---|---|

| Budget Carriers | Cebu Pacific, AirAsia, Scoot | Book within hours of announcement. |

| Legacy Airlines | United, Emirates, Qatar | Wait 2-4 weeks, then monitor for promos. |

| Premium Carriers | Singapore, ANA, Cathay | Hunt award seats early or catch last-minute cash fare drops. |

Fifth-freedom routes. The hidden launch fare opportunity.

Fifth-freedom flights are routes where an airline operates between two foreign countries as part of a longer journey. Example: Emirates flying Dubai-Milan-New York creates a fifth-freedom opportunity on Milan-New York.

Airlines price aggressively because they lack home market advantages. Local carriers have brand recognition and corporate contracts. The fifth-freedom carrier is the outsider trying to fill seats that would otherwise fly empty.

Award availability is typically better too. Airlines want to fill every segment. Better to use award seats than fly empty. You’ll often find business class awards on fifth-freedom segments when the rest of the network is blocked.

Sales, promotions, and discounts from 150+ airlines

Get a real-time feed of best airline offers directly to your phone or email.

Get promos →

Which airlines offer the best new route promotions?

Not all carriers approach new routes equally. Some airlines treat every launch as a promotional event, while others maintain pricing discipline even during the critical inaugural phase. Understanding these patterns helps you prioritize which airline announcements deserve your immediate attention versus which you can monitor casually.

Tier 1. Generous and frequent launchers.

| Airline | Typical Launch Discount | Best Booking Window | Promotional Pattern |

|---|---|---|---|

| Cathay Pacific | 10-15% cash fares | First 6 months | Release awards 355 days out; generous inventory from launch. |

| British Airways | Double Avios promos | First 3-4 months | Partner award space across all programs immediately. |

| Singapore Airlines | Minimal cash discounts | First 12 months | Frequency increases = second wave of availability. |

| United Airlines | 20-25% for MileagePlus | 24-48 hours post-announcement | Immediate pricing; bonus miles on new routes. |

| ANA | 10-15% standard fares | 355 days before departure | Early award release; monopoly routes = stable availability. |

Cathay Pacific

aggressive expansion

Cathay Pacific is on a major growth streak. The airline launched or resumed 11 routes in 2024–2025, bouncing back from pandemic cuts with impressive momentum.

- Dallas-Fort Worth ().

- Munich ().

- Brussels ().

- Seattle (coming ).

Here’s what sets Cathay apart: they don’t win on cheap fares—they win on opportunity. When they open a new route, they release generous award seat inventory from day one.

The airline hit 85% full flights on several 2024 launches without heavy discounting. They’re focused on premium travelers and building connections, not racing to the bottom on price.

Cathay aims to reach 100 destinations by the end of , with more European and North American cities coming in . Each new route announcement means fresh opportunities for travelers who track award releases.

British Airways

strategic but abundant expansion

British Airways ramped up expansion in 2024–2025 with Abu Dhabi, Riga), and Bangkok returning after a three-year pause.

Singapore Airlines

measured but generous

Singapore Airlines takes a different approach: fewer new routes, but excellent award availability when they do expand.

Take their London Gatwick service from . Business class award seats were plentiful in both directions during the first year—a rare find for premium cabins to Europe. Even on secondary routes, Singapore deploys top aircraft like the A350-900, which means more premium seats than most competitors offer.

brought a game-changing agreement with ANA that opened up award travel significantly:

- Singapore customers gained access to 34 ANA destinations (up from 9).

- ANA members can now book 25 Singapore destinations (up from 12).

When either airline adds routes within this partnership, both release strong award inventory to build demand.

Singapore doesn’t just launch and forget. They quickly add flights on routes that work well. These capacity boosts create booking windows beyond the initial launch period, giving you more chances to snag award seats.

- London Gatwick went from 5x weekly to daily within months.

- Adelaide jumped from 7 to 10 weekly flights.

United Airlines

the new route specialist

United leads North America with 28 route announcements recently, including Manila, Christchurch, and Faro.

Agility. Introductory pricing appears almost immediately after announcements, often with round-trip discounts up to 25% for MileagePlus members. They release saver-level award inventory across all partners from day one.

Second daily flights to Hong Kong and Singapore, plus new Cebu service (launched )—all paired with bonus-mile promotions.

ANA – All Nippon Airways

consistent European expansion

ANA rolled out three European routes in quick succession, all with strong award availability:

- Milan ().

- Stockholm ().

- Istanbul ().

Each route uses 787 Dreamliners with 3x weekly service. Award seats were available from day one at 45,000 miles roundtrip.

They’re often the only direct option. ANA is the sole carrier flying direct from Japan to Milan, and the first Japanese airline ever to serve Stockholm. Without competing airlines, they fill planes through quality service and connections rather than fare wars. This means steadier award availability—no wild promotional swings.

Emirates

volume leader

Emirates added eight routes in , including Chinese cities Shenzhen () and Hangzhou (), plus Da Nang and Siem Reap. With 269 weekly flights to 24 East Asian destinations, they create regular opportunities for travelers.

How Emirates prices new routes? The approach varies by destination type:

- Leisure routes (Phuket, Bali): Expect 20-30% off during launch phases.

- Business routes (China): Premium pricing with modest discounts appearing 4-6 weeks after announcement.

Don’t expect immediate deals. Emirates takes a measured approach to promotions.

Emirates filled nearly 80% of seats system-wide in 2023–24 despite rapid growth. Monitor their route announcements, but be patient—the deals come later, not right away.

Qatar Airways

frequency king

Qatar Airways prefers adding more flights to existing cities over launching brand-new destinations. That said, they’ve added 20+ routes over 2023–2024 and now serve over 170 destinations worldwide, with particularly strong Asia Pacific coverage.

How to find Qatar deals? Look for partnerships and seasonal sales rather than new route launches:

- Partner promotions (like 10% off with Maybank cards in Malaysia).

- Student club discounts that increase with loyalty (10% → 15% → 20%).

- Flash sales throughout the year.

- Black Friday deals (up to 30% off in recent years).

Qatar’s QSuites business class attracts travelers willing to pay more, so the airline doesn’t need to discount aggressively. They filled 85-87% of seats in —among the highest rates globally—showing strong demand at premium prices.

Your best bet: watch for their seasonal sales rather than waiting for specific route announcements.

Your new route monitoring system

never miss a launch again

Travelers who score incredible new route deals aren’t lucky—they’re organized. Setting up a monitoring system takes 20 minutes and five minutes daily to maintain.

Newsletter subscriptions

Create a dedicated email and subscribe to airlines you’d fly: Singapore Airlines, Cathay Pacific, ANA, Emirates, Qatar Airways. They announce routes 1-7 days before public releases.

Twitter/X list

Create an Aviation Deals

list with airline accounts (@singaporeair, @cathaypacific), aviation journalists (@omaat, @zachgriff), and deal accounts (@SecretFlying, @TheFlightDeal). Turn on notifications.

Google alerts

This system surfaces opportunities before they hit mainstream blogs and sell out. Set as it happens

delivery for:

new route

+ [airline name].launching service

+Asia Pacific

.inaugural flight

+ [your home airport].

Tier 2. Solid but selective launchers.

| Airline | Typical Launch Discount | Best Booking Window | Promotional Pattern |

|---|---|---|---|

| Japan Airlines | 10-20% cash fares | Launch phase (2-3 months) | Premium focus; modest discounts but excellent award space. |

| Korean Air | 15-25% cash fares | First 2-3 months | Conservative; business class inventory generous on new routes. |

| Qantas | 15-20% early bird | 6-8 months before launch | Award space releases months before partner access. |

| Air Canada | 10-20% business class | First booking week | 15% point rebates; coincides with codeshare expansions. |

| Thai Airways | 10-20% standard | Recovery phase ongoing | Reintroducing cabins = inventory seeding opportunities. |

Japan Airlines

premium focus

JAL takes a quality-over-quantity approach to expansion. Their Chicago Narita launch () featured brand-new A350-1000s—a clear signal they’re investing in product, not just chasing volume.

The airline plans to increase long-haul capacity by 50% by , primarily targeting North America and select Asian routes.

JAL’s joint venture with Garuda Indonesia (effective ) opens up interesting Southeast Asia connections.

Launch discounts typically run 10-20%—modest compared to budget carriers. The real value? Award availability through JAL Mileage Bank or partners like Alaska Mileage Plan tends to be excellent during launch phases.

Korean Air

conservative expansion

Korean Air is playing it safe while integrating with Asiana. Their new Incheon-Kobe service for Expo 2025 visitors shows their cautious strategy: scheduled charter operations first to test demand before committing to permanent routes.

Launch discounts typically hit 15-25%—decent but not remarkable.

The real value comes through SkyTeam partner awards and Korean Air’s Skypass program, which releases generous business class inventory on new routes.

Qantas

targeted and prestige-driven

Qantas takes a measured approach, prioritizing prestige over volume. Their launches—Brisbane-Chicago and Sydney-Dallas A350 services—came with modest early-bird pricing (15-20% off) and double status credits for frequent flyers.

The airline favors loyalty engagement over deep fare cuts. New intercontinental routes nearly always feature short-term Dreamliner or A350 debut

sales that fill premium cabins quickly.

Qantas releases business class Classic Rewards inventory 6-8 months before launch—long before partner programs gain access. This early window is your best shot at premium seats.

Air Canada

methodical North American expander

Air Canada’s expansion is selective: few routes, but significant openings. The carrier added Singapore, Osaka, and Stockholm in , each with targeted Discover More

fare promotions and 15% Aeroplan point rebates.

Business class fares get 10-20% off during the first booking week. Aeroplan runs Mini Global

award deals at 15% off for select new city pairs.

New routes often coincide with Star Alliance codeshare expansions, amplifying award availability across the alliance. This creates more booking options than the airline alone could offer.

Thai Airways

recovery mode

Thai Airways is rebuilding after restructuring. They restored Brussels to daily service as part of returning to 64 destinations. The focus is on adding more flights to existing cities rather than launching new routes.

Expect 10-20% discounts on promotions.

The airline recently reintroduced premium economy and is releasing inventory in that cabin to build demand—creating opportunities for award travelers.

Read announcements like a pro

What to look for?

Not all route announcements create equal opportunities. Learn to assess them quickly to prioritize which deserve immediate booking.

Green lights (book now signals)

Daily service from launch

: Strong commitment means better award availability and schedule flexibility.Introductory fares starting at $X

: Specific pricing means 24-72 hour promotional window. Book immediately.- Wide-body aircraft on regional routes: More premium seats mean better award availability than narrowbody competitors.

Award seats available now

: Airlines rarely market to award travelers. When they do, inventory is genuinely generous.- Tourism partnerships:

In partnership with Tourism X

means promotions extend beyond typical 30-90 days through co-marketing subsidies.

Red flags (proceed with caution)

Subject to regulatory approval

: Route might never operate. Don’t commit until confirmed.Seasonal service

: Limited dates constrain award availability. Promotions may not appear if seasonal demand is strong.Pending aircraft delivery

: Significant delay risk. Book with free cancellation only.Competitive fares

orattractive pricing

: Vague language means no real discount commitment.- Limited frequencies (1-3x weekly): Fewer departures mean harder booking and less award availability.

Tier 3. Budget carriers with aggressive launch pricing.

| Airline | Typical Launch Discount | Best Booking Window | Promotional Pattern |

|---|---|---|---|

| Scoot | 25-40% off | Announcement day | “Time to Fly” campaigns; immediate deep discounts. |

| AirAsia | 50-70% off (Free Seats) | Within hours | Multiple subsidiaries = multiple sale cycles weekly. |

| Jetstar Airways | 30-50% off | Announcement day | “Launch Flight Frenzy”; dynamic pricing rewards speed. |

| WestJet | 20-35% off | First week | “New Horizons Sale”; longer booking windows than LCCs. |

| Cebu Pacific | 85-95% off (Piso Fares) | Announcement day | Most aggressive; need account/payment pre-saved. |

Scoot

Singapore’s LCC powerhouse

Scoot goes aggressive on launch pricing. When they announced Phu Quoc, Padang, and Shantou in 2025, promotional fares of S$119-169 one-way dropped immediately.

Their Embraer E190-E2 aircraft can serve smaller airports that can’t handle widebody planes. This opens up secondary cities competitors can’t reach.

Scoot runs multiple major sales yearly with new routes featured prominently. Their Time to Fly

campaigns often deliver 25-40% off new services for the first 3-4 months. They skip fancy pricing algorithms early on—they just price low to fill planes fast.

If you’re flexible with dates, you’ll find genuine bargains.

AirAsia Group

the discount leader

AirAsia announced 30+ new routes for —an extraordinary pace. Their Free Seats

promotions (MYR 39 domestic, MYR 49-189 regional) and flash sales create regular opportunities. When they launched Kuala Lumpur-Darwin on , promotional fares with 50-70% discounts appeared immediately.

The catch? AirAsia operates multiple subsidiaries—Malaysia, Indonesia, Philippines, and Thai AirAsia X. Each announces routes independently. Miss one newsletter, miss deals.

Sales typically last 3-5 days for travel 3-6 months out. You need to act fast.

Jetstar Airway

Australasia’s volume launcher

Jetstar Australia launches new routes frequently and prices aggressively. Their 2025-2026 expansion includes Perth-Bangkok, Melbourne-Seoul, and Sydney-Osaka—all with headline one-way fares from AUD 199.

Jetstar slashes fares 30-50% for the first two months of operation. Bundles including baggage and seat selection are offered at near-cost rates.

Their dynamic pricing rewards early bookers with the deepest discounts. Email-exclusive pre-sales give subscribers first access—sign up to their list to catch these before they go public.

WestJet

Canada’s competitive LCC-hybrid

WestJet blends network ambition with leisure-focused pricing. New routes to Edinburgh () and Barcelona () launched with fares at CAD 499 round-trip, plus bonus WestJet Dollars for members booking within the first week.

Expect 20-35% discounts on freshly announced routes. This recurring pattern has become WestJet’s standard approach.

WestJet’s 787 Dreamliner long-haul expansion continues through , making it one of North America’s most consistent sources of launch-period bargains.

Cebu Pacific

the Piso fare king

Cebu Pacific’s Piso Fare

promotions (PHP 1 base fares) are the most aggressive in aviation. When they launched Manila-Sapporo on , Piso Fares went live immediately. The carrier is growing 20% to reach 30 million passengers in , with each new route featuring promotional pricing.

You need speed. Piso Fare sales last 3-5 days but often sell out within hours once deal sites publicize them.

If you can move fast and handle the fees and ancillary charges, these fares are unbeatable—essentially free flights.

Book now or wait?

You’ve spotted a new route announcement. Do you book immediately or wait for better pricing? The general rule: book when you see good value, not theoretical maximum value. Saving $200 by waiting doesn’t matter if your dates sell out.

Book immediately

If the announcement includes specific promotional pricing (fares from $99

), your window is 24-48 hours maximum—possibly just hours for budget carriers.

- Check booking dates and blackout periods.

- Verify all-in price with taxes.

- Search multiple dates.

- Book if dates work—even if not perfect.

Wait 2-4 weeks if

- Legacy carrier shows standard pricing (promotions typically drop later).

- Award space shows

standard

only (saver inventory loads within 1-2 weeks). - Multiple carriers announce same route (potential price war).

- Fifth-freedom route with strong competition.

Don’t wait if

- Airline announces faster-than-expected bookings.

- Award availability tightening (dates disappearing).

- Seasonal events at destination.

- Deal going public on Reddit.

$2500 in savings from top travel brands

Discounts on premium services, free hotel stays, free guided tours, big rebates on travel gear, and much more.

Get discounts →

Questions? Answers.

How far in advance do airlines announce new routes before they launch?

The timeline varies significantly by carrier and route type. Long-haul international routes typically announce 6-8 months before launch, giving airlines time to secure regulatory approvals and coordinate with destination marketing organizations. Cathay Pacific’s Dallas, Munich, and Brussels routes all showed 195-240 day timelines from announcement to launch. Regional routes within Asia Pacific often announce 90-120 days out.

Should I always book the day a new route is announced?

Not always. Use the 24-Hour Rule: Book immediately if the fare is deeply discounted ($\ge$50% off), airline is known for immediate promos, and cancellation flexibility exists. Otherwise, waiting 2–4 weeks may yield deeper prices.

Do all new routes actually offer discounted fares, or is this just marketing hype?

Not all new routes feature aggressive promotional pricing. Low-cost carriers (AirAsia, Cebu Pacific, Scoot) almost universally offer 40-90% launch discounts, sometimes within hours of announcement. Legacy and premium carriers vary: some use Delayed Drop strategies (Emirates, Qatar Airways showing 20-30% discounts 2-4 weeks after announcement), while others never discount at all (Singapore Airlines, ANA, Cathay Pacific on most routes). The real opportunity with premium carriers is award availability, not cash fares.

What’s the catch with ultra-low “Piso Fares” and “Free Seat” promotions?

The base fare is genuinely PHP 1 or free, but total cost includes mandatory taxes, fees, and charges typically adding $30-80 depending on route length and airport fees. Baggage, seat selection, meals, and priority boarding all cost extra. A “free” flight often totals $50-100 with one checked bag. The other catch is availability: these fares release in tiny quantities (10-30% of seats) and sell out within hours. You need flexibility on dates and willingness to accept 5am departures or late-night arrivals. Finally, change fees often equal or exceed the original fare, so these work best when your dates are certain. Despite the catches, Piso Fares genuinely represent 85-95% discounts versus regular pricing, making them the best deals in aviation if you can snag them.

Can I use frequent flyer miles for new routes, and if so, when should I book?

Yes, and new routes often offer the best award availability in an airline’s entire network. Airlines release generous award inventory during launch phases (first 3-6 months) because they need strong load factors and lack historical booking data to optimize revenue. Book the moment the schedule opens, typically 330-360 days before first flight. For ANA new routes, this means booking 355 days out when Star Alliance partner inventory releases. Singapore KrisFlyer opens 355 days for own members. Cathay Pacific Asia Miles typically opens 360 days out. The absolute best award availability appears in that first week; waiting even two weeks often shows tightened inventory.

Are there specific days of the week when airlines announce new routes or release promotional fares?

Budget carriers follow patterns: AirAsia often launches sales 9am Malaysia time Tuesday-Thursday, Cebu Pacific favors Wednesday 12am Philippines time, Scoot frequently announces Thursday afternoons Singapore time. Legacy carriers prefer Monday-Wednesday announcements during business hours for maximum media coverage. Routes Asia conference ( in Perth, in Xi’an) generates announcement clusters during and immediately after the event. CAPA Summit dates also see multiple announcements. Avoid expecting Friday announcements; airlines want work-week media attention. The most reliable pattern is monitoring airline social media at 9-11am their local time Monday-Wednesday. Award availability often releases at midnight airline local time when the booking calendar extends forward, so check after midnight if you’re dedicated enough.

What’s the best strategy for travelers who can’t be flexible with dates?

Rigid dates reduce your ability to capture promotional fares, but strategies still exist. First, set price alerts on your specific dates and monitor for 90 days; even Slow Burn routes sometimes drop prices on specific dates. Second, focus on new fifth-freedom routes where competition keeps pricing consistently lower rather than relying on temporary promos. Third, consider booking immediately when announcements appear if your dates fall within the launch period; you won’t capture maximum discount but you secure the flights at initial pricing before premium dates sell out. Fourth, look at nearby airports; a new route from secondary airport might offer better pricing than waiting for deals from your primary airport.